IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

GAWA Capital Partners

Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

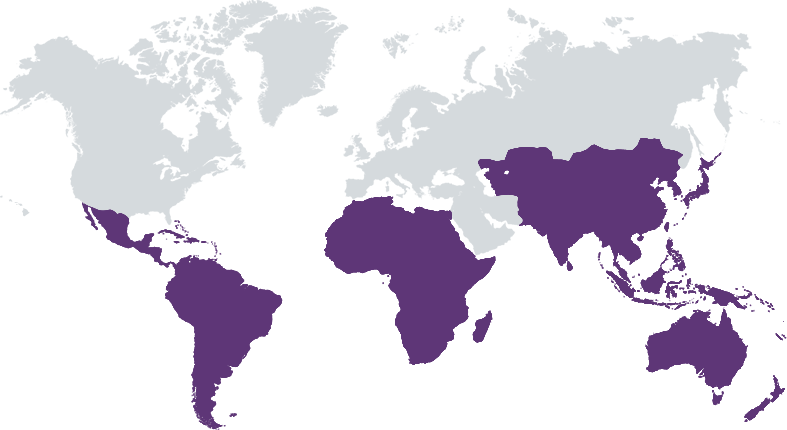

GAWA Capital is an impact fund manager that seeks to build opportunities for low-income communities via investments in social companies. Founded in 2009, GAWA pioneered impact investing in Spain and has since built a strong track-record, with AUM worth $164 million across three funds focused on microfinance, MSME-lending and agricultural-financing worldwide. It has impacted the lives of over 770,000 families across 20 countries in Latin America, Asia and Africa through 87 investments in 40 institutions. GAWA is finishing investing Huruma, that aims to improve access to appropriate financing solutions and strengthen agri-value chains for smallholder farmers. It will launch Kuali before the end of 2024 that targets climate change adaptation and mitigation solutions through financial service providers and innovative companies. GAWA strives to improve the social performance of its investees using SPTF framework, IRIS standards and Technical Assistance helping transform and maximize the social impact of investees on excluded populations.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

We believe that real transformative change arises from market-based solutions to critical issues like poverty, food insecurity and climate change. GAWA aims to help low-income communities in developing countries boost their livelihoods, carefully selecting companies with strong social missions and sustainable business models, balancing social impact with market-return for investors.

GAWA believes that two types of impact investing exist: (i)generic impact investments, and (ii)investments in social companies that provide tailor-made solutions to the market failures resulting in issues like poverty, food insecurity or climate change. GAWA focuses on (ii), whereby our funds have a well-defined theory of change. Supported by Technical Assistance, we aim to solve crucial social issues &maximize the impact of investees. To date, we have focused on financial inclusion (MFIs, MSME-lending, agriculture, vehicular financing), but we continue to expand into vital excluded sectors. In this sense, we are developing a fund which aims at supporting the financial inclusion of MSMEs, while supporting their transition towards greener energies. GAWA makes debt and equity investments in developing markets around the world, whilst social impact management is key from due diligence to divestment. Our performance fee is directly linked to the social performance of investees, proving our commitment to impact.

GAWA Capital has been one of the key drivers of the Spanish impact investing scene and aims to continuously innovate and bring international best-practices to the sector. We believe that impact investing should be transformative. Our funds have a Theory of Change achieved through financing, active social performance management, technical assistance and social impact-driven professional development. Our strong focus on Social Performance Management is integrated throughout our investment process. This implies an exhaustive initial Social Performance Audit (using CERISE- ALINUS audit tools), social covenants in transaction documentation and active investee social performance monitoring. Technical Assistance aims to improve investee outreach, product/process and technological adaptation, amongst others. GAWA’s performance fee is linked to its social impact, which is audited by a third-party upon investment exit, ensuring Management’s alignment with our social mission. GAWA has pioneered the movement of blended finance solutions for impact investment to catalyse risk-adjusted market-rate financing.

