IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

WaterEquity, Inc.

Health and Wellbeing

Health and Wellbeing Microfinance and Low-income Financial Services

Microfinance and Low-income Financial Services Water and Sanitation

Water and SanitationFirm Overview

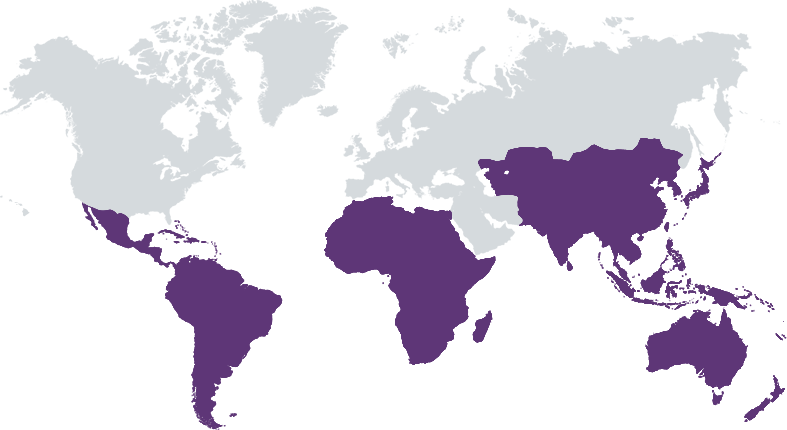

WaterEquity is the first asset manager exclusively focused on solving one of the most urgent issues of our time—the global water and sanitation crisis. Founded by award-winning entrepreneurs Gary White and Matt Damon of Water.org, the success of WaterEquity is built on decades of experience investing in water and sanitation in emerging markets. WaterEquity’s funds invest in financial institutions, enterprises, and infrastructure in emerging markets delivering access to safe water and sanitation to low-income communities, while offering an attractive risk-return profile to investors. Since 2016, WaterEquity has raised more than $200 million across three funds, reaching more than 3 million people with access to safe water or sanitation with women comprising 97% of individuals directly supported by our investments.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

Lack of financing is the key barrier preventing individuals from securing safe water or sanitation, and the infrastructure necessary to deliver it. WaterEquity identifies investment opportunities in the water and sanitation sector aiming to accelerate universal access to safe water and sanitation for millions of women, children, and men.

Economists estimate there is a $1 trillion market opportunity for providing water and sanitation services to all people worldwide by 2030. Affordable Financing for Household Solutions: Among low-income consumers, at least 600 million people could access water and sanitation products, services, and upgrades if financing was available, equating to a $35 billion market demand. Climate-Resilient Infrastructure: There is an urgent need to expand and rehabilitate water supply and sanitation (WSS) infrastructure globally to reach billions of people who are increasingly vulnerable to the impacts of climate change. According to the World Bank, investments in WSS infrastructure must at least triple to fully achieve SDG6. WaterEquity believes that investment capital can address this demand and accelerate access to safe water and sanitation for all. We invest in financial institutions, enterprises, and infrastructure that has significant capacity for scale, a demonstrable financial track record, and a deep reach into underserved communities.

WaterEquity stands apart from other impact-focused asset managers due to our deep experience in both emerging markets and the water and sanitation sector. Our Investment Management team is comprised of individuals with decades of banking and financial institution experience and an unparalleled understanding of the barriers emerging consumers face. This unique combination enables us to identify investment opportunities with an attractive mix of financial returns and multifold social impact. WaterEquity emerged out of Water.org, an internationally renowned NGO that built the case for water and sanitation microfinance. Beginning in 2022, WaterEquity is embarking upon a new initiative with Water.org to originate investable opportunities in both WSS microfinance and infrastructure. Water.org will engage in market building activities to strengthen and expand WaterEquity’s pipeline including providing technical assistance and advocacy activities in nascent markets. Our shared goal is to identify and cultivate the most promising opportunities for both impact and financial return.

Investment Example

MBK Ventura is a leading microfinance provider in Indonesia, with 800+ branches serving 1.5M clients. MBK’s mission is to provide access to capital to traditionally unbanked, low-income women in rural areas with a strong focus on gender inclusion – 100% of their clients and loan officers are women, while 40% of their board and 43% of their senior management are women. In 2018, MBK partnered with Water.org to build out their WSS microloan portfolio. In 2019, MBK qualified for investment from WaterEquity funds to further scale their WSS portfolio—helping more women secure financing for household toilets, piped water connections, and private wells. Thanks to two debt investments from WaterEquity totaling $12M, MBK has disbursed 125K+ WSS microloans, reaching more than 500K people. In working with global partners like MBK, WaterEquity can direct more capital into the hands of women and provide access to affordable WSS solutions for underserved communities.

Leadership and Team

|

Paul O’Connell – President More Info

Paul O’Connell oversees and manages WaterEquity’s day-to-day activities. He brings over 25 years of experience in the research and practice of international finance and asset management to the organization. Prior to WaterEquity, he spent more than 20 years as President and Managing Partner of FDO Partners, LLC, a quantitative asset manager providing currency and equity advisory services to sovereign wealth funds, pension funds, and other institutional investors. His research interests include exchange rate behavior, international capital flows, and labor migration, and he has published extensively on these topics. He has served as a member of the Editorial Board of the Emerging Markets Review, and the Review Board for the Research Foundation of the CFA Institute. |

|

John Moyer – Chief Investment Officer More Info

John Moyer oversees WaterEquity’s investments including strategy, due diligence, structuring, and monitoring. He brings 15 years of experience in the financial services and water and sanitation sectors in emerging markets. Previously, John led Water.org’s market entry into Southeast Asia, where he launched operations in three new countries and led engagements with 20+ financial institutions and water utilities. Prior to Water.org, John worked for CHF International’s (now Global Communities) Office of Development Finance, managing a network of financial institutions in Sub-Saharan Africa and the Middle East. He has also held multiple roles as an independent consultant in the financial services sector in emerging markets. |

|

Catherine Colyer – Chief Operating Officer & Chief Compliance Officer

Catherine Colyer provides operational and compliance oversight of WaterEquity’s business and its funds. She manages teams that are collectively responsible for maintaining WaterCredit’s status as a Registered Investment Adviser with the SEC, domestic and international regulatory compliance, fund management, operational strategy, corporate governance, HR, and systems. Catherine brings to her role 25 years of experience in regulatory compliance, financial services, fair lending, and balancing business and legal objectives. Catherine’s prior work experience includes working as a lawyer in an international law firm, a consultant in an international accounting firm, and overseeing compliance for a nationwide mortgage lender. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

WaterEquity invests in financial institutions or enterprises targeting the water and sanitation needs of low-income communities, particularly women. Understanding the client base served by our investees is a key part of the due diligence process. All loan agreements with investees contain covenants requiring that WaterEquity capital be used exclusively for water and sanitation, and that the investee meet certain impact targets related to number of people reached and client demographics.

During due diligence, WaterEquity’s Regional Investment Directors conduct comprehensive risk assessment on investee candidates using an ESG scorecard, identifying any key issues and the potential risk associated with those items, such as compliance with local environmental laws. Findings are presented to the Investment Committee with specific short-term and long-term recommendations to address risk and enhance practices. Any candidates that do not have acceptable ESG risk levels and are unwilling to agree to action plans to close ESG performance gaps will be disqualified from WaterEquity funding.

Impact Tracking and Monitoring

Learn More

117 W 20th Street, Suite 204, Kansas City, MO 64108 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.