IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

EFM

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

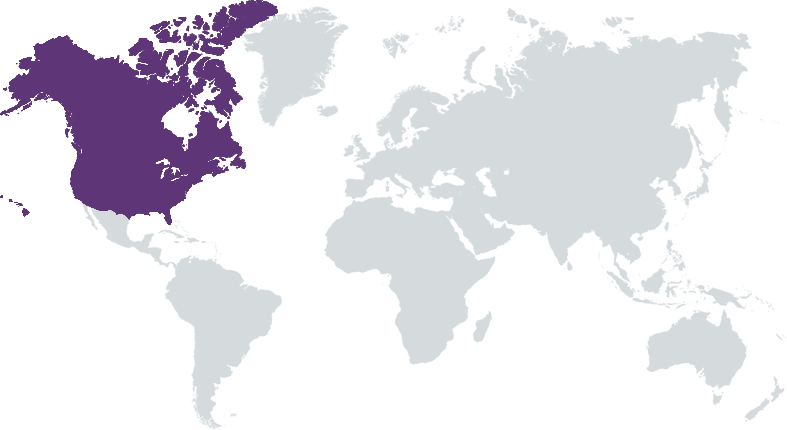

EFM manages commercial forests and other natural assets with a climate-smart strategy that creates long-term financial value alongside enduring social and environmental impact. Our four co-mingled private equity funds focus on FSC-certified forests in the US. Our advisory business reviews and recommends investments in cutting-edge natural climate solutions both domestically and abroad. Investors and clients include accredited individuals, family offices, corporation, institutions and more. The EFM team has deep experience in natural climate investments and management, finance, tax credits, and environmental markets.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

EFM believes that managing natural assets to co-produce environmental services alongside high-quality products leads to a differentiated investment strategy and a more valuable asset.

EFM was founded in 2004 with the conviction that forests are worth more than the commodity value of the lumber they produce. The founders recognized that forests were inextricably linked to the long-term health of the planet and its inhabitants. They also believed that managing forests for long-term value would benefit investors, forests, and the surrounding communities. Today, EFM is committed to this approach and these principals more than ever. We feel optimistic that the market is finally beginning to adopt our perspective and recognize the intrinsic value of forests for our financial, social, and environmental health. This is manifested in increased public and private funding for conservation, restoration, and climate-smart management to the benefit of the ecosystem, landowners, and investors.

Traditional timber managers mainly grow few species of trees in a plantation setting and harvest wood as quickly as possible to maximize yield and short-term financial gain. The main value drivers are timber, capital appreciation, tax advantages and real estate development. EFM designs an FSC-certified plan for each property that will create a desired future condition that includes forest health, resilience, and long-term value creation. These management practices grow timber while sequestering carbon, promoting biodiversity and protecting fresh water. Value drivers include timber, capital appreciation and tax advantages, but also conservation easements, carbon offsets, mitigation banking, environmental credits, public funding, recreational leases and more.

Investment Example

In December 2023, EFM Fund II sold its Chimacum Ridge property to the Jefferson Land Trust (JLT), a local conservation nonprofit working with their community to preserve working lands and habitat, forever. The 854- acre property on the east side of Washington’s Olympic Peninsula was originally purchased in 2015 from a commercial timberland owner. At that time, EFM was able to enter into a longterm purchase and sale agreement with the JLT for a future sale at market prices. This derisked the investment in the Fund and gave JLT the time necessary to gather resources and capital to acquire the site. During the eight-year ownership, EFM stewardship activities included thinning to enhance forest health and productivity, permanently protecting the land through conservation easements, and managing the forest with FSC and climate-smart practices. EFM achieved both its financial and impact goals during ownership.

Leadership and Team

|

Bettina von Hagen – CEO More Info

Bettina co-founded EFM and earned her CEO role in 2008. A former commercial banker, Bettina has over 30 yearsof experience in banking, forestry, conservation finance and fund management. As Vice President of the NaturalCapital Fund, a $26M fund that is the working endowment of Ecotrust, she helped guide the organization towardsa 100% impact investment strategy. In this role she also helped launch Beneficial State Bank, redevelop theNatural Capital Center (the first historic redevelopment to receive LEED gold certification), and develop markets forhigh-quality forest carbon projects at the state, regional, and federal levels. Prior to joining Ecotrust, Bettina was aVice President at First Interstate Bank of Oregon. |

|

Amrita VK Vatsal – Managing Director More Info

Amrita joined EFM in 2011 and is a member of EFM’s management team. In this role, she shapes the company’s growth and impact investment strategies managing new product development, fund structuring and investor recruitment. Additionally, as a member of the investment committee, she contributes to property sourcing, transaction structuring, conservation finance, and carbon project development. Prior to EFM, Amrita was an Assistant Manager with Pricewaterhouse Coopers in Singapore for 5 years and she subsequently cultivated a passion for financing the growth of environmental business while working for Piper Jaffray’s clean-tech banking group. |

|

Chris Sweeney – COO More Info

Chris leads the day-to-day operations of the Management Company and its Funds including finance, accounting, tax, valuation, financial reporting, investor reporting, compliance and office operations. He has 30 years of experience in the financial services and investment industry most recently as Chief Operating Officer at Prime Buchholz, an institutional investment advisor headquartered in the greater Boston area. Prior to Prime Buchholz, Chris served as Chief Financial Officer and Treasurer of World Learning, Inc., a global education organization, and held several executive roles at State Street Global Advisors and State Street Corporation. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact Tracking and Monitoring

Learn More

721 NW 9th Ave, Suite 230, Portland, OR 97209 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.