IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Afrishela Investment Fund

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

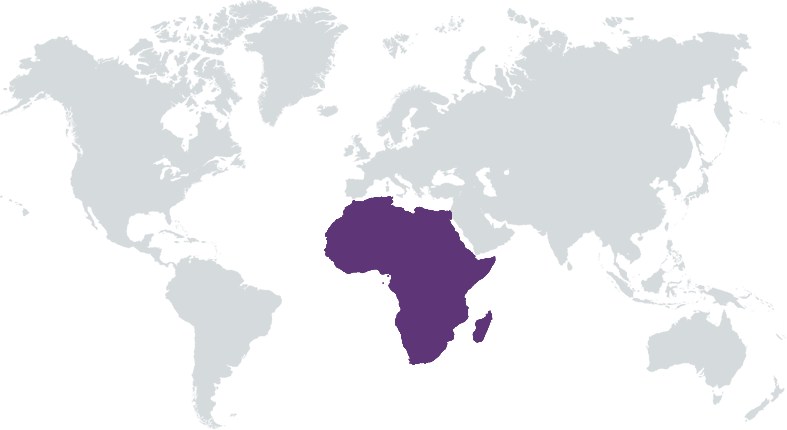

Afrishela is a $30M gender lens investment fund that seeks to facilitate the flow of capital to women-led enterprises with gender and climate aligned solutions to create a positive impact for women in the form of job creation, increased leadership and greater income equality, ultimately leading to improved economic and social well-being in African communities with a disproportionate impact on women and girls. The fund employs pan-African solutions, which African women design for African women and initially targets East and Southern Africa.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Afrishela drives innovative blended capital to early growth stage women-owned and led businesses operating in sectors where women are prevalent to increase their power and influence, and elevate those in male dominated sectors.

Afrishela employs the use of blended finance by providing post-investment technical assistance and investment capital, applying a gender lens in the investment process, employing a milestone-based approach to investing. We target the missing middle entrepreneur segment by focusing on early growth stage women-owned and led businesses with robust and scalable models, providing innovative, responsive financing through mezzanine structures (including revenue-based instruments and impact linked loans). We target businesses with robust and scalable models, gendered solutions, processes, and policies operating in in a variety of growth-oriented sectors. Our deal sizes range from $20K – $500K with an average of $300K. Up to 80% of the portfolio is allocated to mezzanine financing structures while 20% is allocated to equity. Larger deals are considered on a case-by-case basis through co-investments. Our initial focus countries are Kenya, Uganda, Tanzania, Rwanda, Malawi and South Africa

Afrishela, with its focus on the missing middle and deals ranging from $20,000 to $500,000 seeks to address a segment of the market often overlooked either due to its perceived risk or operating costs with funders seeking collateralized lending or bigger deal sizes. Afrishela brings into the market a pure gender lens investing vehicle with a gendered approach throughout the investment process. Among different gender lens funds, strategies differ with ticket sizes, capital type and sector focus among other varying strategies. Afrishela seeks to bring in early growth stage capital to the missing middle in a variety of sectors to increase women’s representation or strengthen their role where they are prevalent, complementing solutions available in the market. We are a locally rooted team (based in Kenya and South Africa) with robust ecosystem relationships and social capital due to our deep entrepreneur networks through Graca Machel Trust (our promoter) in-country networks.

Investment Example

USD$10,000 grant-funding-investment into Genesis Care (Manufacturers of eco-friendly sanitary-pad-incinerators) in 2019. Fund Utilization: increasing online presence, product expansion and initialization of construction of local production-facility. Business Growth since intervention: reached 2,500 girls under 12, 8,980 adolescents and 5,257 women across the country with the distribution of incinerators to 11 learning-institutions in urban and rural areas; winning $7,000 during Nairobi_Innovation_Week 2019, $7,000 during the Sogal_Global_Competition; qualified for Leaders_in_Innovation_Fellowship (LIF) under the Royal_Academy_of_Engineering UK; secured funding ($6,650) to pivot the menstrual incinerators to PPE-incinerators in 2020; qualified for $30,000 funding from Kenya_Innovation_Agency (KENIA) for the commercialization of the incinerators, completion the production facility and purchase basic machinery for in-house production. Piloted new M-pesa based sanitary-pad dispenser in partnership with Safaricom. Expectations for 2022: raise funding to support the sanitary-pad dispenser roll-out with Safaricom and alternative power source for the company’s incinerators and dispensers

Leadership and Team

|

Andia Chakava – Investiment Director More Info

Andia Chakava is the Investment Director at the Graca Machel Trust. Has over 20 years’ experience in fund management and 10 years of driving women economic empowerment. Established global thought leader in gender lens investing, one of the first female fund managers in the Africa region and has made considerable contribution in promoting the social and economic inclusion of women in Africa through the development and structuring of fit for purpose funds. Set up two fund management companies in East Africa (Old Mutual Investment Services and Alpha Africa Asset Managers). Skilled at business unit management, entrepreneur technical support, investor relations, investment strategy and implementation, gender lens mainstreaming, strategic advisory, project design and implementation, research formulation and execution, fund and product development, fund management, network building and advocacy. |

|

Jane Muia – Senior Investment Officer More Info

Jane Muia is currently the Investment Analyst at the Graca Machel Trust and will take on the role of Investment Manager within Afrishela. Has over 12 years’ combined experience in financial services, financial management & accounting, investment analysis, gender lens investing and women economic empowerment. |

|

Korkor Cudjoe – Entrepreneurship Manager More Info

Korkor Cudjoe currently leads the Graça Machel Trust Women Creating Wealth Initiative, which with her teams, she has designed, piloted and is now scaling. An entrepreneur at heart with 20 years’ development sector experience, she will lead the technical assistance program within Afrishela. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Afrishela targeted women businesses that contribute to increased access to products and services for underserved female consumers - for example, SRH products/services, products/services that increase access to women's health, education & training, financial services, clean water, energy, security, mobility, wellness and their reach and impact on end users

Afrishela targets companies that demonstrate action or commitment to contribute to: (i)increased participation of women within the workforce, supply and value chains (ii)contribution to the reduction in carbon footprint and or environmental degradation based on business operating model (local suppliers, use of renewable energy in manufacturing, use of bio-degradable production and packaging material (iii)job creation or increased incomes for groups such as youth, marginalized, low-income, rural communities

Impact Tracking and Monitoring

Learn More

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.