IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

WaterEquity, Inc.

Gender Equality

Gender Equality Microfinance and Low-income Financial Services

Microfinance and Low-income Financial Services Water and Sanitation

Water and SanitationFirm Overview

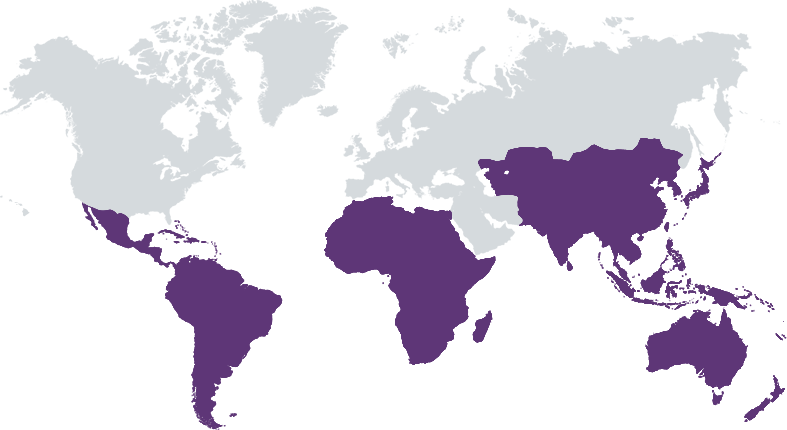

WaterEquity is an asset manager dedicated to mobilizing private investment into the water and sanitation sector in emerging and frontier markets. WaterEquity invests in financial institutions, enterprises, and infrastructure in emerging and frontier markets delivering safe water and sanitation solutions to vulnerable communities, while seeking financial returns for accredited investors. Founded by award-winning entrepreneurs Gary White and Matt Damon of Water.org, the success of WaterEquity is built on decades of experience investing in water supply and sanitation (WSS) in emerging markets. Since 2016, we have launched five funds, raised more than $460 million in committed capital for Sustainable Development Goal 6, and reached more than 6.2 million people with access to safe water or sanitation, of which women comprise 95% of microloan end-clients.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

Lack of financing is the key barrier preventing individuals from securing safe water or sanitation, and the infrastructure necessary to deliver it. WaterEquity identifies investment opportunities in the water and sanitation sector aiming to accelerate universal access to safe water and sanitation for millions of women, children, and men.

Economists estimate a $1 trillion market opportunity for providing water and sanitation services to all people worldwide by 2030. Our goal has always been to build a sustainable, global capital market for safe water and sanitation access that will directly reach those in need. We focus on two areas: Household Solutions: Among low-income consumers, at least 600 million people could access water/sanitation products, services, and upgrades if financing was available, equating to a $35 billion demand. Climate-Resilient Infrastructure: While infrastructure investments have grown by 350% in the last decade, only 1.9% of private infrastructure financing went toward WSS infrastructure specifically. There is an urgent need to expand and rehabilitate these systems globally to reach billions of people who are increasingly vulnerable to the impacts of climate change. WaterEquity believes that investment capital can bridge the financing gap that exists as a barrier to low-income clients solving for their families’ needs.

WaterEquity emerged out of Water.org, a non-profit organization that built the case for water and sanitation microfinance. Our genesis and deep experience in emerging markets and the water and sanitation sector uniquely sets us apart from our peers. WaterEquity’s team is comprised of individuals with decades of banking and water/sanitation experience, and an unparalleled understanding of the barriers low-income consumers face. This unique combination enables us to identify investment opportunities with an attractive mix of financial returns and social impact. WaterEquity and Water.org are on a mission to reach 100 million people with access to water and sanitation. Water.org’s network leverages investable opportunities for water and sanitation household solutions and climate-resilient infrastructure, as well as strengthens and expands WaterEquity’s pipeline by bringing technical assistance and advocacy activities to nascent markets. This shared goal further cultivates the most promising opportunities for both impact and financial return.

