IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Amazonia Impact Ventures

Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and Conservation Place-based Impact

Place-based ImpactFirm Overview

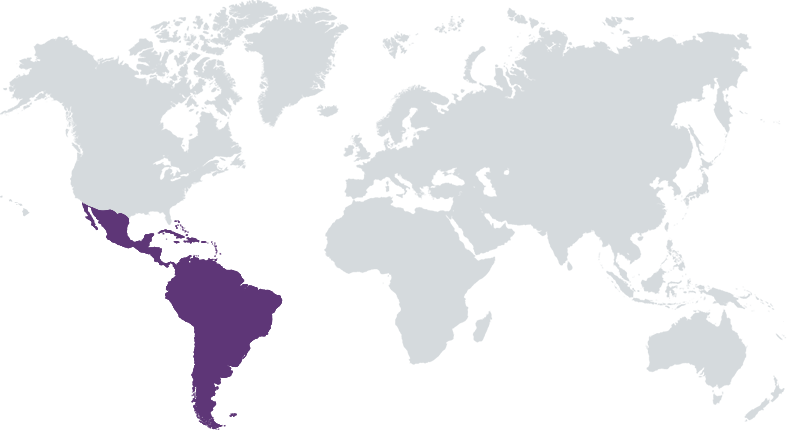

Amazonia Impact Ventures (AIV) is an impact investor that seeks to mitigate climate change by protecting the Amazon Rainforest. It does so by investing in indigenous peoples and local communities’ enterprises to protect and regenerate the Amazon rainforest and improve the livelihoods of its people. AIV designs and manages impact-linked investments to promote regenerative agricultural practices, deforestation-free commodities production and nature-based solutions to conserve and regenerate the Amazon Rainforest hand in hand with forest people, responsible companies and impact investors AIV carefully selects investees, diligently monitor progress and provide practical support for our investments. Our investments directly contribute to forest conservation, reduce deforestation, protect biodiversity, restore degraded lands and improve the livelihoods of people living in the Amazon. From London to Peruvian rainforest communities, from European speciality coffee buyers to ethical health food companies in the US West-Coast, we participate in every step of the impact investment value chain.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 100%

AIV provides financial solutions for viable indigenous and forest peoples enterprises and communities committed to forest conservation and regeneration, whilst providing a financial return with manageable risks to its investors with a measurable impact on the rainforest and its people.

AIV invests in viable indigenous and forest peoples enterprises and communities committed to forest conservation and regeneration, whilst providing a financial return with manageable risks to its investors with a measurable impact on the rainforest and its people. The investment approach is based on three key strategic pillars: (i) Impact Finance: specialising in impact-linked trade finance and capital investment loans, providing innovative range of loans to cooperatives, producers associations and business buying from the Amazon, structured to provide incentives to borrowers for meeting sustainability targets.; (ii) Regenerative investments: developing agroforestry and forest restoration projects to regenerate value chains and forests; and investing to increase access to international markets for responsibly grown and deforestation–free commodities. and (iii) Technical assistance and business support to improve knowledge of regenerative farming practices (to increase output and improve the environmental impact), strengthen their business models to be more resilient and deliver better long-term returns.

One of the key things that differentiates AIV from its peer group is our results-based lending which is linked to the achievement of sustainable land use targets. This ensures both us as a lender and the businesses we are investing in monitor and maximise the positive environmental impact of the process. We take a holistic approach to meet the the specific needs of communities, small-holder farmers and organisations across the supply chain, recognising that no two businesses have the same needs and providing unique assistance on a case by case basis. We also recognise that requirements for impact measurement varies between investments. We gather data from specific areas throughout the investment process to ensure our reporting and decision making is as accurate as possible. Our direct relationships and belief in the importance of partnerships with Indigenous communities enables many of our key differentiators to work.

Investment Example

Over two years AIV has invested in a cooperative of indigenous communities in Central Peru growing and selling speciality coffee, providing working capital to export 20 tonnes of organic coffee to Europe, enabling the cooperative to purchase and process the coffee ready for export. Established 10 years ago, this cooperative is buying coffee from 117 families in Indigenous communities. AIV’s impact-linked loans and technical assistance supported the cooperative and indigenous communities to approve a sustainable land use and forest conservation policy in 2020, establish agroforestry farms, set up a reforestation pilot project and promote forest conservation agreements with the communities and producers. An impact linked Capex loan for a dry mill will improve the cooperative’s competitiveness and coffee quality.

Leadership and Team

|

Pajani Singah – Co-Founder and Investment Director More Info

Pajani has over 15 years investment management experience. He is a partner and COO of Inflection Point Investments, a boutique fund management company investing in listed global technology companies. He is a Certified Chartered Accountant, President of the Entrepreneurs Organisation (EO) UK and Executive Board Member of Cybernaptics Ltd. |

|

Aldo Soto – Co Founder and Managing Director More Info

Aldo brings over 15 years’ experience leading conservation and sustainable livelihoods programmes in the Amazon to protect indigenous and local communities’ lands from illegal logging, mining and deforestation. Aldo worked hand in hand with indigenous communities, smallholder farmers, public and private stakeholders. He has played strategic roles in developing partnerships between indigenous peoples and conservation organisations, rural businesses and ethical buyers. Aldo is a biologist with studies in forest conservation, development of rural enterprises and social finance. He structured the first Development Impact Bond in Latin America to support indigenous farmers. |

|

Carla Koffel – Governance and Impact Director More Info

Carla is a corporate lawyer and international development professional with more than 20 years’ experience working with the private sector, international development organisations and philanthropic initiatives. Areas of expertise include promoting good corporate governance practices within both global companies and SMEs, ethical supply chain management and human rights. She has conducted social impact assessments across multiple jurisdictions and managed grants for international donors such as United Nations agencies. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

It is a part of our investment thesis to invest in enterprises that demonstrate a commitment to improving sustainable land use within the Amazon Rainforest and the lives of indigenous peoples and local communities in the forest. Amazon’s indigenous communities tend to be among the poorest, most vulnerable and excluded groups in the Amazonian countries. We reach organisations not sufficiently served by current social and commercial lenders, filling a gap in the market, and leaving the potential for the greatest amount of impact. Access to finance is key to helping indigenous Amazonian communities achieve sustainable development and, ultimately, to mitigating the effects of climate change. Our investments ultimately empower indigenous and other forest communities.

AIV combines a leadership team with decades worth of investment experience with local teams who have extensive on-the-ground experience. We conduct land use and deforestation analysis of areas where companies are conducting business alongside our organisational, financial and commercial analysis. By making contact with them prior to investing, including through utilising our experienced team on the ground, we are able to target companies who through the production of their goods are able to have positive impact, both socially and environmentally. This due diligence also serves as a form of risk management, as comprehensive assessments of investments' full potential are conducted. By targeting demographics which need financing and have been traditionally undervalued and underrepresented, the investments have the potential to help eliminate racial and gender biases. Our investments regenerate value chains and forests through investing in companies that have the potential to conduct their practices in socially and environmentally positive ways.

Impact Tracking and Monitoring

Learn More

413 Parkway House, Sheen Lane, London, SW14 8LS, United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.