IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Envisioning Partners

Climate Change

Climate Change Education

Education Health and Wellbeing

Health and WellbeingFirm Overview

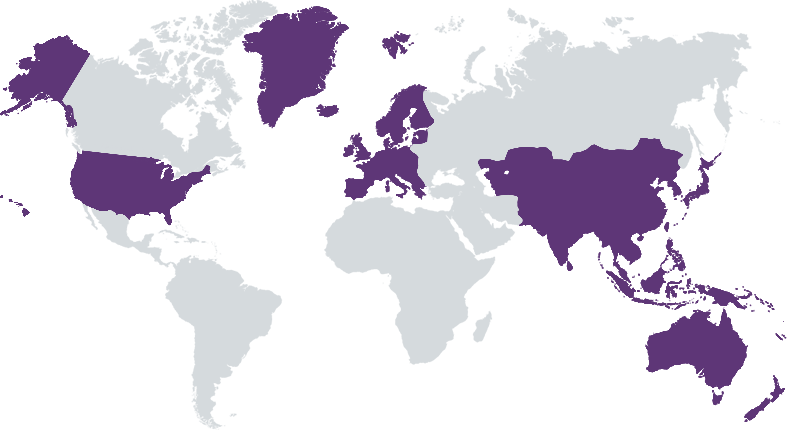

Envisioning Partners (“Envisioning”) is the largest impact investing venture capital firm based in Seoul, South Korea, with 100% of its portfolio dedicated to impact. The firm currently manages approximately $140 million in assets and has a portfolio of 36 companies in Korea, US, Singapore, and Vietnam as of September 2022. Envisioning was established with the assets and the team transferred from Yellowdog, a leading first-generation impact investing institution in Korea. Hyunjoo Je, the former CEO of Yellowdog, is leading Envisioning Partners, together with Yong Hyun Kim, the former CEO of Hanwha Asset Management, Korea’s 3rd largest asset management company with $90bn+ AUM.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Envisioning invests in startups that transform social and environmental needs into significant market opportunities in four key impact areas - (1) climate change, (2) health and wellness, (3) education, and (4) future of work.

We invest in startups, ranging from Pre-Series A to Series B, that will achieve growth by approaching various environmental and social problems, unresolved by existing markets and social systems, by utilizing innovative technologies and business models. In particular, Envisioning focuses on investing in four key impact domains - (1) climate change, (2) health and wellness, (3) education, and (4) the future of work: (1) Climate Change: Businesses that contribute innovatively to the transition to a decarbonized economy. (2) Wellness: Businesses that provide healthier eating / lifestyle services, or quality healthcare services to a wider range of people. (3) Education: Businesses that present innovative educational models and provide access to education across physical and economic barriers, from children to adults. (4) Future of Work: Businesses that enhance the quality and diversity of jobs under the changing paradigms of ‘work’ and help resolve the gap between supply and demand in the labor market.

First, we believe that applying social and environmental lenses allows us to capture new and big opportunities arising from long-term trends one step faster than the pack. We defined our own impact domains aligned with the UN SDGs, and have refined investment thesis and strategies. Ultimately, Envisioning aims at achieving a return higher than market rate as well as positive social impacts. Second, our resolute impact discipline positions us as the first choice of bold and mission-driven entrepreneurs. Third, we provide effective post-investment support by utilizing an extensive network of advisers and investors across Asia. Envisioning Partners organized by investment professionals from diverse backgrounds – global private equity, strategic consulting, IB, IP, and various industries - also adds value to the rapid growth of the invested companies.

