IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Acumen Latam Impact

Ventures LLC “ALIVE Ventures”

Education

Education Financial and Economic Inclusion

Financial and Economic Inclusion Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

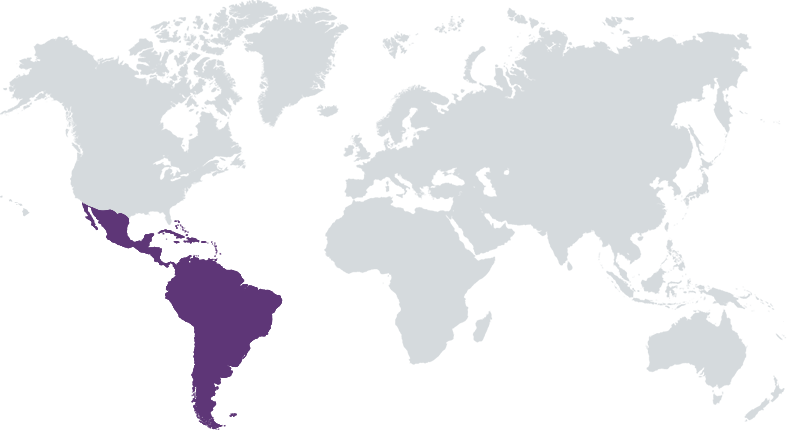

Acumen Latam Impact Ventures (ALIVE) is a fund manager that invests in impact-driven, early-growth companies that leverage technology and other game-changing innovations to address the challenges faced by low-income communities in Latin America, with a focus on Colombia and Peru. ALIVE is a 2X Global Founding Member that applies a gender lens throughout its investment process, engaging closely with companies to work towards gender equality. Through its second fund, ALIVE also implements a climate change investment strategy, strengthening the climate resilience of low-income communities across the region. To measure impact, ALIVE performs recurring in-depth measurement studies, with expert third parties 60 Decibels, to understand the profile of beneficiaries and depth of impact from initial investment to exit. More broadly, ALIVE aims to expand the impact investing space in Latin America by sharing learnings broadly and by fostering a community of learning with its investors, of which 38% are Latin American.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

ALIVE provides critical growth capital to innovative, high-impact, scalable businesses that leverage technology and other game-changing innovations to address the challenges faced by low-income communities in Latin America, thus creating an opportunity to achieve significant impact while achieving risk-adjusted financial returns for investors.

Over the past decades, Latin America has made significant progress in addressing the issues of poverty, lack of access to critical services and gender inequality – though many of these gains were set back during the pandemic. It is increasingly clear that governmental policies and traditional philanthropy alone will be unable to bridge the remaining gaps. The past few years have seen the rise of a large number of high-impact businesses that are leveraging technology and other innovations to address the challenges of low-income communities in the region. ALIVE has identified an attractive opportunity to support these companies, with critical growth capital, expertise, and access to global networks. Investing in these businesses is an opportunity to achieve significant impact while achieving risk-adjusted financial returns for investors.

A highly diverse team, including 50% women, 25% LGBTQI+ A rigorous impact management approach, using deep recurring studies to understand how customers’/beneficiary lives are impacted, not just number of lives impacted, and working with investees to improve impact. Partnered with 60 Decibels in Fund 1 to implement studies, ensuring a high level of quality. Fund 2 will have similar approach. Applies a gender lens from Initial Due Diligence to Exit, supporting investees in working toward greater gender equality. In Fund 1, partnered with gender experts, Value For Women, to support gender integration projects for all investees. Fund 2 will have similar approach. Conducts ESG Technical Assistance projects with all investees, improving ESG practices, identifying and managing risks, and addressing opportunities. Includes significant proportion (38%) of local investors. Proactively shares learnings with LPs and broader community to grow impact investing in Latin America.

Investment Example

Symplifica is a Colombian company that leverages technology to formalize the employment of domestic workers in Latin America. Domestic workers represent 14.3% of all female employment in the region and 77.5% of these workers are employed informally, often subject to severe exploitation – without written contracts, paid below the minimum wage and without access to mandatory benefits such as paid vacations, health care and pensions. Via its online platform, Symplifica streamlines the hiring process for these workers, ensuring that employers are compliant with the law and that employees receive all legal benefits. In addition, the company is layering in additional benefits for workers, such as financial services training and discounted services. To date, Symplifica has formalized the employment of 35k+ workers, growing at a 40% CAGR over the last two years. ALIVE has invested $610k since 2021, has a board seat and is actively supporting the growth of the company.

Leadership and Team

|

Virgilio Barco – Co-founder & Managing Partner More Info

Virgilio has more than 30 years of experience in impact investing, the private sector, the social sector and government. He has served in various management positions of pioneering organizations in the impact investment sector in Colombia and has been an entrepreneur that has founded various companies and social organizations. |

|

Santiago Alvarez – Co-founder & Managing Partner More Info

Santiago has over 18 years of experience in investments, including 12 years dedicated to investments in emerging markets and impact investments across Latin America and Africa. Additionally, Santiago has extensive experience in management consulting, as well as in entrepreneurship. |

|

Maria Pia Morante – ALEG II General Partner, ALIVE Investment Director More Info

Maria Pia joined the ALIVE team in September 2017 and is responsible for the origination, structuring and administration of investments, particularly in Peru. Prior to her work with ALIVE, Maria Pia was Head of the Equity Research Team of Profuturo AFP, one of the leading pension funds in Peru, where she was responsible for the analysis and recommendation of investment opportunities in equity assets to the Investment Committee, focusing mainly on the Peruvian and Latin American market. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

ALIVE only invests in companies that are addressing the challenges of low income communities in Latam and have social impact embedded in their business model. Fund 1 invests across three verticals or impact objectives: (1) Education & Pathways to Quality Jobs (2) Sustainable Income Generation Opportunities and (3) Access to Critical Goods and Services. Fund 2 invests across those three same verticals, and a fourth additional vertical, Solutions for Climate Resilience & Mitigation. If the company does not meet this definition, or if we feel that the promoters are not committed to social impact, we do not invest. We apply a gender lens across all our investment processes and take a rigorous approach to understanding and managing impact. We apply a climate lens across our investment processes, analyzing climate risks and opportunities starting in due diligence, and supporting investments with their climate management strategies as part of our post-investment accompaniment.

During due diligence we also apply the IFC’s Performance Standards as a framework to assess the risks and impacts of a company across all ESG dimensions. We continue using this framework post-investment to monitor on these aspects. We are also signatories of the UN Principles Responsible Investment. We have also been Signatories of the Principles for Responsible Investing (PRI) since 2018, and have been in the top quartile in terms of performance compared to other Signatories on the PRIs annual reporting assessment.

Impact Tracking and Monitoring

Learn More

Carrera 7 No. 83-29, Of. 502, Bogota, Cundinamarca, Colombia

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.