IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Oryx Impact S.L.

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

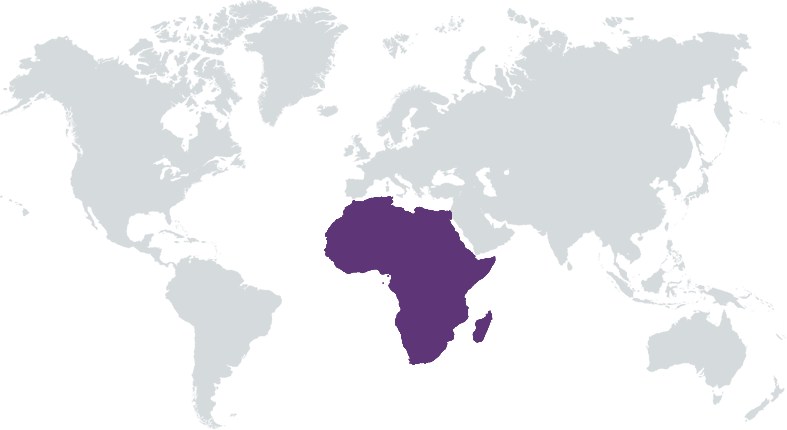

Oryx Impact is the first impact oriented, gender lens fund of funds focused solely on Africa. The key impact objectives of the fund are to: i) drive economic development and create job opportunities, ii) support investments in climate change mitigation and adaptation and iii) promote gender equality, all while generating attractive financial returns. Another important objective of Oryx Impact is to mobilize capital that will unlock Africa’s growth potential and promote sustainable and resilient economies and societies, which in turn is expected to reduce forced migration and regional and global inequalities. One of the key value adds of Oryx Impact will be fostering the local ecosystem of impact fund managers investing in Africa, especially the women-led and emerging fund managers. This will be achieved through a Technical Assistance facility focused on implementing top standards in impact and ESG measurement and management.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 100%

The Oryx Impact fund mobilizes capital for investments in the African Continent, unlocking Africa’s growth potential and promoting sustainable and resilient societies, with the aim of reducing forced migration as well as regional and global inequalities.

Oryx Impact unlocks growth opportunities in Africa and increases private capital flows by investing in private equity, venture capital and private debt funds with strong local presence and networks and by seeking co-investments into companies. Ultimately, the fund will provide growth capital to SMEs and businesses facilitating the production, supply and trade in essential goods and services for low and middle income populations. The fund applies a gender lens at SME and fund level, proactively seeking women-led fund management teams that in turn are more likely to invest in female-led businesses. By investing into funds that address at least one of the three impact objectives of Oryx Impact: i) drive economic development and create job opportunities, ii) support investments in climate change mitigation and adaptation and iii) promote gender equality; the fund will contribute to building a more sustainable and resilient Africa.

100% Africa focus: a. Expertise in opportunities and challenges specific to Africa b. Selection of fund managers with strong local presence c. Ability to mobilize private capital for impact investments in Africa, including investors from the continent Impact driven investor: a. Finance first Gender Lens fund of funds b. Investments with a clear focus on: Job creation, Climate change, Gender equality c. Support to the local impact investing ecosystem by: Including emerging managers, Seeking women-led funds, Providing TA Curated portfolio of funds: a. Ability to pick top performing fund managers in countries and sectors experiencing dynamic growth through a single investment b. Ability to design, structure and deliver a well-balanced, diversified portfolio while mitigating risk Experienced team: a. Track record in impact investing, Private Debt & Equity and Fund of Funds b. Investment experience and presence in key African geographies c. Predominantly women-led team

Investment Example

Sample investment of a Fund well-advanced in Oryx Impact's pipeline: Emerging fund manager raising a Venture Capital fund to invest into series A to series C companies in Sub-Saharan Africa. The team has a positive and relevant track record in similar strategies and is supported by world-renowned entrepreneurs and investors. The investment team is mostly local, female-led and based on the continent. The Fund is targeting investments which can have a significant impact on the African population in the spaces of financial inclusion, healthcare and education, while targeting market-rate returns.

Leadership and Team

|

Teresa Guardans – Founding Partner & CEO More Info

More than 25 years of experience in investment banking, wealth management, and impact investing with SBC Warburg, UBS, Rothschild and Pictet. Driving the transition from traditional financial return driven portfolios into net positive impact investments. |

|

Sebastian Waldburg – Founding Partner & CIO More Info

Seasoned impact investor with significant experience in climate finance and venture capital. More than 25 years in the financial sector related to energy investments and private equity, with relevant exposure to emerging markets. |

|

Lisa Hehenberger – Chief Impact Advisor More Info

Professor at ESADE Business School and a recognized expert on impact measurement, impact investing and social entrepreneurship. Active in expert groups (EU, OECD, GSG, etc.) and advisory boards (Rubio, Creas) and former research and policy director of the European Venture Philanthropy Association. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Oryx Impact targets impact fund managers that screen potential investments with an impact lens. For those fund managers that have not formalised impact screening tools, Oryx Impact will support their development through a Technical Assistance Facility. Oryx Impact will encourage fund managers to analyse potential deals through the IMP's 5 impact dimensions in order to screen and later scale and deepen the SME's impact.

Oryx Impact embeds its impact and ESG criteria within its entire investment process, adhering to the IFC Operating Principles of Impact Management and as a Signatory of the Principles for Responsible Investment. Oryx Impact has developed a scorecard to evaluate the fund manager's ESG practices at fund and portfolio levels. Indicators are primarily based on SDGs and IRIS indicators. Oryx Impact also uses a gender lens to proactively seek investment in women-led fund managers that satisfy the criteria of the 2X Challenge. If additional support can be given to underlying fund managers, Oryx Impact's Technical Assistance facility will provide ESG and IMM input.

Impact Tracking and Monitoring

Learn More

Escoles Pies 115, Barcelona, Catalonia 08017 Spain

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.