IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

CrossBoundary Group

Energy

Energy Natural Resources and Conservation

Natural Resources and Conservation Place-based Impact

Place-based ImpactFirm Overview

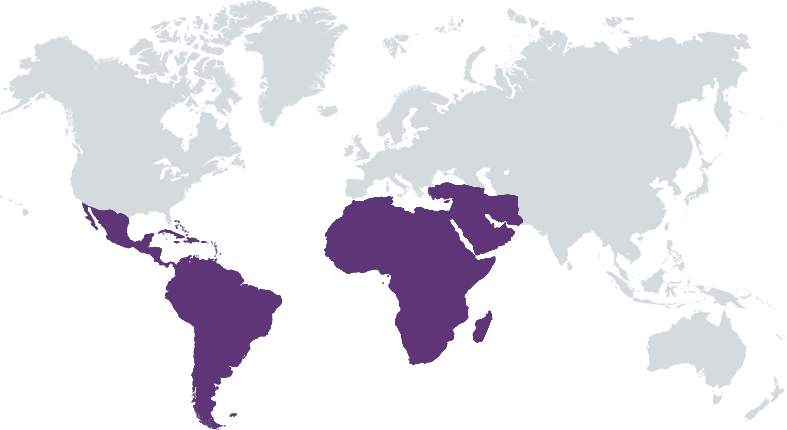

CrossBoundary Group is an investment firm that unlocks the power of capital in underserved markets. CrossBoundary Group takes a transaction-focused approach to mobilizing private capital for impact through its asset management vehicles: CrossBoundary Energy (2015), CrossBoundary Access (2019), CrossBoundary Real Estate (2020), and The Fund for Nature (2023). These vehicles mobilize blended finance to extend affordable project financing toward essential infrastructure asset classes and offer investors compelling financial, environmental, and social returns. CrossBoundary Energy has deployed $115M into commercial and industrial renewable energy projects across 14 countries and delivered a 15% IRR in 2020 to investors in its first fund. CrossBoundary Access has, to date, signed $90M of investments in solar mini-grids as it builds a distributed utility for rural electrification in Africa. CrossBoundary Real Estate provides affordable student and young professional housing in East Africa. The Fund for Nature provides up-front finance for nature-based carbon projects.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

CrossBoundary is an investment manager focused on long-term infrastructure assets, pairing expertise in blended finance structuring with in-house project development capabilities to create and finance a pipeline of bankable projects in underserved markets.

Rapidly growing populations and economies in emerging markets require robust, modern infrastructure to thrive. Private capital can complement public financing in standing up these facilities quickly and ensuring they are well-maintained into the future. But certain classes of high-impact infrastructure – including distributed energy and student housing – fail to attract affordable financing from local high-net-worth individuals, private equity investors, or large infrastructure funds. These infrastructure projects are overlooked due to their relatively small ticket size, moderate financial returns, long investment tenors, and unassuming public profiles relative to energy megaprojects or premium shopping malls. CrossBoundary identifies market opportunities to invest in these essential, high-impact classes of infrastructure projects, then raises blended financing tailored to the asset class’ specific return and impact profile. CrossBoundary’s funds, like CrossBoundary Energy I LP, crowd in public and private capital to these new asset classes while delivering best-in-class returns for our investors.

CrossBoundary’s team and partners have deeper infrastructure project development experience than the typical investment fund manager. In the markets we’ve invested in to date, bringing capital to the table is not enough to secure a reliable pipeline of bankable projects. By contributing our in-house experience in, or directly leading, project origination, development, construction, and asset management, CrossBoundary plays a more impactful role than typical investment managers and works to improve the viability of prospective infrastructure deals through the application of our own engineering, legal, and development experience, whilst upskilling contractors and beneficiaries in the process. Through these pioneering efforts, CrossBoundary effectively creates new asset classes for impact-focused investors: CrossBoundary was the first to deploy project financing against commercial solar PV installations in Sub-Saharan Africa through CrossBoundary Energy, and then again the first to project finance rural solar mini-grid installations, via CrossBoundary Access.

