IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Ember Infrastructure

Management, LP

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Water and Sanitation

Water and SanitationFirm Overview

Ember Infrastructure Management, LP (“Ember” or the “Firm’) was founded by a team of professionals with extensive experience in the infrastructure and renewable energy sectors at best-in-class institutions. Since its inception, the Firm’s objective was to bring capital and expertise to companies and assets that offer essential services driving down greenhouse gas (GHG) emissions and increasing the efficiency with which water, natural resources and waste are used and managed. Ember is a returns-oriented investment manager, and we believe the sustainability characteristics of the assets and companies we invest in contribute to their long-term viability and growth potential.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

Ember’s objective is to bring capital and expertise to mid-market companies and assets providing decarbonization and resource efficiency solutions across energy transition, water, waste, and agriculture and industrial infrastructure.

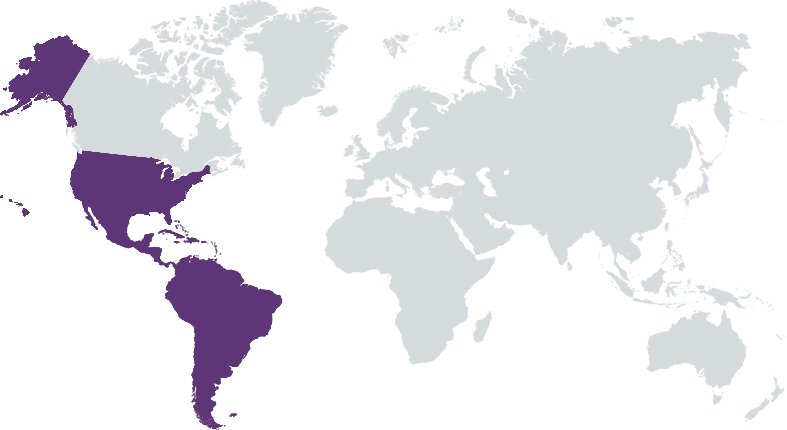

Ember looks to deploy capital across four sectors: energy transition, water, waste, and industrials and agricultural infrastructure. We believe that in our target sectors there is a compelling opportunity to realize attractive returns by investing in platforms with strong operating teams, clear growth potential and limited access to capital. We target equity investments in the range of approximately $25 million to $75 million, primarily in the North American mid-market. We believe that sustainable infrastructure companies and assets operating in the North American mid-market have expanding growth opportunities but remain undercapitalized. There is also a scarcity of investment managers focusing on this space that have the experience and capabilities necessary to adequately support companies and their management teams. Ember targets investment opportunities with meaningful growth potential, while emphasizing downside protection. Our first fund targets a portfolio gross IRR of 15% to 20% per annum.

Unlike many of our peers, a defining feature of Ember's investment strategy is that every business or asset we invest in furthers some positive sustainable goal, generally, and, in particular, one or more UN SDGs. As you can see from the illustration above, we also quantify the impact each company has in furtherance of their specific UN SDG goal targets using industry specific metrics.

Investment Example

In September 2021, Ember made an investment in SunShare, a leading full-service developer, owner, and operator of community solar gardens (CSGs), based in Denver, Colorado. SunShare owns 23+ MW of community solar assets and has developed CSGs totaling 118 MW. SunShare's operations further two UN Sustainable Development Goals (UN SDGs): UN SDG 7 Affordable and Clean Energy and UN SDG 11 Sustainable Cities and Communities. Many households in the U.S., including renters and homeowners, as well as small businesses remain excluded from access to affordable clean energy. This exclusion stems from a lack of financing options, of suitable roof conditions, or of control (e.g., renters and residents in multi-unit buildings). SunShare solves this challenge and today provides access to over 16,000 residential subscribers and over 50 commercial, industrial, and government customers.

Leadership and Team

|

Elena Savostianova – Founder, Managing Partner More Info

Elena Savostianova is the Founder and Managing Partner of Ember Infrastructure, and has 20 years of professional experience in the energy and infrastructure sectors. Prior to Ember, Elena served as a Principal with Global Infrastructure Partners CAPS team, focusing on renewable energy opportunities. Before GIP, Elena spent nearly a decade as part of Credit Suisse’s Power and Renewables group where she was responsible for coverage of energy corporates with a focus on renewable energy and infrastructure, as well as financial sponsors active in the energy and infrastructure space. Her responsibilities included deal sourcing and execution of the complete capital stack, from equity transactions on the corporate side to senior secured debt underwritings at the asset level. Elena joined Credit Suisse in 2005. Prior to that Elena was a member of Deloitte’s Management Consulting division and the JPMorgan Chase Oil & Gas Investment Banking team. Elena holds an M.B.A. from Yale University and a B.A. in Philosophy and Economics from Hamilton College. |

|

Bob Kelly – Partner More Info

Bob Kelly is a professional with extensive experience in the power and renewables sector. Bob served as Chief Financial Officer of SolarCity Corporation, a distributed solar energy company, from October 2011 to August 2014. Prior to joining SolarCity, Bob served as Chief Financial Officer of Calera Corporation, a clean technology company, from August 2009 to October 2011, and as an independent consultant providing financial advice to retail energy providers and power developers from January 2006 to August 2009. Bob served as Chief Financial Officer and Executive Vice President of Calpine Corporation (CPN NYSE), an independent power producer, from March 2002 to November 2005, as President of Calpine Finance Company from March 2001 to November 2005, and held various financial management roles within Calpine from 1991 to 2001. |

|

Mary Weisskopf – Principal More Info

Mary Weisskopf is a professional with 13 years of experience in the infrastructure and energy sectors. Mary was most recently a Vice President on the investment team of Global Infrastructure Partners’ flagship fund. Prior to Global Infrastructure Partners, Mary was part of Credit Suisse’s Power and Renewables group within the Investment Banking division. Mary was involved in the execution of a wide variety of M&A, strategic advisory, capital markets, and project financing transactions for developer, corporate, and private equity clients. Mary started her career with Charles River Associates providing economic consulting services in the Energy and Environment Practice. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Each investment we make promotes sustainability, often through decarbonization or resource efficiency, and thus furthers a United Nations Sustainable Development Goal (UN SDG). This determines what sectors we target, which investments we make, how our portfolio companies are operated, and what information we monitor and report. We identify which UN SDGs are furthered by each investment, we quantify the extent to which each investment moves those goals forward, and we monitor and report material ESG metrics and aspects of operation for each of our portfolio companies.

Our framework incorporates comprehensive ESG due diligence simultaneously with business, accounting, engineering, and legal due diligence. Our ESG due diligence criteria align with international standards to ensure we are capturing material information, important for its implications about both firms’ financial value and firms’ impact on the world at large, particularly regarding climate change and other environmental impacts. Target investment management teams complete ESG questionnaires and participate in Q&A sessions with third-party ESG advisors who assist us in evaluating the ESG profile of each investment, including the company’s ability to comply with Ember’s sustainability and ESG reporting requirements. ESG due diligence findings are highlighted in the investment memoranda for each potential investment. Any investment opportunities that have unresolvable ESG risks or liabilities or do not further a global goal identified by the UN will not receive Investment Committee approval.

Impact Tracking and Monitoring

Learn More

220 Fifth Avenue, 18th Floor, New York, NY 10001 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.