IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Omnivore Capital Management

Advisors Private Limited

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

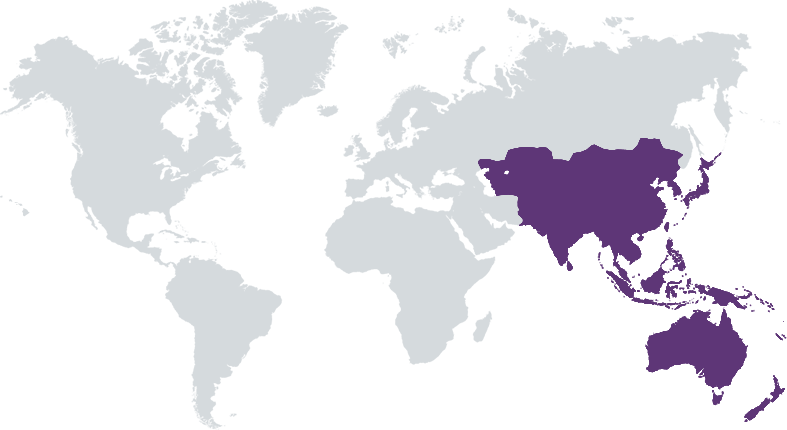

Omnivore is an impact venture capital firm, based in India, which funds entrepreneurs building the future of agriculture and food systems. Omnivore pioneered agritech investing in India, backing over 40 startups since 2011, and currently manages INR 24 billion (approximately $300 million) across three funds. Omnivore defines itself as a “financial first” impact investor, seeking to deliver market-rate venture capital returns, while impacting the lives of smallholder farmers and rural communities. Every day, Omnivore portfolio companies drive agricultural prosperity and transform food systems across India, making farming more profitable, resilient, sustainable and climate-proof.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Omnivore invests in Indian startups developing breakthrough technologies for agriculture, food systems, climate resilience, and the rural economy.

Omnivore’s Theory of Change (TOC) is to drive agricultural prosperity, transform food systems, and promote climate resilience in India through four impact pillars: a. Increasing Smallholder Farmer Profitability: raising farm yields, securing better prices for farm outputs, and reducing farm expenditures b. Enhancing Smallholder Farmer Resilience: providing access to innovative finance, risk management solutions, steady/augmented sources of income, and improved market dynamics c. Improving Agricultural Sustainability: lessening environmental impact of agriculture by optimizing consumption of natural resources while minimizing wastage and spoilage d. Catalyzing Climate Action: mitigating GHG emissions from agriculture, promoting climate adaptation for smallholder farmers, and increasing the area under sustainable cultivation Flowing from the Theory of Change, Omnivore’s investment thesis focuses on six core agritech themes: Agri Platforms & Marketplaces, Climate-Smart Deeptech, Sustainable Consumer Brands, Agrifood Life Sciences, Rural Fintech, and Circular & Novel Materials.

Omnivore is the only impact investor in South Asia focused entirely on agriculture. We have built a reputation over the past decade as the preferred investor for Indian agritech startups, given our deep sector expertise and catalytic value addition. Omnivore's investment team is drawn from the agribusiness and agritech sectors, with backgrounds in agricultural development, food processing, farm machinery, animal nutrition, agrochemicals, seeds, rural banking, dairy, poultry, and aquaculture. We have significant experience in helping entrepreneurs pioneer new business models in rural India, including digital farmer platforms, app-based subscription services, innovative hardware, fintech, and tech-enabled supply chains. Omnivore has been able to catalyze significant follow-on capital into our portfolio companies. We have helped bring multiple global funds into their first Indian agritech investments, including Temasek, Sofina, Sequoia, Prosus (Naspers), Quona, Rocketship, Nexus, Kalaari, SIG, AgFunder, Flourish, Wavemaker, Creation, DSG, and Alpha Wave.

Investment Example

DeHaat is a technology-based platform offering full-stack agricultural services to farmers, including distribution of high-quality agri inputs, customized farm advisory, access to financial services, and market linkages for selling their produce. DeHaat has been designed as a one-stop solution for the needs of Indian smallholder farmers; currently over 800,000 farmers across Bihar, UP, Jharkhand, and Odisha are on the platform. The platform integrates a digital marketplace with a rural network of over 8,800 last mile service delivery centers, overseen by village-level entrepreneurs, radically increasing farmer profitability and resilience. For more information, please see https://agrevolution.in

Leadership and Team

|

Mark Kahn – Managing Partner More Info

Mark co-founded Omnivore with Jinesh Shah in 2010. Previously, Mark was the Executive Vice President (Strategy & Business Development) at Godrej Agrovet, one of India’s foremost diversified agribusiness companies. At Godrej Agrovet, Mark was responsible for corporate strategy, M&A, R&D, and new business incubation. Earlier in his career, Mark worked for Syngenta and PFM. He earned a BA (Honors) from the University of Pennsylvania and an MBA from Harvard Business School, where he graduated as a Baker Scholar. |

|

Jinesh Shah – Managing Partner More Info

Jinesh co-founded Omnivore with Mark Kahn in 2010. Previously, he was Vice President and CFO at Nexus Venture Partners, one of India’s leading venture capital funds. Earlier in his career, Jinesh worked in corporate finance roles for Datamatics (leading Treasury/M&A), Patni Computers (initiating the IPO process), and HCL Technologies (founding the BPO business). He is a member of the IMC Chamber of Commerce and Industry’s Agriculture & Food Processing Committee, the core working group of the World Economic Forum related to agriculture, and chairperson of Impact Investors Council’s Executive Council. |

|

Reihem Roy – Partner More Info

Reihem joined Omnivore in 2013 and runs our Chennai office. In addition to his investment responsibilities, he serves as Omnivore’s E & S and Business Integrity Officer. Previously, Reihem was an Associate at Villgro, a social impact fund and incubator, where he built a portfolio of social enterprise investments across agriculture, healthcare, and energy. Reihem began his career as an Analyst at the United Nations International Fund for Agricultural Development (IFAD), working on agribusiness investments in West and Central Africa. He earned a BA in Economics from the University of Madras and an MSc in Environmental Economics from the University of East Anglia. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Omnivore’s Theory of Change (TOC) is based on four key pillars - increasing smallholder profitability, enhancing smallholder resilience, improving agricultural sustainability, and catalyzing climate action. The first step of Omnivore's investment process is to filter deals against the Theory of Change. A deal only proceeds if it addresses at least one of the four TOC impact pillars, and the potential for significant social and/or environmental impact is clear.

Yes, Omnivore follows IFC ESG standards, and the transaction documents for any investment mandates the adoption of an ESG policy and an ESG action plan implementation.

Impact Tracking and Monitoring

Learn More

SF-A-03, 2nd Floor, Maharashtra, Mumbai, 400070, India

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.