Investment Example

CrossBoundary Access collaborated with ENGIE Energy Access on the largest mini-grid project finance transaction in Africa. The $60M transaction closed in September 2022 to finance 60 mini-grids, bringing power to 150,000 people in Nigeria for the first time. As part of that transaction, CrossBoundary Access’ activities included: 1) setting up a special purpose vehicle (SPV) in Nigeria to be the long-term 100% owner of the mini-grid assets, 2) structuring and raising finance (equity, debt and concessional capital), 3) drafting and negotiating the key Project Development Agreement (PDA) through which CrossBoundary Access finances the projects, 4) drafting and negotiating the long-term Operating Services Agreement through which ENGIE is compensated to operate and maintain the mini-grids, and 5) using an asset monitoring platform to track and monitor performance of the assets, 6) as the long-term owner of these mini-grids, CrossBoundary Access is also responsible for regulatory compliance and investor reporting.

Leadership and Team

|

Pieter Joubert – Chief Investment Officer, CrossBoundary Energy More Info

Pieter has a Bachelor of Commerce majoring in Accounting & Finance and a Bachelor of Laws (Hons) from Bond University in Australia. Prior to joining CrossBoundary, Pieter worked in J.P. Morgan’s investment banking group in Sydney where he was responsible for mergers and acquisitions coverage and execution in the diversified industrials, mining services and infrastructure sectors. At CrossBoundary, Pieter leads fundraising and investment within CrossBoundary Energy whilst supporting wider strategy development and general management. |

|

Humphrey Wireko – Managing Director, CrossBoundary Access More Info

Humphrey is a Managing Director of the Energy Access team and a member of the CrossBoundary Group Council. Prior to joining CrossBoundary Humphrey worked at The Boston Consulting Group where he focused on advising senior leaders in a variety of sectors across Africa on strategic business issues. He also worked at the Public Utilities Commission of Ohio where he specialized in working with electric utilities, government officials, and other stakeholders. He has an MBA from Georgetown University and a Bachelor of Arts in Political Science from The Ohio State University. |

|

Kate Wharton – Managing Director and Head of Natural Capital, The Fund for Nature More Info

Kate Wharton leads CrossBoundary’s Natural Capital practice, focusing on climate and conservation finance in emerging and frontier markets. She advises nature-based carbon projects globally and is launching The Fund for Nature. Kate previously launched and managed CrossBoundary’s investment advisory office in Iraq. Prior to CrossBoundary, she served as Chief Operating Officer at Hala Systems, a humanitarian technology company focused on civilian protection in Syria. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

CrossBoundary Access invests project finance capital into rural solar mini-grids providing first-time electricity to communities in Africa. CrossBoundary Access partners with developers who share a similar commitment to environmental sustainability, including reducing GHG emissions, responsible e-waste, and water management, and promoting positive social and economic outcomes by connecting businesses and households to clean and reliable energy. Additionally, CrossBoundary Access’ due diligence process places a strong emphasis on identifying partners dedicated to eliminating racial and gender biases, both within their organization and in the projects. CrossBoundary Access firmly believes that responsible investments not only yield financial returns but also catalyze positive societal and environmental change while fostering diversity and inclusivity. This twofold commitment to impact and equity lies at the core of CrossBoundary Access’ investment philosophy.

CrossBoundary has a dedicated Environmental, Social, and Governance (ESG) team that implements an Environmental and Social Management System (ESMS) throughout its investment process. In the early stages of deal sourcing, we adhere to a thorough procedure for assessing prospective renewable energy investments, contractors, and clients to identify ESG-related risks. Using our in-house screening tool, all investments undergo an initial review against the agreed-upon exclusion list, followed by comprehensive due diligence. Our due diligence assessments draw upon well-established guidance from the IFC's Sustainability Framework, particularly the IFC Performance Standards. In some cases, we collaborate with external ESG experts to conduct our due diligence. To address any identified risks, we ensure the development of customized ESG risk management plans for each infrastructure project and actively monitor performance.

Impact Tracking and Monitoring

Learn More

PO Box 14365-00800, Nairobi, Kenya

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.