IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Aruwa Capital Management

Climate Change

Climate Change Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Gender Equality

Gender EqualityFirm Overview

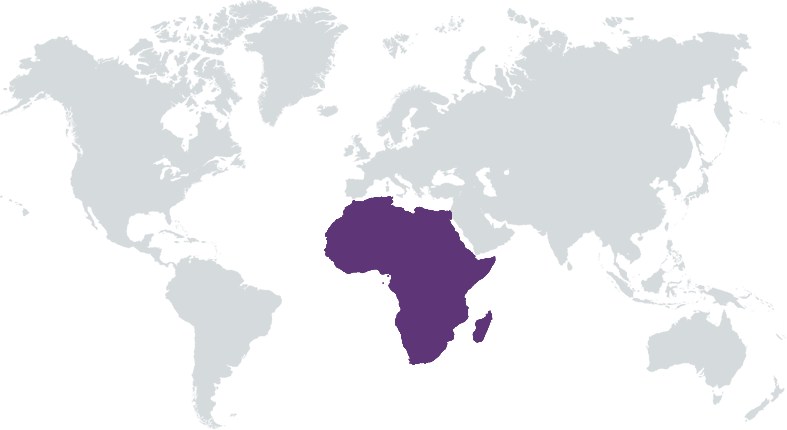

Aruwa Capital Management is one of the few black African women owned and managed early-stage growth equity and impact funds in Africa. Africa has the highest proportion of female entrepreneurs in the world, but they significantly lack access to capital and opportunity, although women make up half of the population in Africa. Aruwa Capital aims to close the gender funding gap by applying a gender lens investment strategy. With c.$40 million in AUM across 2 funds, we only invest in businesses that provide essential goods and services that improve women’s lives or businesses that are founded or led by women in Nigeria & Ghana. With few funds owned, managed or led by women in Africa, Aruwa Capital aims to change the narrative for women as capital allocators, entrepreneurs, consumers, and stakeholders in Africa and globally. To date, Aruwa has made 10 investments showcasing the intersectionality between financial return and impact.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

Women as capital allocators, consumers and entrepreneurs represent an untapped and underserved investment opportunity; by investing in businesses for women and by women, we are able to combine superior returns with positive long term social impact for families and communities due to the role women play in society in Africa.

The mismatch of demand and supply for female led or female owned SMEs in Nigeria and across Africa, provides a significant opportunity for Aruwa Capital to provide access to capital for underserved SMEs that contribute to job creation and tangible poverty alleviation. In addition, being one of the very few women owned and managed impact growth equity funds in Africa, intentionally investing with a gender lens, provides us with a natural competitive advantage to invest in the best businesses that are providing solutions to problems we understand and also the best female entrepreneurs through our extensive network. By investing in basic needs that are non-cyclical, these are defensible sectors in the unpredictable frontier markets in which we invest. Our core sectors, healthcare, financial services, essential consumers goods and renewable energy represent consistent demand from the rapidly urbanising and growing population in Africa for the next 30-50 years.

We are one of the few 100% woman owned and managed impact funds in Africa investing with an intentional gender lens. We are intentional about investing in businesses that are either female led or female focused that enable us to deliver positive socio economic development and impact through job creation and tangible women’s empowerment outcomes whilst also generating an attractive return for our investors. We are also local and hands on investors with on the ground presence in Nigeria, that actively monitor our investments from a board perspective, but also at a day-to-day operational level to ensure our social impact and gender mandate for the business is delivered. With our average ticket size range of $1 million to $3 million and our gender lens mandate, we target companies that are currently underserved and overlooked with less than 4% of capital targeted towards female led businesses in Africa.

Investment Example

In December 2022, Aruwa Capital invested $1 million into Koolboks, a female co-founded business that is a provider of solar freezers to women owned micro-SMEs in off grid areas across Africa. With over 700 million Africans without access to electricity, Koolboks through its innovative cooling solution is able to use the power of the sun and water to ensure that business have affordable and accessible access to cooling for up to 4 days without access to the grid. Since our investment, the Company has grown revenues by 4.2x and has provided access to electricity for over 2,000 women in off grid areas across Africa. The Company has also expanded its reach and is currently selling its products across 25 countries globally having created thousands of direct and indirect jobs in the process.

Leadership and Team

|

Adesuwa Okunbo Rhodes – Founder & Managing Partner More Info

Adesuwa has 15 years of investment banking and PE experience from global institutions. Adesuwa spent 5 years as Managing Partner of Syntaxis Africa, a provider of growth capital to SMEs across Africa. Prior to co-founding Syntaxis Africa in 2014, Adesuwa was in the Leveraged Finance and M&A teams at J.P. Morgan, involved in $5.6 billion worth of transactions. She has also worked at TLG Capital as an Investment Professional, involved in PE transactions across Africa. She was named as an Agent of Impact and recognised as one of the Top 35 Women Moving Africa Forward for her commitment to gender equality in PE. With Aruwa Capital, she is the first female solo GP to raise over $10m in an institutional fund in Nigeria. She started her career at Lehman Brothers and holds a BSc in Economics from the University of Bristol and sits on a number of boards in Nigeria. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We are intentionally only invest in businesses that are either founded or led by women or have gender diverse teams. This includes businesses whereby women own at least 51% of the company or its founded by a woman or the senior management team has at least 30% female representation. We are focused on eliminating gender biases across the SME ecosystem by providing female led businesses with equal access to capital and opportunity. We are focused on hiring, promoting and retaining roles for women in our portfolio companies, within the workforce and across the supply chain, and actively monitor and measure gender diversity and job creation within our portfolio companies, enhancing gender equality. In addition, we are focused on investing in indigenous business whereby at least 75% of our portfolio is led by people of colour and of African origin.

We incorporate ESG analysis into our investment process from screening to exit, to limit stakeholder risks and position our portfolio companies for sustainable growth and success. Before every deal, the deal team conduct an in-depth review of all ESG factors of the company business plan and operations. Additionally, where necessary we may engage third parties to assess potential ESG risks and opportunities. After a deal has closed, Aruwa continues to monitor ESG performance and progress throughout the life of each investment. We ensure ESG measures are maintained through regular conversations and documented check-ins with the portfolio company management and leadership, as well as board oversight during quarterly meetings. We have a documented ESG Manual and policy for the team to adhere to across our investment process.

Impact Tracking and Monitoring

Learn More

14 Adeyemi Lawson St, Ikoyi, Lagos 106104, Lagos

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.