IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Beyond Capital Ventures

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Health and Wellbeing

Health and WellbeingFirm Overview

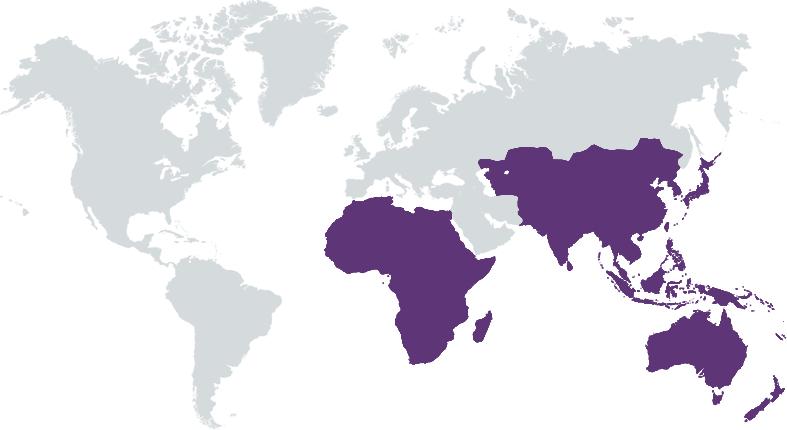

Beyond Capital Ventures is a women-led, diversified emerging markets venture capital firm investing in early- to growth-stage startups to create superior financial and social returns on investment by unlocking opportunities for one billion consumers in Africa and India. The firm invests in conscious leaders building businesses addressing the needs of these rising consumer classes in the healthcare, financial services and climate sectors.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: Less than 25%

Rising consumer classes in Africa and India are driving innovation and fueling global consumption via demographic tailwinds and the desire for needs to have — necessary (and non-discretionary) for physical, mental, financial, and environmental health and happiness.

Our investment strategy is to fund and nurture early- to growth-stage businesses that are addressing the growing demand for critical goods and services from one billion rising consumers in India and Africa. Beyond Capital Ventures creates a diversified, resilient portfolio by focusing on needs to have in healthcare, financial services and climate and generate top-quintile venture returns and deep, measurable impact around three themes: gender, distribution, and livelihoods. Our multi-asset approach of equity and debt helps founders and investors navigate emerging markets with agility, while our locally-embedded team effectively evaluates markets and invests in sustainable business models with clear pathways to positive unit economics, early traction, and impact baked into the business model. The firm’s people-centered investment process identifies and mentors conscious leaders who maintain long-term focus, build inclusive management teams, and deliver value to all stakeholders.

Beyond Capital Ventures’ unique value proposition consists of the following five key elements. Performance. The team has executed 16 investments, projecting top-quintile financial returns while impacting over 22 million lives in the first three years of the Fund. Multi-asset firm. Our multi-asset approach of equity and debt helps founders and investors navigate emerging markets with agility. Beyond capital support. We dedicate every suitable and available effort to make each portfolio company successful, starting with our selection process through our private equity-like portfolio management. Recognition. In September 2024, Beyond Capital Ventures became the first VC fund globally to achieve 2X Best-in-Class Certification, the highest rating. This achievement reflects our institutional quality and commitment to gender-lens investing. Equitable Venture. We allocate a portion of the GP’s total carry pool to portfolio company founders who meet predetermined performance milestones related to business, gender and climate metrics.

Investment Example

Kasha is Africa's leading digital platform for last mile access to health products and household goods. The seven-year-old startup provides a digital retail and last-mile distribution platform for pharmaceuticals and fast-moving consumer goods (FMCGs) with a specific focus on women’s healthcare needs and household items. Customers including consumers, resellers, hospitals, pharmacies, and clinics can order products ranging from sanitary pads and contraceptives to diapers and cleaning supplies via its website or USSD. Traction: Annual revenue for 2016 was ~$1.7K whereas revenue being tracked in 2024 is $45M, 26,200x increase $25M Series B Customers and Consumers serviced till date: 97.7K unique customers (61% are females) 57.3K unique low income/BoP customers 3.2M unique consumers/ beneficiaries (with 19% accessing health products and 8% accessing menstrual care products) Products provided access to till date: 27.2M health products 2.6M menstrual care products 1.2M family planning products

Leadership and Team

|

Eva Yazhari – Managing Partner More Info

Eva, Managing Partner of BCV and Co-Founder/CEO of Beyond Capital Fund, is a seasoned impact investor with 16 years of experience in venture capital and asset management. She has worked hands-on with 40+ early-stage entrepreneurs. Well-respected in both the African and Indian markets, and with in-market presence over the past decade, Eva built Beyond Capital to be a recognized global brand which has become a reality with the opening of Beyond Capital’s office in the Westlands of Nairobi in 2023. |

|

Paula Mariwala – GPAC Member and IC Member More Info

Paula was one of the first venture capitalists in India, with 25+ years of experience working and investing in tech companies in India. She is the Managing Director of Seedfund, and co-founder & President of Stanford Angels India. Paula sources, evaluates and mentors start-ups. She is also an advisor to SDG philanthropy platform, Social Impact platform iDoBro, Massive Fund Incubator, and is a founder of KREA University. |

|

Nicholas Java – Partner and IC Member More Info

Nicholas has been involved with the Beyond Capital brand for over a decade, and now oversees deal sourcing and due diligence for BCV. PrevioulsDirector at Tyton Partners, a strategy consulting and investment banking firm focused on education. Previously, Nicholas was COO of Breaker, a leading youth initiative to build management skills. He holds a MBA, Columbia Business School; MA, International Business, Columbia’s School of International and Public Affairs; BA, Johns Hopkins; 6 years, US Army. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Beyond Capital Ventures invests in companies with impact baked into their business models, and are led by conscious leaders. The Fund focuses on the impact theme of Improving Livelihoods cross-cut by three sub-themes: Gender, Climate, and Distribution. Pre-investment, we use an Impact Scorecard to rate the investment against our fund's impact goals, alongside a proprietary Conscious Leadership Questionnaire and scoring of the company’s founders. Our Impact Director creates a customized Theory of Change matrix for each company that maps outputs, outcomes and ecosystem impact, and develops a three-tier reporting framework using IRIS and IMP standards, identifying quantitative and qualitative data points. We use frameworks like the SDGs, 2X criteria, and stakeholder analyses to evaluate how the portfolio intersects with our impact themes.

We extensively review management teams and internal operations to identify impact risks or biases. We assess internal and intracompany sustainability practices through our Conscious Leadership Questionnaire, a 30-question voluntary survey evaluating the integrity of the founders' commitment to authentic, top-down impact. Our gender-smart, 2X-aligned due diligence approach prioritizes (i) female-led executive teams; (ii) businesses with gender-inclusive policies and majority female workforces; (iii) businesses addressing the needs of female consumers. Finally, we pioneered incentives in the Equitable Venture structure, giving a 100% bonus of GP carry stake to founders quantifiably advancing women across all levels of influence in the organization. We are an active partner, engaging founders on incorporating impact into their business strategy and operations. We develop conscious leadership by advocating for impactful intrafirm practices and coaching founders. We constantly communicate with portfolio companies on targets and metrics that extend beyond financial return and link directly to our impact themes.

Impact Tracking and Monitoring

Learn More

25 Highland Park Village, Dallas, TX 75205 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.