Investment Example

Pahal is a fast-growing Indian NBFC-MFI, providing graduating and competitive microfinance services to low-income households, focusing on women and agriculture through group and individual lending. Launched in 2011 by two founders who remain as shareholders and managing directors, it has expanded rapidly (+39% avg. growth in 2 years) with a 344-branch network, outreaching very poor regions like Bihar, and uses tech innovations for scaling. As of June 2024, Pahal manages a USD 194 million portfolio, serving 580,000+ clients, mostly women (98%), rural (57%) and farmers (54%). Since Huruma’s investment in March 2022 (25% stake), Pahal has doubled its assets under management and grown borrowers by 1.6x. Huruma contributes by improving processes, IT infrastructure, and teams, and aiding in the development of individual agri-financing products, adapted to crops and harvests, with Microsave consultancy, backed by technical assistance funds.

Leadership and Team

|

Luca Torre – Co-Founder and Co-CEO More Info

Luca has spent most of his career investing in and advising microfinance and financial institutions. Prior to founding GAWA, he worked at Credit Suisse Investment Banking in New York advising many microfinance institutions in accessing capital markets, including Banco Compartamos' IPO. Luca gained on-the-field operating experience working for Annapurna, an Indian MFI. Luca began his career at BCG and holds an MBA from Kellogg where he was awarded Siebel scholarship for leadership. |

|

Agustin Vitorica – Co-Founder and Co-CEO More Info

Agustín has been dedicated to impact investing since founding GAWA in 2009. Previously, he held the position of Managing Director at Dalbergia, one of Spain's largest family offices, where he worked for almost 10 years focusing on Venture Capital & Private Equity investments. Formerly an auditor and consultant to financial institutions at Deloitte, Agustín holds an MBA from the Kellogg School of Management and has played a key role in supporting the development of the Impact Investing sector in Spain. |

|

Tomás Ribé – Director of Investments More Info

Tomás joined the team in January 2020, bringing extensive experience in development finance after having worked for almost ten years at the European Bank for Reconstruction and Development, covering financial institutions from Morocco to Mongolia. Most recently he was Business Leader for Lebanon, Jordan and West Bank & Gaza. Previously he worked as a fixed income analyst at Société Générale in London and holds an MSc in International Trade, Finance and Development by Barcelona Graduate School of Economics. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

GAWA Capital’s managed and advised funds only target companies that have a tangible, direct social impact, recently setting focus on environmental impact as well. Prior to investment, exhaustive financial, social and environmental analysis of investees is carried out. During the due diligence, the investees’ social/environmental impact and risks are analysed, including features related to client protection and employee well-being. Regarding risks, we follow the IFC exclusion list to avoid financing activities that are harmful for the environment or society. In relation to impact, we score each investee with a methodology based on selected CERISE-SPI4 indicators, agricultural readiness parameters and customized metrics designed per investee. Together with the social and environmental analysis, potential technical assistance projects are also assessed during and post the due diligence in order to foster the entity’s transformation and boost its impact. During the investment cycle, there is periodic monitoring and management of social/environmental indicators per investee.

The exhaustive social performance due diligence detailed in the previous question provides key insight into the company’s policies towards clients, but also places a strong focus on intrafirm policies. The analysis covers investee Human Resources policies regarding discrimination (sex, race/ethnicity, sexual orientation, disability), sexual harassment, health and safety at work, training & development, fairness of employee compensation, grievance systems, etc. These topics are all addressed and improved, where necessary by including social covenants and targets in legal documentation, within the scope of GAWA’s active social performance management of investees. Regarding environmental sustainability, GAWA fosters the implementation/improvement of formal Environmental policies and environmentally friendly practices at investees, promoting employee awareness and commitment to reducing their environmental footprint. GAWA commits to the SFDR European regulation and monitors consumption and GHG emissions of our investees. During our screening process we ensure that no IFC exclusion list activities are financed by our target investees.

Impact Tracking and Monitoring

Learn More

Calle Alcalá 96, 4 Centro, Madrid España 28009

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.