Investment Example

Located in the Philippines, Negros Women for Tomorrow Foundation (NWTF) is a renowned microfinance institution dedicated to empowering women living in rural communities with affordable financing to solve their water and sanitation needs. A long-term partner of Water.org, NWTF's track record in microfinance allowed an opportunity for WaterEquity to include the entity as an investee candidate within our pipeline building activities. In 2023, WaterEquity made a $3 million investment to NWTF, marking our first loan into the Philippines. This investee aims to reach 116,000 people with improved access to water and sanitation facilities, such as the construction and installation of a bathroom, private toilet, or septic tank. This partnership highlights WaterEquity's commitment to driving solutions that address the intersection of water and sanitation needs, gender, health, and economic development.

Leadership and Team

|

Paul O’Connell – President, Chief Executive Officer and Chief Investment Officer More Info

Paul O’Connell oversees and manages WaterEquity’s day-to-day activities. He brings over 25 years of experience in the research and practice of international finance and asset management to the organization. Prior to WaterEquity, he spent more than 20 years as President and Managing Partner of FDO Partners, LLC, a quantitative asset manager providing currency and equity advisory services to sovereign wealth funds, pension funds, and other institutional investors. His research interests include exchange rate behavior, international capital flows, and labor migration, and he has published extensively on these topics. |

|

Lauren Ferstandig – Managing Director and Chief Strategy Officer More Info

Lauren Ferstandig is responsible for overseeing the development and implementation of WaterEquity’s strategic growth plan. In this capacity, she works closely with the investments team on the implementation of the investment and asset management strategies. Prior to WaterEquity, Lauren led NatureVest, The Nature Conservancy’s sustainable investment business unit where she played an active role in the development and strategic oversight of NatureVest’s multi-billion dollar impact investment portfolio. Before joining The Nature Conservancy, Lauren spent over a decade at Ares Management LLC, working across their private credit strategies in the United States and Europe. Lauren holds a Bachelor of Arts with honors in American Literature and Civilization from Middlebury College and a Master of Science with distinction in International Relations from the London School of Economics. |

|

Elan Emanuel – Managing Director and Chief Investor Relations Officer More Info

Elan Emanuel is responsible for mobilizing investments and partnerships with a broad portfolio of investors to accelerate WaterEquity’s impact addressing the global water and sanitation crisis. He brings 15+ years of experience in developing public-private partnerships to this role. Prior to WaterEquity, Elan led Fair Trade USA’s global cocoa program, where he established and directed strategic partnerships with large multi-national corporations, NGOs, and agricultural cooperatives. Additionally, Elan has extensive experience in the legal sector, domestically for Hanson Bridgett LLC, and internationally for the International Criminal Tribunal for Rwanda and the Sierra Leone Ministry of Foreign Affairs. Elan holds a Bachelor of Arts in History from the University of Michigan, Ann Arbor, and a Juris Doctor from the University of California, Berkeley School of Law. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

WaterEquity's funds have a single, overarching purpose: to end the global water and sanitation crisis. Specifically, our investment strategies address the crisis by making investments into high-performing investees, including financial institutions, enterprises, and climate-resilient infrastructure, that serve to increase access to safe water or sanitation among low-income households and communities in emerging markets. Our teams have integrated impact measurement into every stage of the investment cycle to proactively manage and funnel capital towards achieving dedicated impact goals. These steps include screening in five impact dimensions, impact scoring, identification of key impact metrics, and projection of impact in each metric. In addition, all investments contain covenants requiring that investment capital be used exclusively for water or sanitation, and key performance indicators are measured quarterly and monitored throughout the life of the investment to ensure compliance.

During due diligence, WaterEquity’s Regional Investment Directors conduct comprehensive risk assessment on investee candidates using an ESG scorecard, identifying any key issues and the potential risk associated with those items, such as compliance with local environmental laws. Findings are presented to the Investment Committee with specific short-term and long-term recommendations to address risk and enhance practices. Any candidates that do not have acceptable ESG risk levels and are unwilling to agree to action plans to close ESG performance gaps will be disqualified from WaterEquity funding.

Impact Tracking and Monitoring

Learn More

117 W 20th Street, Suite 204, Kansas City, MO 64108 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.