Investment Example

Envisioning declared climate change as its top priority and has been actively investing in climate tech startups. Envisioning’s portfolio companies in climate tech include plant-based meat producer Unlimeat (South Korea), cell-cultured crustacean producer Shiok Meats (Singapore), cultivated fat producer Mission Barns (USA), vanadium redox flow battery (long-duration ESS) manufacturer H2 (South Korea), carbon-neutral jet fuel developer Dimensional Energy (USA), biodegradable plastic (carbon to PHA) developer Mango Materials (USA), plastic waste upcycling technology company Novoloop (USA), battery recycling solution provider Green Li-ion (Singapore), fully automated water monitoring solution provider KETOS (USA). When it comes to the social impact category, we invested in Enuma (winner of Global Learning XPRIZE, USA), an edu-tech startup that enhances general accessibility to quality education, LumanLab (South Korea), a digital therapeutics developer to solve the developmental delay problem, and Caring (South Korea), a professional elderly home care service provider.

Leadership and Team

|

Hyunjoo Je – Managing Partner More Info

Hyunjoo Je, prior to Envisioning Partners, was CEO of Yellowdog, the first generation impact investing venture capital firm in Korea. She worked for Carlyle Asia Buyout Fund, Credit Suisse Hong Kong and McKinsey Seoul office. She founded and led a cooperative engaged in content and knowledge business, and collaborated as an independent advisor and consultant for various social sector organizations including GOs and NGOs. She is currently serving as a BOD member for LG Uplus and Kakao Impact Foundation. |

|

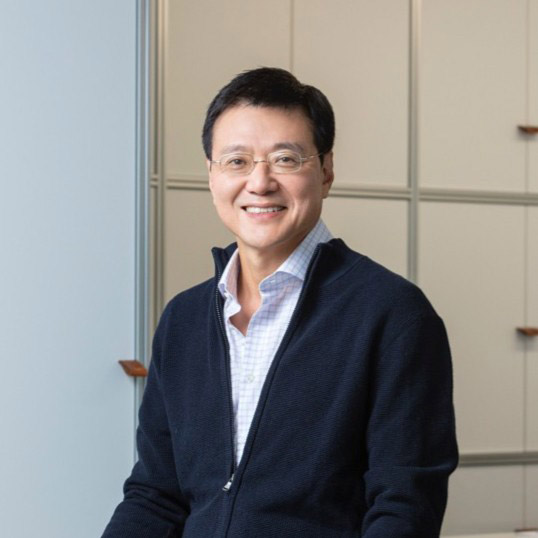

Yong Hyun Kim – Managing Partner More Info

Yong Hyun Kim was CEO of Hanwha Asset Management, Korea’s 3rd largest asset management company with assets under management of approximately US$100 billion. He worked for Hanwha Life Insurance as SVP; Carlyle Korea Ltd., as the Representative Director; Goldman Sachs & Co., New York, as an investment banker; Winthrop, Stimson, Putnam & Roberts, a law firm in New York, as a corporate lawyer. |

|

June Cha – Partner More Info

June worked for LINE Ventures and the corporate development division at Naver and LINE, leading multiple investments and M&A transactions in Southeast Asia. She also has an expertise in strategizing and building businesses from her experience of leading the business strategy team and market development team at LINE. Her experience includes management consulting in a global consulting firm focusing on media and high-tech sectors. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Basically, we do not invest in companies that may generate any negative social impacts. We only back startups that will achieve growth by tackling various environmental and social problems through innovative technologies and business models. “Collinearity” is one of our important principles of investing, which is that a business should address social and/or environmental problems directly; accordingly, positive social impacts are also delivered while the business grows. This principle helps us to keep tracking integral consequences of investments.

Envisioning operates its own “Envisioning Impact Management System” that includes 4 steps below: 1. Definition of Impacts 2. Impact Due Diligence 3. Impact Evaluation 4. Impact Realization Prior to investing, we evaluate criteria in Step 1 and 2, including (1) the size of a social problem the potential investee tries to solve, (2) the urgency or importance of the problem, (3) collinearity between the business growth and the expected social outcome. After investment (Step 3 and 4), we analyze social impact valuation based on theory of change, and support the company to persist in delivering positive social/environmental impacts by deploying the impact discipline into the articles of association as well as its incorporeal culture.

Impact Tracking and Monitoring

Learn More

4F, 21, Wangsimni-ro 6-gil, Seongdong-gu, Seoul, Korea

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.