IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Creation Investments Capital

Management, LLC

Affordable Housing

Affordable Housing Financial and Economic Inclusion

Financial and Economic Inclusion Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

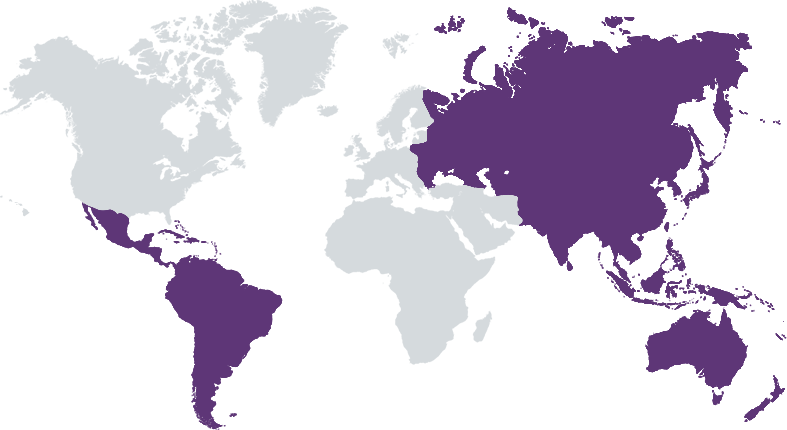

Creation is a leading alternative investment firm with deep expertise in Financial Inclusion, focusing on private equity and private credit in emerging MFIs, SME lenders, Banks, FinTech, and tech-enabled BOP Financial Services Providers. Creation manages over $2.1 billion AUM from family office and institutional investors, 95% of whom had not previously invested in Impact, ESG or socially responsible investments. We provide the un/underbanked access to capital and needed products (SME loans, moto/auto/tractor leasing, solar power finance, factoring, savings, remittances, and insurance) to engage in small-business activity, increase incomes, improve livelihoods, and manage risk.. Our portfolio serves more than 60 million entrepreneurs with $19.5 billion in loans outstanding, $9 billion in deposits, and over $13 billion in insurance risk. Mapped to the UN SDGs and measured with the IRIS+ taxonomy, Creation is committed to rigorous impact reporting. Creation sponsors impact investments and venture philanthropy beyond Financial Services through our Foundation.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

Growth private equity and private credit investments in Financial Inclusion have the greatest potential for aligned social and financial returns, proving the Impact Investments hypothesis with additionality and attribution.

Creation maximizes financial and social returns by: • Identifying unique BOP financial services providers, going beyond the usual suspects in microfinance (blue chip, mono-product) including tech-enabled firms, SME lenders, Leasing, Payments and Insurance providers • Leading the first institutional funding round, preparing management teams for larger capital pools • Negotiating directly with management/shareholders for significant stakes, expanding employee ownership via ESOPs, to ensure our deep involvement, active governance and alignment • Providing growth equity ($15 to $75 million) and secondary buyout capital for expansion, product innovation, and technology development • Leading industry consolidation through strategic mergers/acquisitions • Deep domain expertise in financial services and active involvement in our companies allow us to make fast decisions, ensure the highest corporate governance and develop our management teams for further leadership advancement • Integrating ESG factors into our entire investment process, aligning all investment activities to UNSDGs, reporting and managing to over 100 IRIS+ metrics for measurable impact

•Exclusive focus on Financial Inclusion = deep domain expertise •Private Equity approach demands active involvement, quite different from the DFI or MIV lenders who are very passive and often missing-in-action •Fast decisioning - essential when dealing with high-growth companies and dynamic markets •Highly engaged board members, ensuring the highest corporate governance •Developing management teams, especially women leaders •Invest beyond traditional MFIs, identifying unique BOP financial services providers - SME, Leasing, Factoring, Wholesale, FinTech, Payments and Insurance •Negotiating directly with management / shareholders for controlling stakes, expanding ESOPs •Providing needed growth equity ($15 to $75 million) along with secondary buyout capital to provide the resources needed for expansion, product innovation, technology launches and M&A/consolidation •Leading consolidation in the industry through strategic M&A •Attracting new investors (Institutional and Family Offices) to Impact •Investing significant capital alongside of approximately ~7% of every fund and co-investment (Creation members have invested over $60mm USD)

