IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Peak Sustainability Venture Fund I

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Water and Sanitation

Water and SanitationFirm Overview

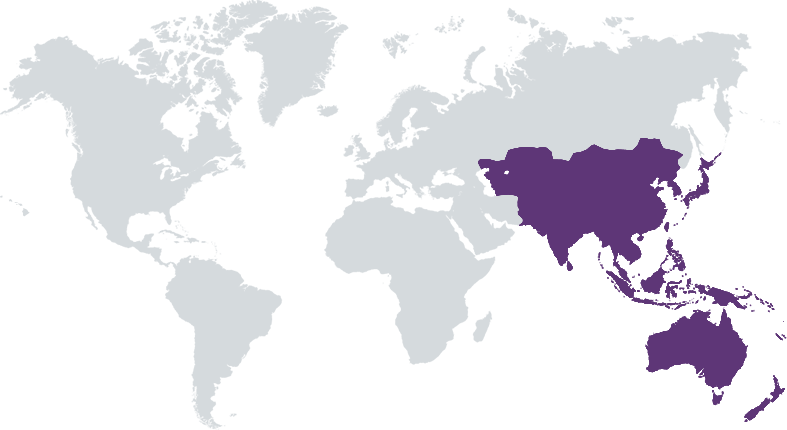

Peak Sustainability Ventures is a sustainability-themed venture capital fund, with its Partners being one of the most active climate investors in India over the last six years. We are pioneering early-stage sustainability investing in India, and were one of the first funds to launch in the region. We have been deeply involved in sustainability, and have built domain expertise over this time across our key verticals: Energy, Water, Agriculture and Climate-Tech. Our investment experience in early-stage sustainability startups has enabled us to identify scalable businesses that can create large positive climate impact, while also generating high risk-adjusted returns. We are passionate about sustainability, and have built a strong team and advisory board consisting of global climate thought leaders. Without India’s active participation, global climate goals cannot be met. We are pioneering early-stage sustainability investing in India, and putting India on the global climate map.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 25% – 49%

Peak Sustainability Ventures is the leading early-stage climate VC fund in India, backing passionate founders that can move the needle on global sustainability goals, with unique, scalable and impactful solutions.

We are putting India on the global climate map. We have identified four areas of focus within sustainability: Energy, Water, Agriculture and Climate (including plastics, biodiversity, air pollution). We believe that sustainability is interlinked – one cannot invest successfully in sustainability by thinking in silos. It is important to think about water and energy usage in agricultural solutions; it is important to factor land-use degradation and negative impacts on biodiversity when thinking about solar farms. This gives us a unique perspective in understanding the true impact of solutions. We are interested in tech-enabled, asset-light and scalable innovations, that have the potential to create large-scale positive impact across multiple sustainability goals. We are backing passionate founders approaching problems with a unique perspective, who have achieved proof-of-concept and are ready for scale. We have built deep domain expertise, a strong track record and diverse sourcing channels to invest successfully in this space.

Established Track Record. We are pioneers in early-stage sustainability investing in India, and one of the only funds with an established track record in this space. We have demonstrated high MoIC’s and exits, and have co-invested with leading funds like Amazon Climate Fund, TPG Rise Fund and Global Innovation Fund. Deep Domain Knowledge. We have built deep domain knowledge in sustainability, and a thesis-driven method of investment evaluation, which is very different from new players in climate. This enables us to identify long-term, defensible and scalable businesses, that can provide high ROI and climate impact. Advisory Board. We have built an Advisory Board consisting of global climate thought-leaders, like Erik Solheim (Former Head of UNEP) and Pavan Sukhdev (Winner of Tyler Prize for Environmental Achievement). who operate as an extension to the Investment Team. They bring deep sector knowledge, and are global voices in their respective areas of expertise.

