IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Catalyst Fund

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Water and Sanitation

Water and SanitationFirm Overview

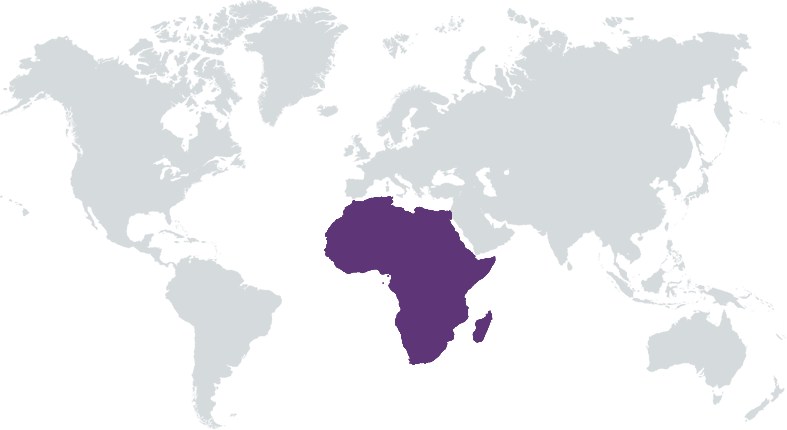

Catalyst Fund is an impact fund and accelerator backing early-stage tech startups scaling solutions for a climate-resilient future in Africa. We take an active, hands-on venture-building approach that leverages our experience as operators in emerging markets, supporting founders on tech, product, growth challenges, and more. We will invest in 40 pre-seed companies pan-Africa, with potential for follow-on investments at Seed and Series A. We invest $200K at pre-seed, of which $100K in cash and $100K in in-kind venture-building support. To date, our climate resilience fund invested in 16 climate adaptation companies across 7 African countries. The fund builds on the track record of our previous accelerator, a philanthropically-backed facility by Bill & Melinda Gates Foundation, FCDO, JPMorgan Chase, and PayPal, founded 7 years ago, backed 61 startups across 15 emerging markets. The portfolio raised >650M follow-on funding, had a 88% survival rate, and reached 40m customers.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Our thesis focuses on supporting mission-driven, local and women founders offering climate adaptation solutions that improve the resilience of African communities and have strong potential for commercial scale. We take a multi-sector approach and invest across three verticals: fintech for climate resilience, sustainable livelihoods, and climate-smart essential services.

Catalyst Fund will invest in solutions that enable climate-vulnerable communities to manage risks, adapt their livelihoods, and build long-term resilience in the face of climate change impacts. Existing opportunities include 1) climate fintech models such as insurance, carbon finance, and climate data solutions (e.g. disaster insurance, weather-index crop insurance; carbon marketplaces); 2) sustainable livelihoods solutions such as climate-smart agriculture, land restoration and fishery management solutions (e.g. agtech platforms connecting farmers to markets and enabling access to climate-smart farming inputs, or digital sustainable fishery management apps); and 3) climate-smart essential services such as water management, waste management, healthcare and cold chain solutions (e.g. solar-powered cold chain solutions for farmers or SMEs).

Catalyst Fund is unique compared to other funds in its peer group because: 1) We are the first and only fund to focus on climate resilience and adaptation in Africa at the pre-seed stage and explore the role of technology in making climate resilience solutions accessible and affordable. 2) Our venture-building approach is deeper and more hands-on compared to other accelerators that typically offer lighter-touch mentorship. We offer bespoke support by a team of dedicated sector and emerging market experts in areas such as user research, UX/UI design, product, software development, tech, data analytics, business modeling, marketing and growth, investment readiness, corporate partnerships, thus filling critical talent gaps for early-stage ventures. 3) We take an ecosystem approach to addressing climate change in Africa. We nurture a network of 200 co-investors and share learnings with the sector to unlock more capital into this vastly underfunded space, while enabling connections across stakeholders.

Investment Example

Sand to Green is a tech company whose mission is to turn deserts into arable land in Morocco to ensure sustainable food production. Through agroforestry, solar-powered desalination, and climate-smart farming practices, Sand to Green hopes to create “climate resilient regenerative farms” by establishing a profitable and scalable plantation for food, biofuel, and carbon credits. Sand to Green’s envisioned franchise model consists of a modeling software that can design highly profitable and impactful plantations across the world; a training program that empowers local farmers to embrace agroecological techniques. It also includes a monitoring platform to track and monetize impacts; and a revenue mix of carbon credits and agricultural sales earnings. The business model targets investors and asset managers who seek to invest in decarbonized assets, food wholesalers looking for greener products and food resilient production, and carbon-emitting companies that are keen to compensate for their emissions.

Leadership and Team

|

Maelis Carraro – Managing Partner More Info

Maelis Carraro is the Managing Partner of Catalyst Fund. She has over 15 years of experience working alongside fintech startups, DFIs, and impact investors to pioneer tech and data-enabled solutions that benefit underserved communities in emerging markets. As the co-founder and leader of Catalyst Fund Inclusive Tech Accelerator for the past 7 years, she selected and supported over 60 ventures across 15 emerging markets, working with a team of 15 venture builders to enable their success. Previously, Maelis worked at the IFC, investing in and advising financial institutions in Africa and other emerging markets on digital innovation and responsible financial inclusion, as well as the OECD, Grameen Bank, and impact investor-Global Partnerships. |

|

Karen Serem Waithaka – Chief Investment Officer More Info

Karen Serem Waithaka is the Investment Principal at Catalyst Fund. She leads the end-to-end investment processes and contributes to the hands-on post-investment support of the portfolio. Before this, Karen worked as an Investment Director for an impact-first fund, Global Partnerships Social Venture Fund and as Investment Manager for Safaricom's pilot corporate Venture Fund, Spark Fund. She has also worked in the Private Equity space for TBL Mirror Fund. She brings over 15 years of experience in the financial services sector spanning Venture Capital, Private Equity and Corporate Finance. |

|

Maxime Bayen – Operating Partner More Info

Maxime is the Head of Venture Building & Lead Venture Partner at Catalyst Fund. Maxime leads the venture building support to Catalyst Fund early-stage startups as well as supports the portfolio startups when it comes to investment readiness. Prior to joining Catalyst Fund, Maxime was a Senior Venture Builder with Greentec Capital where he supported 7 African startups in various sectors ( e.g. e-Commerce, Retail, SaaS, Logistics, Agriculture, and Waste management) for nearly 2 years. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our fund only targets companies with meaningful social and environmental impact. We select companies that a) target low-income, underserved and vulnerable communities, b) increase their resilience to climate change impacts by providing tools to protect from risks and adapt their livelihoods, and build long-term resilience. We screen companies for impact from the very first steps of the sourcing process (our sourcing criteria), we then do a deeper review against our impact goals during the screening phase, and a deep impact assessment during full due diligence. At that stage, we also describe what metrics the company could be collecting and start having conversations with the company.

As part of our ESG screening, we assess all firms' environmental, social and governance practices. We assess whether the businesses have any harmful impact on the environment, as well as the diversity of the teams. We use the IFC exclusionary criteria and the UN Global Compass to vet investments as well.

Impact Tracking and Monitoring

Learn More

625 Massachusetts Ave, Cambridge, MA 02139 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.