Investment Example

Creation invested in Vastu Affordable Housing in 2021 to expand their construction finance business, helping families access capital to build their own single-family home on land they already own. Through $10,000 to $20,000 construction loans, over 100,000 families now own their own homes. Traditional banks will not lend to these clients as they do not have salaried income. Vastu has the capability to underwrite informal income, allowing this HFC to grow to almost $1.1 billion in loan portfolio without losing credit quality. Through Creation's investment, Vastu has added vehicle finance, cross-selling used 2-wheeler/motorcycle finance products to these families. Creation is proud to have added Affordable Housing to our product suite which spans micro-loans, SME leasing, wholesale finance, and insurance.

Leadership and Team

|

Patrick Fisher – Managing Partner & Founder More Info

Mr. Fisher founded Creation in 2007 coming from JPMorgan and continues to lead all operations in the firm including deal generation, deal structuring, capital raising and investor relations. He chairs the firm’s Investment Committee and sits on the board of many of the firm’s portfolio companies, along with several other for-profit and not-for-profit institutions. Mr. Fisher received a Master of Business Administration from Northwestern University and Bachelor of Arts in Philosophy, Theology, and Computer Applications from the University of Notre Dame. |

|

Ken VanderWeele – Partner & Co-Founder More Info

Mr. Vander Weele was instrumental in the establishment of Creation Investments and is a co-founding board member of Creation Investments Social Ventures Fund I, II, and III. He sits on the firm’s Investment Committee and on the board of several of the firm’s portfolio companies. Mr. Vander Weele is an industry veteran in microfinance and prior to joining Creation Investments, he served as President for Opportunity International, a leading NGO in financial inclusion, assisting in their growth from $5 million to over $1 billion in assets. |

|

Bryan Wagner – Partner More Info

Mr. Wagner joined Creation Investments in 2013 and leads the firm’s efforts in Latin America. Previously, he was an Executive Director at Morgan Stanley, where he had leadership responsibility for investment banking activities in financial inclusion after spending several years in the Latin America Investment Banking Group. Outside of Morgan Stanley, he worked in various operational roles in microfinance in West Africa and New York City. Mr. Wagner sits on the firm’s Investment Committee and on the boards of the firm’s portfolio companies based in Latin America. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Creation exclusively targets investments in companies where impact is integral to the financial products delivered. Through tailored, attractive, beneficial financial services aimed at the un/underbaked at the Bottom of the Economic Pyramid, we provide critical access to financial services (Credit, Savings, Insurance, Payments, etc) which is the impact. We target not only traditional MFIs, but those financial services providers who serve SMEs through longer, lower rate loans to finance asset purchases including auto/moto/tractor finance as well as home improvement/sanitation/solar power loans, improving livelihoods and growing wealth beyond what smaller micro loans are able to do. Creation also targets financing machines and vehicles with low carbon output and clean energy production provide substantial social, economic and environmental benefit. We have also begun investing in Wholesale lenders who strengthen the capacity of financial markets and direct capital to MFIs as well as SME, Affordable Housing, and Education lenders, increasing access for all.

Our due diligence checklist includes several areas of sustainability, diversity and social impact. ESG considerations include, but are not limited to, environmental impact, carbon footprint, environmental exclusions, BOP clients served, jobs created and sustained through MSMEs, percentage of women served, and number of dependents in BOP households directly impacted through direct economic activity. Many target companies may not have adequate practices in areas of sustainability, we look to influence our portfolio companies through active governance given the significant ownership we have, including board and shareholder representation and control. In addition, we work with our institutions to institutionalize transparent, comparable and comprehensive social impact standards and policies. In practice, we work hard to build diversity at the management and board level leading to better discussions, better decisions, and better understanding of the clients. We have recently promoted several women to the board level to increase the participation and improve overall performance.

Impact Tracking and Monitoring

Learn More

156 N Jefferson Street, Suite 201, Chicago, IL 60661 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.