Investment Example

ION Energy builds battery management systems (BMS) for electric vehicles leveraging AI-enabled predictive analytics. In effect, building the brain of a battery, and optimizing thermal management and other capabilities to make batteries more effective. We were early investors in ION Energy, and Samir has been an advisor to Akhil since the beginning. We helped orchestrate their acquisition of Freemans SAS – a Paris-based pioneer in BMS – giving ION a strong tech backbone, a Europe presence and 2 year advantage on any India player. ION has clients in over 50 clients globally and raised a Pre-Series A round led by Amazon's Climate Pledge Fund – Amazon’s first investment outside the U.S. In May 2022, Endurance Technologies acquired ION’s hardware unit for $40M all-cash, one of the first deals in this space. ION is now an established global player in the BMS space, fully focused on SaaS for battery analytics.

Leadership and Team

|

Samir Shah – Managing Partner More Info

Samir Shah has been involved in global financial markets for the last 30 years, primarily in principal risk-taking roles. He has held senior roles at Deutsche Bank (New York), Solomon Brothers (New York) and Goldman Sachs (Hong Kong), before launching a multi-strategy investment fund in Hong Kong. In 2014, he started Sattva Capital, a Mumbai-based private investment office, which made has 30+ pre-seed to late-stage investments across sectors. After focusing Sattva’s investments on sustainability since 2017, he launched Peak Sustainability Ventures, India’s first climate-focused VC fund, in 2019. Samir has been on the board of leading startups and organizations in sustainability, including Waaree Energies, ION Energy, Drinkwell and Shell Foundation. He has built core domain knowledge in Energy, Mobility, Water, Biodiversity, Plastics, and Agriculture. Samir received his MBA from Wharton, and holds a BComm degree and Law degree from Bombay University. He is also a qualified Chartered Accountant. |

|

Aakash Shah – Partner More Info

As Partner, Aakash leads the investment team, focusing on all aspects of the deal lifecycle, in addition to , and is also involved previously headed up the early-stage ventures arm of Sattva Capital, where he was responsible for sourcing, deal evaluation and ongoing monitoring of the portfolio, leading deals in Energy Web Foundation (an energy blockchain platform) and Shortlist (an HR tech startup). Prior to Sattva, Aakash was jointly responsible for the Asia portfolio at Accion Venture Lab, a Washington D.C.-based, global fintech impact fund, where he led deals in consumer credit, SME lending and micro-insurance. He is also the co-founder of neonVest, an expert network connecting users to luminaries in their field, using data to make hyper-personalized matches. Over 300+ experts currently use the platform, from the likes of Azure Capital, Silicon Valley Data Capital, and Fifty Years VC. |

|

Karan Mehta – Principal More Info

|

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our investment process incorporates specific environmental impact screening processes starting from the initial screening, which the investment team continues to evaluate and assess through the due diligence phase until the deal is approved and executed. Post-investment, PSV incorporates ESG monitoring and reporting functions in the investee company. To eliminate racial and gender biases, PSV maintains a rigid policy of “No-Bias” when evaluating investments, that it requires all investment team members to follow. This means that there is no positive or negative weightage given to certain races or genders when evaluating investments – it is purely based on merit of the relevant investment. We also strongly encourage gender and minority-inclusion in our investee companies, in order to build the ecosystem and foster greater inclusion. Wherever required, external consultants will be employed for specific assessments or to build credibility and provide a third party approval if needed.

When we are evaluating investments, we intentionally go beyond purely the investment merits of the company, and evaluate multiple other aspects of the business, including: impact on community, governance, second/third-order environmental consequences, job creation and other areas. We use our domain knowledge to filter out businesses that are creating solutions, that would create additional problems, or have negative externalities at scale, such as land degradation or overpopulation. While many of the companies we work with are still small and we appreciate that there may not be clear environmental or social practices embedded at the time of investing, we hope that with our involvement in the company we look to guide the founders and put measures in place to build truly sustainable and profitable companies.

Impact Tracking and Monitoring

Learn More

1003, Lodha Supremus, Lower Parel, Mumbai, India

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.