IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Medical Credit Fund

Financial and Economic Inclusion

Financial and Economic Inclusion Health and Wellbeing

Health and Wellbeing Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

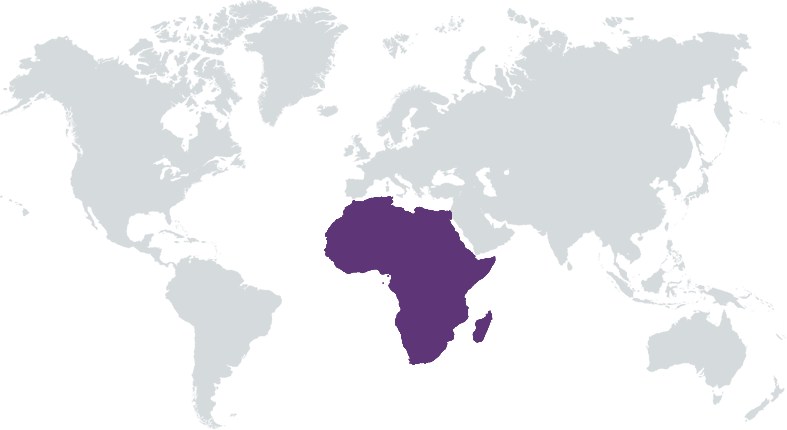

Medical Credit Fund (MCF) is a not-for-profit foundation established by PharmAccess Group in 2009 under The Netherlands' law. For the past 20 years, PharmAccess has been committed to increasing access to quality healthcare services for vulnerable groups in sub-Saharan Africa, utilizing advancements in technology and connectivity. MCF’s mission involves mobilizing public and private resources to benefit healthcare providers and patients through various means, including providing loans to healthcare entrepreneurs, setting quality standards through SafeCare, facilitating health insurance, attracting private investments, and conducting impact and operational research. PharmAccess takes an integrated approach, addressing both the demand and supply sides of healthcare, and employs digital tools to connect patients, providers, and payers. MCF plays a vital role by offering capital and technical assistance to private healthcare firms, thereby enhancing and upgrading their operations. Furthermore, MCF leverages innovative digital solutions to scale its impact in the healthcare sector and beyond.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

MCF addresses the growing demand for quality healthcare services in sub-Saharan Africa by providing loans and partnering with SafeCare for a quality and business improvement program tied to those loans, empowering private healthcare businesses to enhance their capacity, ultimately enabling them to deliver improved services to a broader clientele.

MCF recognizes that the public health sector in most African countries struggles to meet the growing demand for healthcare. Consequently, 50% of the population turns to the private sector, which is predominantly comprised of Small and Medium-sized Enterprises (SMEs). These healthcare facilities, however, face significant challenges in accessing the necessary financing to expand their operations. MCF bridges this gap by providing health SMEs with capital and technical assistance to enhance the quality of healthcare provided, mitigate investment risks and facilitate scalability. MCF’s beneficiaries comprise diverse healthcare entities, including clinics, health centers, hospitals, pharmaceutical and equipment suppliers. The fund offers local currency loans of up to EUR 5 million, complemented by a technical assistance program (SafeCare) for evaluating, improving, and certifying incremental quality improvements. Additionally, MCF responds to market needs by introducing innovative financial products, including a digital loan product based on mobile money turnover and receivable finance through insurance claims.

MCF distinguishes itself from its peer group through its commitment to innovation and the utilization of mobile and digital technology. A prime example is the MCF Digital Loan product, an offering that provides health SMEs with mobile money-based loans featuring flexible repayments linked to mobile revenue. This innovative approach addresses the unique needs of healthcare businesses, offering convenience and requiring no collateral. Currently operational in Kenya and Ghana, MCF will launch the loan product in Tanzania late 2024. What further sets MCF apart is its comprehensive approach. Beyond merely extending loans, MCF is dedicated to enhancing the business and quality performance of its clients, thereby strengthening their capacity and resilience. This is achieved through an effective technical assistance program, delivered in collaboration with PharmAccess. MCF’s holistic approach ensures that healthcare enterprises not only access capital but also receive the support needed to thrive and provide high-quality care to their communities.

Investment Example

ZamZam Medical Services, located on the outskirts of Nairobi, is managed by Mrs. Esther Muthoni Karaya, a 45-year-old registered nurse-midwife. With over 20 years of experience, she has realized her dream of establishing a modern health center. Since 2012, Mrs. Muthoni Karaya has utilized MCF loans to expand ZamZam, adding more admission wards, increasing patient flow, and hiring additional staff. Today, ZamZam employs 40 permanent staff members and serves around 16,200 patients annually. The facility offers a range of services, including maternity, physiotherapy, dental care, laboratory services, and family planning. Committed to quality, ZamZam has progressed from level 1 to level 4 in SafeCare standards (out of 5). With almost 40 digital loans, ZamZam continues to enhance its facilities, positioning itself as a trusted healthcare provider in the community.

Leadership and Team

|

Arjan Poels – Managing Director More Info

Experienced Development Banker with a passion to grow SMEs and strengthen financial institutions in sub-Saharan Africa. Held senior executive positions in Commercial Banking, Risk Management, Change Management and Development Finance focusing on the sectors health, agriculture, education, manufacturing and trade. |

|

Dorien Mulder – Investment Director More Info

|

|

Kennedy Okong’o – Director Medical Credit Fund East Africa More Info

|

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The Medical Credit Fund's primary objective is to increase the delivery of affordable quality healthcare services, particularly to underserved populations, by enhancing access to capital and reducing investment risk. Every borrower, including health facilities, diagnostic centers, pharmaceutical, and medical supply distributors must serve this goal. MCF’s due diligence process specifically assesses the social impact of potential borrowers, including the populations they serve. In addition, the selected healthcare facilities participate in a medical and business quality improvement program that strengthens their business case, debt servicing capacity, and reduces their credit and medical risk. Through its program MCF impacts women at various levels, by improving mother and child care services, by empowering female staff working at the facilities (majority of staff is female) but also by supporting female entrepreneurs. The digital loans do not require collateral, which is a common hurdle for access to financing, especially for women.

Healthcare facilities that seek loans from MCF are required to participate in a quality improvement program using the internationally recognized SafeCare standards (www.safe-care.org). These standards were developed in partnership with the Joint Commission International of the U.S.A. and the Council for Health Service Accreditation of Southern Africa. The SafeCare Standards mandate that healthcare providers not only adhere to local laws and regulations but also actively work to reduce and control hazards and risks, prevent accidents and injuries, and maintain a safe environment. Furthermore, providers are expected to plan for occupational health and safety programs, fire safety measures, emergency protocols, handling hazardous materials and ensuring security. This comprehensive approach underscores MCF's commitment to promoting social and environmental sustainability within the healthcare sector.

Impact Tracking and Monitoring

Learn More

AHTC, Tower C4, Paasheuvelweg 25, 1105 BP Amsterdam

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.