IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Katapult Accelerator AS

Climate Change

Climate ChangeFirm Overview

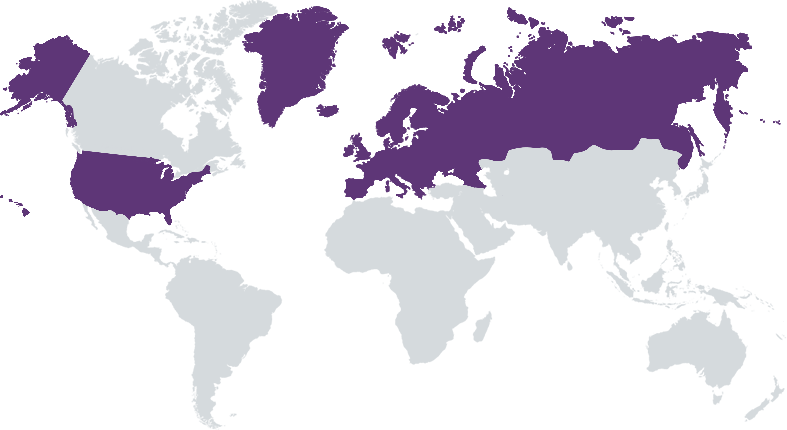

Katapult is a global impact investment firm. We invest in and accelerate early-stage impact startups across three verticals; Ocean, Climate and Africa Since 2017 we have invested in 169 companies across 13 funds. We invest in around 24 companies per year, and all investees participate in our accelerator program.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

We invest in and accelerate global pre-seed and seed stage climate tech startups across Energy, Mobility, Cities and Frontiers

Seed stage climate tech is the world's most attractive asset class. Climate change is real, and it will be profitable to fix it. However, capital markets have been focused on late-stage ventures. This has created a global gap in early-stage venture capital. Katapult has built a system to invest in and accelerate these companies. We have unfair advantages in our dealflow and accelerator program. Our scouting process lets us look at thousands of companies per year, and we invest in the top teams. Then we take startups through our accelerator program, which is focused entirely on impact, fundraising, and growth. The value of this investment system is compounding, allowing us to work with exceptional founders and co-investors. By targeting mainly post-revenue companies we significantly de-risk our portfolio.

Katapult runs a digital accelerator program built for seed stage startups. This sets us apart from most accelerators and climate tech investors in two meaningful ways: Accelerator: - We typically invest €200k-500k into companies raising €1-2m on €5-20m valuations. This is later stage than most accelerators. - This lets us work with higher quality post-revenue seed startups. More expensive, but much better value. - This system has developed over time, built on our insight. We discovered that going slightly later stage increased program value and company performance on both impact and financial metrics. Seed climate tech: - Our network and dealflow allows us to see several thousand companies per year. This reach is hard to replicate for others. - Our accelerator program allows for a scalable, reliable and demonstrable value-add for 20-25 new companies every year to our portfolio. - LPs balance risk by getting exposure to a global portfolio of companies.

Investment Example

In 2021 Katapult invested in the Finnish company Hyperion Robotics. They have built 3D printing and upcycling technology to produce low carbon concrete. Katapult first met the company in 2020, when they applied for our accelerator program. We kept the dialogue going and in 2021 we invested €300k for 8%. At the time the company had 6-7 FTEs and promising commercial traction with industrial partners for their proprietary products. The digital 3 month accelerator program helped the company build out their impact and fundraising strategy, defining their theory of change, setting and committing to impact metrics, and outlining an ambitious fundraising journey. In October 2022 the company announced a €3m round led by Lifeline Ventures, where Katapult participated with a small follow-on investment from the 2021 Katapult Climate Fund.

Leadership and Team

|

Tharald Nustad – Founder More Info

Serial entrepreneur and venture impact investor invested in 120 tech-companies in 40 countries with a proven track and exits. Founder of Katapult and investor in the funds. Early investor in Otovo and Huddly. Involved in all Katapult accelerator and follow-on investments. |

|

Nina Heir – CEO More Info

Angel investor and previous co-founder of 2 impact tech startups. Lead the development and operations of the Katapult flagship accelerator model and been part of executing 4 follow-on investments and 58 accelerator investments in 29 countries since 2017. Experienced startup facilitator and advisor. |

|

Jonas Skattum Svegaarden – CIO More Info

Experienced investment manager and co-founder of the most successful sustainable investing hedge fund in the Nordics. Global experience with small cap investments in non-listed and listed companies within aquaculture, energy and transportation. Pre-IPO investment, debt and equity financing experience. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We have built an investment system that integrates impact at each stage: - We screen for UN 17 SDGs to evaluate initial impact - We review DD and assign scores on impact, principles and purpose - Investment must pass impact and financial IC, and is used in legal agreements with investees - Impact measuring, KPIs and theory of change is a core module of our accelerator program

We have a thorough DD process where segments are dedicated to understanding a multitude of diversity metrics and governance processes in each company.

Impact Tracking and Monitoring

Learn More

Universitetsgata 2, 0164 Oslo, Norway

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.