IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Rubio Fund Management B.V.

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

Rubio Impact Ventures is a Dutch venture capital firm based in Amsterdam. Rubio invests in world-changing entrepreneurs who unite powerful impact with a scalable commercial business, achieving scalable, measurable and systemic impact alongside healthy financial returns for its investors. We believe the most valuable companies will be the ones solving humanity’s biggest challenges. Currently, Rubio is managing two impact funds. The first impact fund was EUR 40 million, with 2015 as vintage year. The second fund has a size of EUR 110 million and the vintage year is 2021.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

Rubio Impact Ventures invests in series seed, series A and series B rounds, of companies that are creating impact while having a scalable commercial business model. Rubio is a generalist fund and invests in People and Planet focus areas.

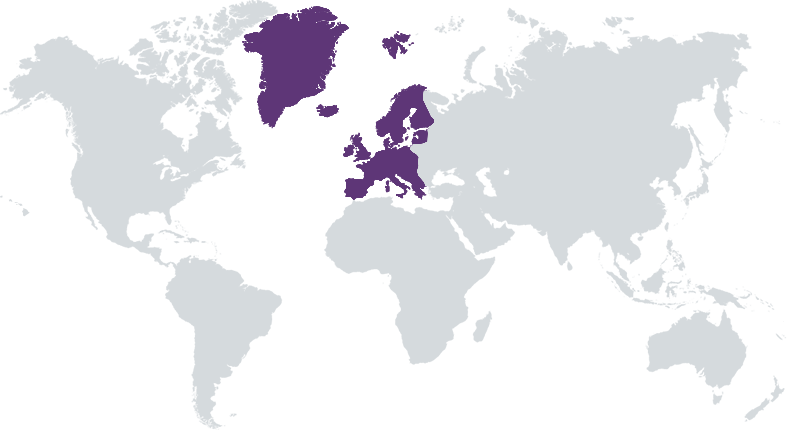

Rubio spots opportunities for scalable solutions in 2 key impact focus areas: Planet Paradise and People Power. We look for true leaders that have the potential for “systemic” impact on their industry or value chain. We have developed a selective investment process across these themes and focus on specific sweet spots and key trends with the largest opportunities for growth with a focus on entrepreneurs in the Netherlands and NW Europe.

Rubio has 100% of the carry linked to the achievement of impact targets which is unique in the European market. Rubio was the first VC in The Netherlands with the 100% linked carried interest. The company is led by an experienced, diverse partner team, which contain over 150 years of cumulative impact investing and operational experience. Our front runner position in the impact investing space drives solid deal flow with quality opportunities in NW Europe across Planet and People themes. Rubio's proactive investment teams continuously research emerging trends, identifying the most promising ventures. Rubio is aligned as an organization as shown by its BCorp certification, its adherence to SFDR 9, and by the Phenix fund assessment (received highest score). Rubio offers substantial venture support, focusing on team development, impact measurement, management, and value-added co-investors.

Investment Example

Rubio has invested in Sympower's seed round in 2019. Sympower is a Dutch start-up developing a software technology to sustainably balance the electricity grid. Sympower sells 'flexibility' to grid operators. The capacity for this flexibility is provided by Sympower's supplier (partners) who have electrical installations that can be switched on/off or have an adjustable energy demand. Sympower is expanding it's business fast and has just raised a successful series B round.

Leadership and Team

|

Willemijn Verloop – Founding Partner More Info

Willemijn is a serial social entrepreneur and driving force behind the NL Social Enterprise movement. She has 20 years experience in starting & growing social enterprises & non-profits, published books and studies. She focuses on growing the international Social Enterprise movement and works closely with game-changing entrepreneurs who make this world a better place for all. Previously she was War Child Founder & Executive Director, improved 1 million children lives in war torn countries; Founder Social Enterprise NL. |

|

Machtelt Groothuis – Founding Partner More Info

Machtelt is an entrepreneurial (impact) investor and boardroom advisor who has 20 years of international experience at McKinsey & Co, AlpInvest Partners, 3i plc. Her focus is on later stage / growth equity investments and works closely with the Rubio team for sound process and decision taking. |

|

Warner Philips – Partner More Info

Warner is an international entrepreneur and impact investor who has 20ish years experience in 40ish venture-backed businesses. His focus is on early stage / growth businesses, consumer products, business model innovation and he works closely with entrepreneurs who seek to positively disrupt industries. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

When making an investment, Rubio assesses the impact in a few ways. From the beginning of the discussions with a start-up, possible impact KPI's are set up and discussed with the founder how this could best be quantified. During the due diligence process, the impact targets are assessed by our external impact board to check the validity. After the investment is done, the impact targets are assessed every quarter with the start-up. The success of the impact of the start-up is incentivised by the carried interest being linked 100% with the impact KPI's. Also, we stimulate diverse teams and have discussions with the companies we invest in how they can improve their diversity.

We will always consider potential ESG issues when assessing potential investments and take those into consideration in our due diligence, decision-making and management practices. We will support our portfolio companies to improve performance on ESG & SDG parameters and assist them in identifying and measuring their progress through metrics and benchmarks. We ask investee companies to disclose to us how they manage ESG related risks and opportunities on a day to day basis, and how they take them into account in their business planning and strategy. Also, we monitor ESG risks and opportunities through, quarterly reports and through the annual SFDR Principle Adverse Impact (PAI) questionnaire from our portfolio. We add ESG to the agenda of board meetings. ADD: Gender diversity opvragen

Impact Tracking and Monitoring

Learn More

Plantage Middenlaan 45, 1018 DC Amsterdam, The Netherlands

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.