IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

JFF Ventures

(fka ETF@JFFLabs)

Education

Education Financial and Economic Inclusion

Financial and Economic Inclusion Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

JFFVentures (JFFV) is building a future where innovative products and solutions give everyone increased and equitable access to learning, employment, and economic advancement opportunities. JFFVentures is strategically aligned to the national nonprofit, Jobs for the Future (JFF). JFFVentures is the only fund in the market that has specialized focus on workforce solutions supporting the needs of underserved and underrepresented learners and workers. Through its activities, JFFVentures provides early-stage capital to founders with lived-experience who are closer to the problems they are seeking to solve; increasing access to quality and affordable learning and skilling solutions, access to career navigation and job placement; access to benefits and supports specifically designed for low-wage workers and ultimately increasing access to quality jobs and economic mobility.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

JFFVentures’ mission is to invest in underrepresented founders with lived experience who are building education, workforce, and future of work technologies serving low-to-middle income learners and workers.

JFFV is dedicated to supporting economic advancement opportunities for individuals from low to moderate-income backgrounds. Given longstanding inequities, the unprecedented impact of recent economic shocks, and technological advancements in AI and automation, the JFFV team believes that there is an urgent and significant need for a specialized impact-driven fund that specifically uplifts individuals on their path to quality jobs and economic advancement. JFFV makes direct investments into early-stage technology companies led by founders with lived experiences that support and scale solutions for the millions of learners and workers seeking opportunities for economic mobility. We consider workers' needs holistically and invest across four key areas: Education Technology; Workforce Technology; HR Technology; and Wraparound Support.

Beyond financial investment, JFFVentures leverages the unique strengths of a nationally recognized workforce development organization, JFF, to add strategic value for portfolio companies. JFF's extensive network provides JFFVentures portfolio companies with unparalleled insights and connections across the learn-to-work ecosystem, fueling a powerful synergy that enables them to forge connections to deploy impactful technology solutions at scale. JFFVentures partners closely with leaders across JFF to identify opportunities for shared value creation through strategic introductions, thought leadership, and project and program work leading to systems-wide change. To further support our portfolio companies, we have launched the Corporate Innovation Council. The Council is a cohort of 20 corporate leaders from HR, L&D, and corporate social responsibility divisions of Fortune 1000 companies, serving to provide feedback and mentorship. Concurrently, our diverse team is committed to investing in founders with lived experience, who are inherently equipped to navigate the challenges within workforce and education.

Investment Example

Pace is an AI-powered English language learning platform for adult ESL learners, transforming content into personalized, interactive lessons. Pace offers pronunciation practice, comprehension feedback, and AI tutoring. Targeting the 60% of adult immigrants facing economic mobility challenges due to limited English proficiency, Pace bridges the gap between language acquisition and workforce readiness. The platform addresses the unmet demand for innovative ESL solutions in adult education, potentially catalyzing career advancement for learners. Pace was founded by Victoria Pu and My Tran, TEFL-certified English language teachers and AI research scientists and engineers who are driven to support learners like their own parents and families when they first arrived in the U.S. JFFV sees Pace tapping into a significant market opportunity, with its seamless integration into daily workflows and workforce training programs.

Leadership and Team

|

Yigal Kerszenbaum – Founder and Managing Partner More Info

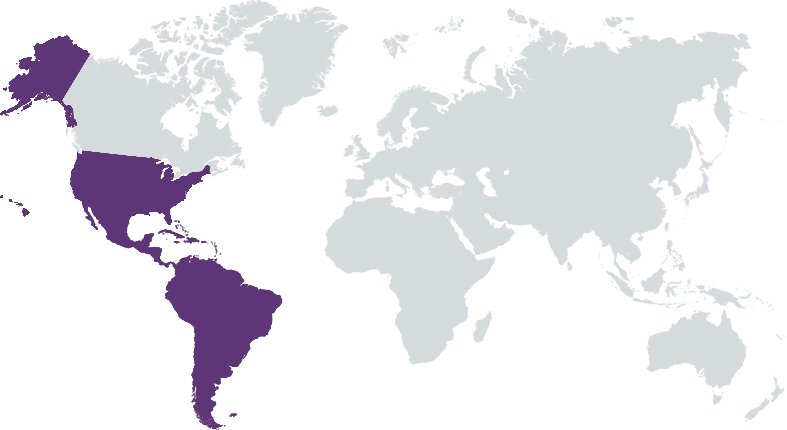

Yigal Kerszenbaum is JFF’s managing director for innovative finance, a role in which he will oversee the organization’s investment strategy. He was the founder and managing director of the Employment Technology Fund (ETF), which is now ETF@JFFLabs. An expert in impact investing, Yigal’s goal in managing ETF@JFFLabs is to support entrepreneurs who develop technology solutions to train and upskill low-income and lower-skill adults and connect people from underserved communities with employment opportunities. Yigal has executed more than $120 million worth of transactions in impact investments in the United States, Latin America, Europe, Asia, and sub-Saharan Africa. |

|

Sabari Raja – Managing Partner More Info

Sabari Raja is a managing partner at JFF Ventures. She plays a key role in shaping the JFF Ventures fund’s strategy, honing JFF’s investment thesis, leading investments, and supporting the growth of the organization’s portfolio. Sabari is an experienced business operator, board member, and advisor with more than 20 years of experience leading product and go-to-market strategies, business development, strategic partnerships, and emerging market growth. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

JFFVentures is an impact-led fund that exclusively invests in technology solutions in which the core product or service helps underserved workers advance economically. Impact is prioritized across all aspects of the investment process. In the sourcing process, JFFV leverages JFF’s education and workforce development expertise, experience, and networks (ie. community colleges, workforce development agencies, and governments) to target innovations with the highest likelihood to generate positive impact on workers. In the diligence process, JFFV’s investment team specifies and analyzes the theory of change supporting how a company’s product or service will yield economic advancement for underserved workers, with a strong equity lens. Lastly, the fund’s portfolio management processes ensure such impact is measured and advanced.

JFF Ventures prioritizes founder diversity in investment decision making. 82% of JFFV’s debt and equity investments to date have been in companies with a founder or CEO who is a woman or person of color. This figure includes 73% of our investments that are in companies with a founder or CEO of color and 48% with a female founder or CEO. The diversity of JFFV’s portfolio reflects the strong belief and experience that entrepreneurs with lived experience in the workforce challenges JFFVentures seeks to address – which disproportionately affect women, minorities, and immigrants – are the best suited to effectively tackle those challenges.

Impact Tracking and Monitoring

Learn More

50 Milk Street, 17th Floor, Boston, MA 02110, USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.