IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Achebe Capital

Climate Change

Climate Change Health and Wellbeing

Health and Wellbeing Racial Equity and Justice

Racial Equity and JusticeFirm Overview

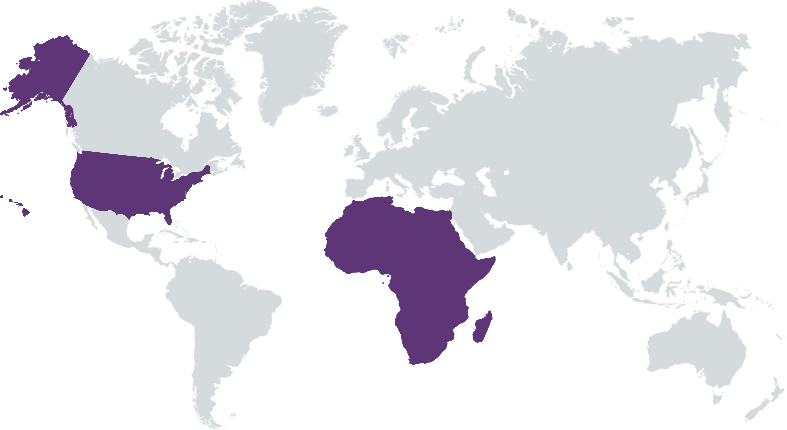

Achebe Capital is an early-stage venture capital fund that is on a mission to be a bridge across the US, Africa, and the African Diaspora by backing founders building across 4 key sectors: Care, Climate Action, Commerce, and Culture. The firm is actively fundraising for a $50M fund to invest in pre-seed to Series A deals, with a 50:50 gender parity fund portfolio target.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Achebe Capital is an early stage fund that invests in advancing joy and equity across the Global Diaspora, starting with Black and New American founders in the US and Africa, across 4 verticals: Care, Climate Action, Commerce, and Culture.

“Talent is Universal, Opportunity is not.” We believe (and history has shown) that New Americans (1st and 2nd generation “immigrants”) and Diaspora communities possess incredible entrepreneurial talent, and could change the face of the US and the world, if given the opportunity and access to catalytic capital and business development support to fully realize their vision and boldly go after their version of the American Dream as entrepreneurs. Achebe Capital Fund I plans to prove this thesis, starting with the African Diaspora in the US, which encompasses African American, Caribbean, African, and Afro-Latine New American founders. We’re starting with Black founders because they represent both the fastest growing entrepreneurial segment and the most under-resourced and under-networked segment in the US. At the intersection of these truths lies a massive market opportunity and a path to greater economic equity and social justice in the US and beyond.

Achebe Capital has three key differentiators which collectively position us as a competitive and compelling option for founders and the communities they represent and /or serve: Our demographic focus on African Diaspora (Black) and New American (1st and 2nd generation “immigrant” founders in the US and Africa. We plan to remove all barriers for “immigrant” founders that are building high impact, world changing companies by removing all barriers, including sponsoring visas as needed. Our vertical focus on investing in Culture and “Joy”, alongside healthcare,climate action, fintech, and commerce. Our community driven approach to supporting our founders with access to industry specific and culturally relevant domain expertise, Go-to-market / business development services, and diverse cap tables through equity crowdfunding.

Investment Example

My first angel check was in an African fintech company that later became a unicorn, Flutterwave. I was a mentor to one of the co-founders. Flutterwave Overview: Fintech Lagos, Nigeria flutterwave.com Flutterwave (YC S '16), provides digital payments infrastructure for the African continent. The company offers a single API which enables African banks, merchants, and payment service providers (“PSPs”) to collect and disburse payments across Africa, UK, and US, and 150+ currencies. Chi invested in Flutterwave’s Series B round at a $170M pre-money valuation. One year later, the company raised a $170 million Series C round led by Tiger Global, which confirmed its unicorn status. 5.8x valuation growth in one year In 2021, Y Combinator ranked Flutterwave as one of its 40 most valuable private companies and its most valuable Africa investment. According to Bloomberg, Flutterwave is now valued at over $3 Billion.

Leadership and Team

|

Chi Achebe – Founder and Managing Partner More Info

Chi Achebe, Founder and Managing Partner of Achebe Capital, has invested in multiple unicorn companies, advances joy and equity through VC, and has over a decade of experience as an African ecosystem builder, operator, and investor. Chi founded an award-winning African healthcare startup, established one of the largest African startup accelerator programs (Anzisha Prize) in conjunction with African Leadership Academy and MasterCard Foundation, led Global Go-To-Market strategy at Google, and built financial models at Citi. At Omidyar Network, Chi sourced 200 investable ESG opportunities. At Astia, a global angel fund that invests in women-led companies, she managed investments, one of which (nVision Medical) was acquired for $258 million dollars. As a healthcare startup founder, she developed an award-winning emergency response app that was recognized by Forbes and U.S. State Department. She holds a BA from University of Pennsylvania (with honors) and MBA from Columbia Business School (Feldberg Scholar). |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our entire mandate for the fund is 100% impact. We invest in Black and 1st and 2nd generation New American "Immigrant" founders across the US and Africa. We also invest in women founders, with a target of reaching at least 50:50 gender parity across our entire portfolio. Additionally, the 4 sectors we invest in are centered around impact: 1) Healthcare, 2) Climate Action, 3) Equitable Commerce (Fintech, Supply Chain & Logistics, Affordable Housing, Circular Economy), and 4) Culture (Creator and Creative Economy, Media, Music, Sustainable Food, Fashion, and Beauty).

Our entire mandate for the fund is 100% impact. We invest in Black and 1st and 2nd generation New American "Immigrant" founders across the US and Africa. We also invest in women founders, with a target of reaching at least 50:50 gender parity across our entire portfolio. Additionally, the 4 sectors we invest in are centered around impact: 1) Healthcare, 2) Climate Action, 3) Equitable Commerce (Fintech, Supply Chain & Logistics, Affordable Housing, Circular Economy), and 4) Culture (Creator and Creative Economy, Media, Music, Sustainable Food, Fashion, and Beauty).

Impact Tracking and Monitoring

Learn More

159 West 118th Street, 3D, New York, NY 10026 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.