IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

EG Capital

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Education

Education Health and Wellbeing

Health and WellbeingFirm Overview

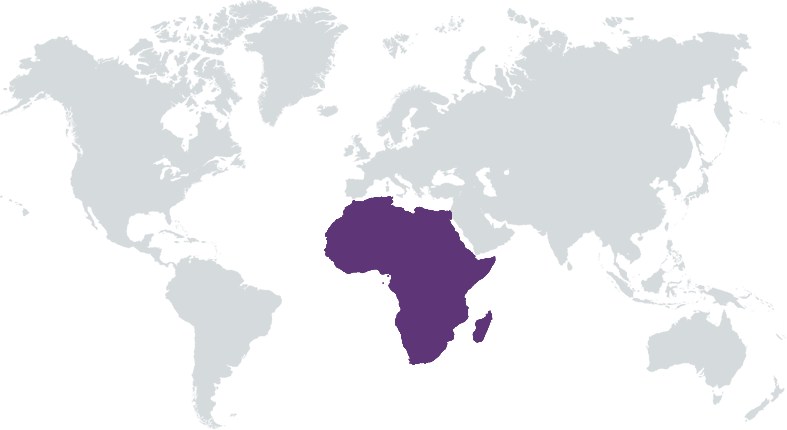

EG Capital is investing in the Food, Health, Education and Climate Resilience sectors in East Africa and Zambia with an experience team that has 100+ years investment experience from reputable firms (IFC, HSBC, PWC, Russia Partners, IFU, Norsad) across SSA managing over US$2BN assets including 30 exits in relevant sectors of the fund mandate with realized returns between 15% and 25%. Our team is multi-cultural with international, local and regional investment experience, deep proprietary networks and in-country presence in Kenya, and Zambia. We are over 65% women-owned with equal gender representation at the Board, Investment Committee, and Team level. EG Capital is qualified for 2x Ignite under the 2x Challenge of the G7 to bring more capital to women fund managers, and diverse teams.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Investing in high growth & established medium-sized businesses in the Food, Health, Education, and Climate Resilience sectors in East Africa and Zambia delivering measurable financial and social returns.

EG seeks to invest equity or quasi equity in expansion capital to 10-12 mid-sized companies growing at 20%-30% per annum in the key Eastern African markets of Kenya, Uganda, Rwanda, and Tanzania as well as secondary market in Zambia. We will invest in established medium-sized businesses operating in high growth sectors: Health, Food, Education and Climate Resilience. We bring a hands-on approach to value creation with a medium to long term horizon (5 to 6 years holding period), consistent with the real needs of mid-cap companies in Africa. We will invest between US$5M to US$10M per investment. The fund’s investments are primarily expected to constitute Equity, and Quasi-equity or Hybrid securities. One of the investment team’s core competency is to tailor and structure the instruments flexibly to match the stage of company’s growth. EG Capital will aim to exit its investments typically through self-liquidating structures, follow-on capital or trade sale.

EG Capital has a differentiated investment strategy with a thematic focus investing alongside the principles of Risk, Return and Impact, offering a unique proposition to impact investors: - Competitive risk-adjusted returns with measurable positive impact - Capital tailored to the needs of mid-cap businesses in Africa with a blend of equity and mezzanine with self-liquidating instruments to mitigate exit risks / improve liquidity - Risk diversification and focus on selecting under-valued deals within high growth and defensive markets in Food, Health, Education and Climate Resilience sectors - Enhanced value creation through focus on positive climate action, diversity and economic empowerment for youth & women The team is experienced, and exploiting an attractive market opportunity: - Investing in the fundamentals of the recovery & growth sectors (Food, Health, Education, Climate) of East Africa

Investment Example

Project Jupiter: 1. Business overview: One of the largest blended tertiary education technology platforms in Africa operating both online and physical campus learning courses across 19 countries on the continent and generating ~US$50M in revenue. 2. Transaction Summary The investment will be used expand its network of campuses across Africa, further develop the in-house technologies and broaden types of degrees exploring further opportunities in technical and vocational training, including online training & accreditation of medical professionals in Africa. 3. Investment rationale: Proprietary Technology Physical Campuses First to Market 4. Financial and impact performance: Actual conversion rates of enrolling students have outperformed budgeted during the pandemic leading to an increase in revenue from US$17M in FY2020 to US$50M in FY2021 (~x3 fold increase), and EBITDA positive. Impact target via improved access to quality and affordable education (SDG4), and increased household savings (SDG8).

Leadership and Team

|

Sandrine Henton – Managing Director More Info

Sandrine co-founded EG Capital. She has over 15 years experience, including private equity roles across Europe and Africa. Sandrine is on EG’s Investment Committee and is based in Kenya. |

|

Ananya Sengupta – Investment Director More Info

Ananya, a Director co-leads the firm’s investment mandate. She has over 23 years transaction and investment experience. She was formerly Head of Transaction Advisory at PwC for the Eastern Africa region, and with IFC (6 years) as Senior Investment Officer for direct investments in Agriculture, Health and Education. Ananya is on EG’s Investment Committee, and is based in UK / Kenya. |

|

Mainga Mukando – Investment Director More Info

Mainga, a Director, co-leads the firm’s investment mandate. He has over 25 years experience investing in Sub-Saharan Africa with IFC (11 years), the Danish International Investment Funds (IFU), Norsad Agency and PWC. Mainga is on EG’s Investment Committee, and is based in Zambia. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

EG capital screens businesses with an impact due diligence based on impact target the fund seeks to achieve, and this includes social, environmental, governance (ESG) criteria, Gender Lens Investing (GLI) criteria as per the 2X Challenge CDC Toolkit looking at gender across leadership, consumers, employees, value chain partners as well as our own firm, and Climate Resilience outcomes we seek to achieve.

We screen and due diligence intrafirm ESG practices with an audit at the start of the investment with an action plan to remedy any deficiencies, as well as exclusions. We monitor progress and risks overt time thereafter.

Impact Tracking and Monitoring

Learn More

Keystone Park Tower A, 3rd Floor, 95 Riverside Drive, Nairobi, Kenya

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.