IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Elevar Equity

Demographic-based Impact

Demographic-based Impact Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Financial and Economic Inclusion

Financial and Economic InclusionFirm Overview

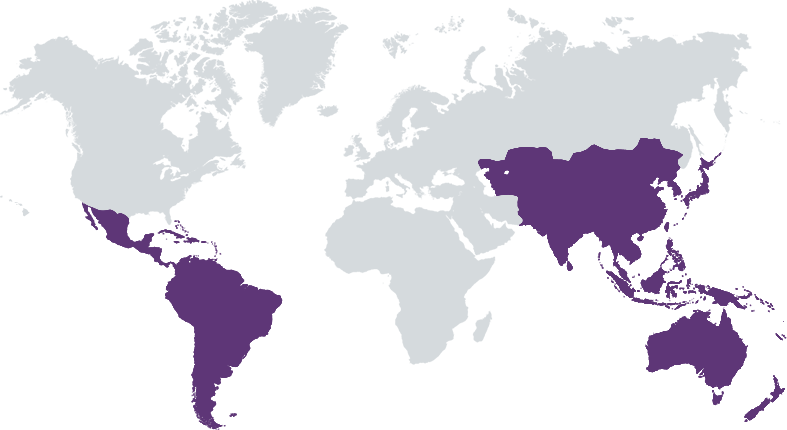

Elevar Equity pioneered the commercial approach to impact investing, backing seasoned entrepreneurs building large-scale, enduring businesses focused on Entrepreneurial Households and the #EPICopportunity. Elevar was early in identifying the entrepreneurial trends within these households and has consistently invested in this thesis since 2006 starting with microfinance and quickly expanding to affordable housing, healthcare, education, agriculture, and small businesses (MSMEs). With two decades of ground-up field insights and the scale journeys of ~50 companies, the #ElevarMethod of investing has delivered high-priority services to over 55 million Entrepreneurial Households across India and Latin America. Elevar is actively involved in all phases of company creation and manages the current active funds: Elevar Equity III LP (2014), Elevar Equity IV LP (2018), Elevar India V (2021).

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

Elevar Equity pioneered the commercial approach to impact investing, backing seasoned entrepreneurs building large-scale, enduring businesses focused on Entrepreneurial Households and the #EPICopportunity.

The Elevar Method, or e.M, is the outcome of 18+ years of building ‘equity for equity’. Our investment thesis focuses on four aspects: underserved customers, business models that deliver products and services affordably, entrepreneurs with the ambition and ability to build businesses that address barriers of access and inequity, and scale. We view marginalized communities as large sources of untapped economic and social value and develop our investment themes around specific products or services that can link underserved customers to global networks (such as financial, communication, information and market systems), prioritizing opportunities based on the community’s expressed needs for specific essential products or services. Elevar invests in thematic areas that are essential products and services focused (financial inclusion, MSME & market linkages, education & employability, agri supply chains).

Elevar has invested in 50+ companies and reached over 55Mn households over a span of 18 years, with the same razor sharp focus on Entrepreneurial Households. We have been the founding investor in 25 of our 50 investments and the first institutional investor in 42 of our 50 companies. Leveraging this track record, the founders of Elevar have seeded EPIC. This platform will support the creation of multi stage/ multi asset funds by raising funds, providing full operational fund support, branding and micro market data to support investing decisions and post investment management support. In addition, their proprietary data driven, customer insights tool is tailor designed for operating companies to improve GTM strategies in tier 3+ cities - this is already in beta mode with a couple of fast growing portfolio companies.

Investment Example

Developing countries have a chronic scarcity of critical care options per capita. Most ICU beds are concentrated in tier 1 and tier 2 cities, with limited or no critical care capacity in smaller districts and towns. Cloudphysician is a healthcare services and med-tech platform enabling improved health outcomes by addressing the lack of access to quality critical care in ICUs across the globe, including tier 2/3 cities and beyond. Through its technology-driven tele-ICUs, Cloudphysician tackles the problem of limited ICU infrastructure and the unavailability of skilled critical care physicians in remote locations. The Cloudphysician model and proprietary technology, RADARTM, allow small hospitals in these locations to provide their patients with better, more cost-effective and efficient critical care solutions. Over the last year, there has been a 55% YoY growth in total revenue and a cumulative total of 87,946 patients (as of Jan 2024).

Leadership and Team

|

Sandeep Farias – Co-Founder and Managing Partner More Info

Sandeep Farias leads Elevar globally and is responsible for the firm’s strategy and organizational development, while engaging with entrepreneurs in India and Latin America to think through inflection points in their entrepreneurial journeys. Sandeep has close to 25 years of work experience in diverse areas such as emerging markets investing, governance and regulation, organizational design, transactions and structuring, and corporate law. He founded Elevar in 2008, being passionately driven by working with early stage companies that foster economic development for low income communities; particularly in financial services including MSME finance and microfinance (where he played a leadership role in the sector’s transformation over a decade from the non-profit space to formal banking), affordable education, healthcare and agricultural services. |

|

Johanna Posada – Co-Founder and Managing Partner More Info

Johanna co-founded Elevar in 2008 with the view that “The efficient allocation of capital into the hands of productive communities in developing countries creates wealth and a foundation for prosperity. We accomplish this by maintaining an investment discipline and backing entrepreneurs who know best how to serve and empower their clients. We can positively impact people’s lives by promoting scalable, market based solutions that address their needs.” Johanna has over 17 years of emerging markets investing experience, corporate finance, microfinance and economics. She has partnered with and invested in companies which are today some of the biggest providers of services to disconnected communities in India and Latin America. |

|

Jyotsna Krishnan – Managing Partner More Info

Jyotsna is Managing Partner at Elevar and a founding team member at Enmasse. She leads the firm’s investing strategy and priorities in India, along with driving the overall fund performance globally. While building Elevar’s investing practice in India, she has closely partnered with entrepreneurs building transformational business models in sectors such as agriculture, MSME services, affordable education and quality healthcare. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Elevar explicitly targets Entrepreneurial Households (EHs). EH’s are characterized by their innovative spirit and their ability to generate multiple streams of income, making them significant players in driving economic growth and enhancing social mobility. These households are characterized by their unwavering, long-term dedication to transforming aspirations into tangible outcomes. The defining features of Entrepreneurial Households are multiple incomes and revenues, and the high frequency and strategic nature of their transactions, as they continuously balance their cash flows to meet both immediate and future goals. This customer base has purchasing power (though limited) and is acutely aware of the disparities that exist in their communities, limiting their economic opportunities. This lack of connection, whether caused by oversight, discrimination, poverty or other obstacles, represents a highly inefficient condition that can be addressed by entrepreneurial, scalable, customer-focused business models.

Elevar believes that effective management of ESG issues across the lifecycle of our investments is important. As an early growth capital provider, it is vital to the long term sustainability of our companies to begin factoring in ESG considerations in a thoughtful, intentional and stage appropriate manner. As an early stage investor, and typically the first institutional investor in our portfolio companies, the intentionality of the entrepreneurs with respect to an impact journey is an important aspect of our underwriting process - including in this context, the recognition of the importance of ESG practices. We have documented this approach in our investment and portfolio management processes. This includes a detailed discussion with the founders prior to investment on the ESG risks and opportunities in their business model, identified gaps as well as agreed action plans to mitigate these risks. Post investment, these discussions are held on an ongoing basis.

Impact Tracking and Monitoring

Learn More

450 Alaskan Way S., Suite 200, Seattle, WA 98104 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.