IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

BlueOrchard Finance Ltd

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Gender Equality

Gender EqualityFirm Overview

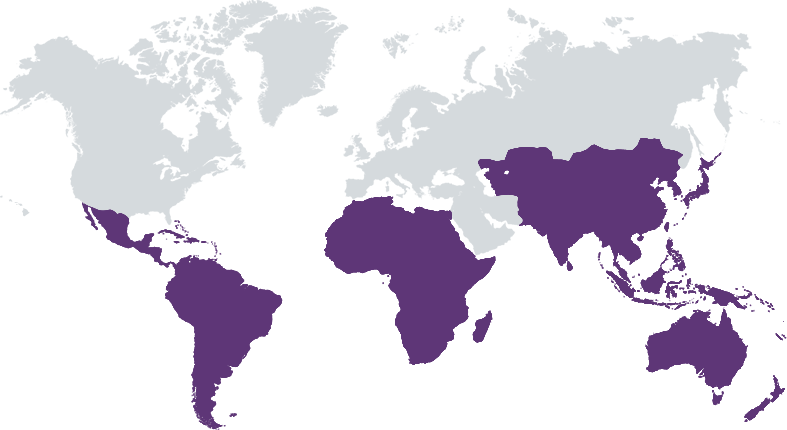

BlueOrchard is a leading global impact investment manager and member of the Schroders Group. Established in 2001 as the world's first commercial manager of microfinance debt investments, BlueOrchard now provides impact investment solutions across Private Debt, Fixed Income, and Private Equity. Being a professional investment manager and expert in innovative blended finance mandates, BlueOrchard has a sophisticated international investor base and is a trusted partner of leading global development finance institutions. Today, BlueOrchard splits their activities into two broad topics: inclusion and climate. The firm has significantly increased its climate investing capabilities to contribute to the target of the Paris agreement.To date, BlueOrchard has invested over USD 11 billion across more than 100 countries. As of December 2023, BlueOrchard supported over 300 million people in emerging and frontier markets with its investments. The BlueOrchard offices are located in Switzerland, Luxembourg, Georgia, Peru, Kenya and Singapore.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

At BlueOrchard, we align profit with purpose, dedicated to generating lasting positive impact while providing attractive returns to investors. Our mission is to tackle global issues by focusing on underserved communities and environment, utilizing innovative strategies, expertise and our vast network to "include the excluded".

Sustainable and responsible investments are the heart of BlueOrchard’s operations. The company strategy is unique in combining a stable financial return with fundamental social and environmental focus. Investments in impact investing, specifically aim to invest in institutions that are resulting in a positive social and environmental impact. This is achieved through the expansion of financial services to those who have historically been excluded from such services (financial inclusion and reduction of inequalities) or through the financing of the transition towards a low carbon economy (climate finance). BlueOrchard’s strategy consists of identifying promising socially responsible investees worldwide, and to accompany them in their growth and development while earning a stable financial return for investors through a risk-controlled, rigorous asset selection process. BlueOrchard focuses on “including the excluded” and recognizes the importance of the financial sector in accelerating the transition to climate neutrality and meeting the goals set by the Paris Agreement.

1. Impact pioneer and leader: global reach of over 300m people (as of Dec-2023) & manager of the largest commercial microfinance fund globally. 2. Expertise and track record: unprecedented 20+ year track record & highly experienced staff, local know-how and network across the countries in which we operate. 3. Proven investment platform: we provide impact investment solutions, particularly focusing on emerging and frontier marketplaces spanning diverse asset classes and impact themes. 4. Thought leadership: BlueOrchard's proprietary B.Impact Framework inspiring Schroders' impact framework, distinctively quantifying social and environmental impacts across assets, with specific tools and independent governance. 5. Climate investing: we launched climate specialised funds targeted at countries and communities suffering from resource scarcity, which are most adversely affected by changing climate patterns. 6. Gender-lens investing: We developed a gender rating tool to assess an institution’s gender smart & inclusive products & services, and their corporate Gender, Diversity & Inclusion practices.

Investment Example

BlueOrchard supports microfinance institutions (MFIs) that provide financial products to low-income groups, enabling them to grow income-generating activities and to break out of poverty. An illustrative example is an MFI in Georgia that BlueOrchard has been supporting for more than 10 years. The MFI focuses on its mission of providing financial services to individuals and small businesses who need it the most, including disadvantaged minorities in the country. The institution serves more than 113,000 customers, 58% of whom are women and 46% live in rural areas. A third of its GLP is dedicated to micro borrowers with an average loan size of USD 1,700. Moreover, the institution promotes environmental sustainability by offering green loans that enable customers to finance the installation of energy-efficient cook stoves.

Leadership and Team

|

Philipp Müller – Chief Executive Officer More Info

Philipp Mueller is Chief Executive Officer of BlueOrchard. As CEO, he leads the executive and extended management team and has executive oversight of the firm’s client and business areas, including strategy and resource management. Prior to that, Philipp held the position of Head Investment Solutions, heading the Global Investment Committee, and overseeing the portfolio management and asset allocation of all funds and mandates. Philipp joined BlueOrchard in 2018 from Partners Group, where he worked for ten years in Switzerland and the UK, most recently as Senior Vice President of Investment Solutions. |

|

Maria Teresa Zappia – Chief Impact & Blended Finance Officer, Deputy CEO More Info

Maria Teresa Zappia is responsible for the Public Private Partnership (PPP) funds under BlueOrchard’s management and impact practice. Maria Teresa joined BlueOrchard in 2008 as Chief Investment Officer. Previously Maria Teresa worked as Senior Banker in the European Bank for Reconstruction and Development financial institution team both in London and Central Asia. Prior to that she worked for the Asian Development Bank in Manila and was an ODI Fellow in Africa. |

|

Michael Wehrle – Head of Investment Solutions and Private Equity More Info

Michael is Head Investment Solutions & Private Equity at BlueOrchard. In this function, he is the Chair of the Private Debt Global Investment Committee, Chair of the Private Equity Investment Committee, and is overseeing the portfolio management and asset allocation of BlueOrchard’s funds and mandates as well as the development of product solutions. He has over 20 years of in-depth knowledge and extensive experience in public and private markets investment management and design and development of product and investment solutions. Prior to joining BlueOrchard, Michael held several management positions at Partners Group in Switzerland and UK. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

ESG and impact management is an integral part of our investment process. Our proprietary BlueOrchard tool, called the B.Impact Framework, includes as one of its steps an analysis dedicated to assess and track the potential impact of each investment. This analysis follows the five dimensions of the Impact Management Project. It combines the investment intent with impact KPIs and information on the end beneficiaries, and further assesses the investment’s contribution while factoring in the different potential risks that the intended impact may not be achieved. As a result, we assess impact on various levels, not only focusing, for instance, on the amount of beneficiaries reached by an investee, but also analysing what type of beneficiaries are reached (e.g. female, rural) or what the local circumstance are. The B.Impact Framework is an important part of the investment process, helping to guide BlueOrchard’s investment decisions.

Our own proprietary ESG & impact management tool, the B.Impact Framework, includes next to an impact analysis as well an ESG assessment of our investees. The ESG assessment entails a sustainability risk assessment taking into consideration environmental, social or governance characteristics of the investee. Aspects such as employee diversity, responsibility towards clients, or a company’s environmental practices are an integral part of this analysis. The ESG assessment allows BlueOrchard to identify potential negative impact on the value of our investments but also guarantees that the company needs to meet certain minimum safeguards standards from a sustainability perspective.

Impact Tracking and Monitoring

Learn More

Seefeldstrasse 233, 8008, Zürich, Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.