IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Camco Management Limited

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Financial and Economic Inclusion

Financial and Economic InclusionFirm Overview

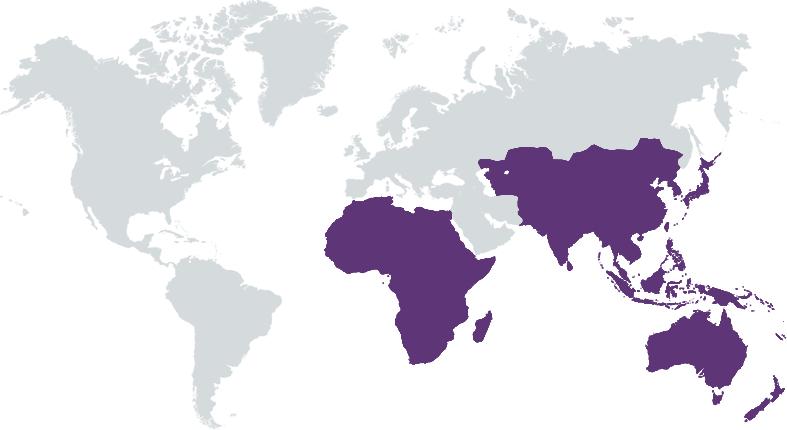

Camco is a climate and impact fund manager leading the way to a brighter future in emerging markets.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Camco invests in seed and growth assets that address the joint challenges of economic development and climate change, generating the right kind of returns that are boosted as the world transitions to clean energy.

Camco provides flexible capital to the projects, technologies, companies, and entrepreneurs leading the fight against climate change in emerging markets. Through our targeted regional and thematic investment platforms, we provide debt, equity, or convertible note financing to climate change mitigation and adaptation solutions, filling key funding gaps in local markets. Camco believes in having on-the-ground presence in the markets and communities where we work, and we have established regional offices in South Africa, Kenya, Ghana, and New Zealand.

Camco has a deep understanding of how to deploy capital and accurately assess risk in emerging markets, gained through more than 30 years of on-the-ground experience. This expertise allows us to take calculated risks that others initially won't. When we invest, we aim to take the first step so that others may follow, and we have a proven track record of investment "firsts" such as our investment in Burundi's first ever solar PV project. In this way, we catalyse investment in unproven markets and sectors and have mobilised more than USD 500m in third-party investment from partners.

Investment Example

Mubuga Solar PV Project: Through REPP, Camco financed the construction of the 8.67MWp Mubuga Solar PV project in Burundi in 2021. The project was the first independent power producer (IPP) project in Burundi, and the first grid-connected renewable energy project in the country. The Mubuga Solar PV project now generates power to supply more than 90,000 people with 100% renewable electricity and has boosted the country's total generation capacity by 10%, paving a path for a broader rollout of renewable energy and energy access in the country.

Leadership and Team

|

Geoff Sinclair – Managing Director More Info

Geoff is responsible for all of Camco’s fund advisory and management activities, including the delivery of existing mandates, which focus on supporting the development of – and providing finance for – renewable energy projects in sub-Saharan Africa. He joined Camco in 2015 after 10 years working for Standard Bank, during which time he built and led the bank’s multi-award-winning international climate finance business and team. Geoff has completed transactions on over 1GW of renewable energy and energy efficiency projects across Africa, Asia, Europe and the Americas, and has experience across a wide range of technologies and financing structures in both the primary and secondary markets. He previously worked for the New Zealand Treasury, successfully founded a start-up and is Chairman of UK renewables fund, CO2 Sense. He has an MBA from London Business School and a Bachelor of Commerce (First Class Honours) from the University of Melbourne. |

|

Benjamin Hugues – REPP Director More Info

I'm a director and a shareholder of Camco, a leading impact and climate fund manager. My main responsibility is to manage Camco's flagship fund, REPP. Throughout my career, I worked on setting up two funds totalling $330m and led a diverse range of debt and equity transactions for renewable energy projects across Africa, Asia and North America with total project costs in excess of $1.5bn. I have an MBA from the London Business School with a speciality in finance and a Master’s degree in Industrial Engineering from Grande Ecole ENSIACET in Toulouse, France. |

|

Brian Wambani – CIO More Info

Astute, globally minded, collaborative, innovative and enterprising finance professional with experience working in different challenging roles providing bespoke deal origination and execution covering multiple countries . All-rounder with versatile management skills coupled with excellent communication, interpersonal and leadership skills. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Camco invests in companies and projects that address specific climate, energy and development problems. Camco has strict ESG investment criteria which mandate that all investees implement Environmental and Social Monitoring Systems (ESMS) and impact monitoring plans.

Camco has an environmental and social management system (ESMS) in line with IFC performance standards and UN Global Compact principles. The firm has a gender mainstreaming strategy and diversity and inclusion action plan.

Impact Tracking and Monitoring

Learn More

28 St Johns Square, London EC1M 4DN United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.