IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Third Sphere

Climate Change

Climate Change Natural Resources and Conservation

Natural Resources and Conservation Water and Sanitation

Water and SanitationFirm Overview

Third Sphere is the leading seed stage fund focused on rapid, scalable climate action and outsized financial returns. Founded in 2013, the fund is operated by 3 diverse GPs, Shaun Abrahamson, Stonly Blue, and Shilpi Kumar, supported by 10 team members across west and east coast US as well as EU, and a global community of LPs, founders, and talent. We've accomplished financial + impact outcomes such as: Q2 2022 net TVPI of 3.88x (2014), 3.22x (2016) and 1.85x (2019) with 4.62x DPI from GP angel portfolio. 30 million metric tons of CO2 equivalent avoided across the portfolio (nearly 4x Tesla’s 2021 abatement) LPs include senior leadership from firms like Nvidia, UBS, KKR, WPP, Generate Capital, Solana. Founders from Third Sphere portfolio companies Onewheel, Logcheck, and Blue Print Power. Impact Assets as well as family offices such as George Kaiser’s Atento Capital, Marsha Soffer of Turnberry, & SPDG (D’Ieteren Group).

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

We seek pre-seed and seed stage opportunities to partner with founders to generate financial returns and planetary impact from large markets that exist today (not decades from now) and customer groups who are making purchase decision regardless of policy or altruism.

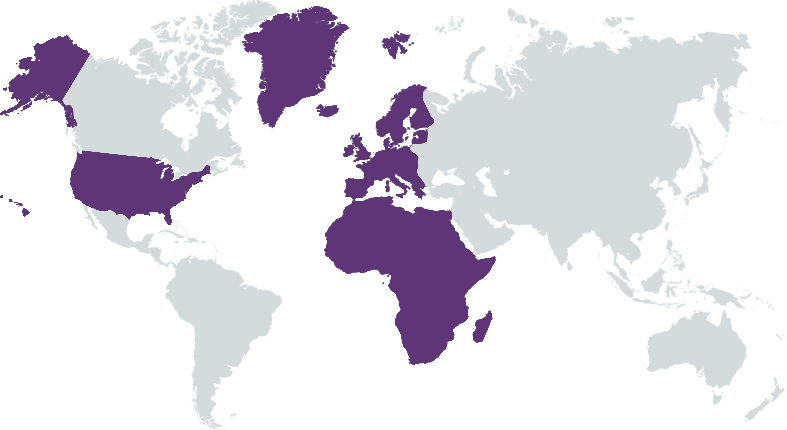

Our investing focus is best described by the EU Article 9 “dark green” taxonomy with at least 80% expected to link directly to climate change mitigation and adaptation. Target investments are seed stage venture (Pre-seed, Seed, Seed+) with 80% North America, Europe & Israel. We support founders leveraging a unique global network that includes a curated community of 12k who receive monthly email updates that help get us to 130+ new deals per month. 50% of first customers and 50% of lead follow-on investors come from introductions to the 1k closest collaborators from our community. Our proprietary deal management platform enables deal sharing with LPs. Our in-house but separately managed series of credit funds provide additional types of capital and insights.

We're a rare GP team in that we have a track-record of top returns over 14-year seed and 9-year climate investing history. We've built, operated, and sold both software and hardware firms. After 9-years together we hold top rankings from founders & investors. See Techcrunch "VCs who Founders love most", NfX Signal, Founders Choice, Climate50, and YC-Bookface for more. We support founders leveraging a curated and expansive global network of investors, customers, experts, and talent. Most generalist VCs aren’t focused on how to achieve planetary benefits, especially climate change mitigation and adaptation. Even the best early-stage investors (like YC) have limited track records backing unicorns that combine hardware and software. Few climate VCs understand rapid growth. Too many assume adoption driven by policy or customers desire to “do good”.

Investment Example

Bowery Farming uses “post-organic” brand positioning and potential economics of indoor farms to carve a path to food supply chain resilience without requiring prolonged premiums. The platform opens up opportunities for not only future of food but also organic materials. The company is now at $2.3b valuation which we’re holding at 37x. Bowery is our investment in the future of more resilient food systems with lower carbon footprint food transportation. We were one of the first funds the founder called when starting Bowery. Shaun had been an angel investor in Irving’s (CEO and founder) previous company. We helped with investor intros, in particular to General Catalyst who co-led the series A. Co-investors include GGV, KKR, Temasek, General Catalyst, and GV.

Leadership and Team

|

Shaun Abrahamson – Co-Founder More Info

Shaun co-founded Third Sphere to help startup founders to build the world beyond climate change. He’s responsible for venture investments, founder coaching and connecting founders to the Third Sphere extended family of customers, investors and partners. Before Third Sphere (fka Urban Us), Shaun was an active angel investor, investing in more than 20 firms and 3 unicorns between 2007 and 2013 including ZocDoc, Public, Trialpay (acquired by Visa), Refinery29, Skycatch and Tonx (acq Blue Bottle Coffee). During this time, Shaun also led multiple sustainability focused projects like Life Edited to design ultra low GHG apartments in New York City as well as Betacup to cut paper cup waste for Starbucks. |

|

Stonly Blue – Co-Founder More Info

Stonly is a founding Partner of Third Sphere (fka Urban Us). Stonly has taught at University of Chicago’s Booth School of Business and lectured at Harvard Business School and UC Berkeley. Stonly previously founded Veddio Cloud Solutions, an enterprise software company, which was acquired after a year of self-funded growth. He is a serial entrepreneur, having built five ventures spanning different sectors from technology to real estate and international markets, including Brazil and Canada. Stonly enjoys learning languages, playing instruments, studying math and science, practicing martial arts, reading and spending time with friends and family. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Each investment goes through an environmental and climate issue review during due diligence. This is a critical filter for whether we explore further or make a final investment decision. We create an impact investment memorandum for each investment, including a narrative of the company’s climate impacts and an explanation of the scoring process as well as key impact tracking factors. We look for companies that produce explicit positive externalities as part of our strategy, and therefore we seek to multiply that impact by making introductions to other portfolio founders where collaboration might help enhance their individual efforts. This is included in a list of "how we can help" action items at the end of the deal memo.

We do not invest in startups where there are signs of abusive behavior or toxic culture. We have a bias towards diverse teams and teams with diversity plans. Because we invest in early-stage companies, cost and lack of data are major barrier to generating climate analytics and reporting about our portfolio companies. We make up for this by collectively tracking all our investments to the SDGs as well as key areas of impact: GHG Emissions, Resilience, or Density in our portfolio tracking. As we grow the size of our investment capability and expect more returns on our early investments, we would be open to standardizing our method using a third-party ESG auditor or environmental accountant.

Impact Tracking and Monitoring

Learn More

490 Post St Suite 452, San Francisco, CA 94102 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.