IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

SoGal Ventures, LLC.

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Health and Wellbeing

Health and WellbeingFirm Overview

SoGal Ventures is the first women-led, next-gen early stage venture capital firm with a fantastic track record. We represent how far our generation has come, and how deep our impact could be. It was founded and led by trailblazers Pocket Sun and Elizabeth Galbut. We create history by investing in world-class women and diverse founders who are building future billion dollar, iconic businesses. Our portfolio defines the time we live in. SoGal Fund I delivered top of industry returns, with an underlying portfolio of 100% diverse & underrepresented founders building startups with profit + impact. SoGal's execution of our triple arbitrage investment thesis has already generated +4.5X on invested capital and 77% Gross IRR since 2017, with multiple unicorns.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

SoGal capitalizes on the three biggest arbitrage investment opportunities of our time: undervalued founders, undercapitalized geographies, and underserved problems.

SoGal is investing in next-gen billion-dollar businesses that revolutionize the future of living, working, and staying healthy. Our companies also unapologetically benefit people, society, and the planet. Our companies are global-first, human-centric, design-driven, community-powered, and sustainability-minded, created for and by the rest of us.

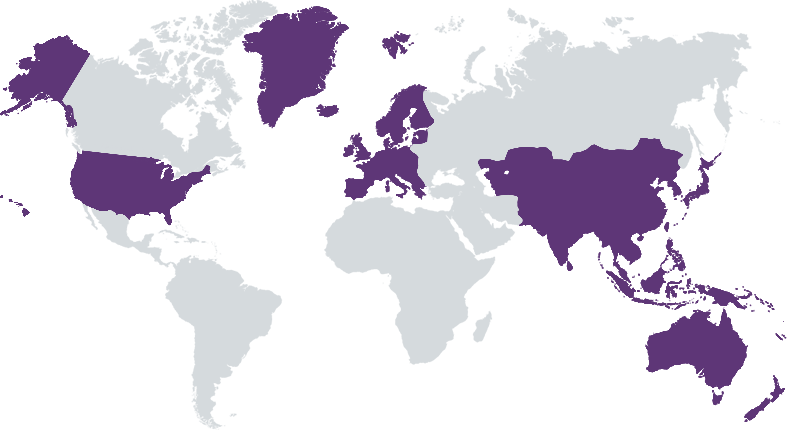

We have a clear brand, a clear track record, clear next-generation insights, and clear global community advantage. We are the first to market and the youngest self-made GPs that have 7 years of stellar performance. We consistently invest in and create high-growth women entrepreneurs like no one else. Behind the fund we have a community of 127,000+ subscribers around the world, across 50 cities and 6 continents. SoGal's large global audience creates big pipelines of women entrepreneurs, investors and operators, and serves as a distribution channel for all key tasks of the fund and our portfolio. It's also a proprietary, massive deal source: 120K+ Black women & non-binary founders applied for our SoGal Black Founder Grant program in the past 18 months. SoGal community hosts educational programmings: two marquee programs are Fempire x SoGal (angel investing training) and Black Founder Startup Grant (in collaboration with Walmart and other corporates).

Investment Example

We were one of the earliest VC investors in Everly Health (f.k.a. EverlyWell) in 2017, and the company was recently valued at $3.6B. Founded by solo female founder Julia Cheek, Everly Health creates at-home health testing kits that are affordable, convenient, and accurate. We believe millennials and Gen Z will consumer health differently, at low costs and with autonomy. We invested because Everly Health was exactly what we were looking for - democratizing access for consumers to obtain and monitor their own health data. In 2020, Everly Health was the first to develop an at-home COVID test and the first and one of the only to receive FDA approval. In 2021, Everly Health acquired two companies, rebranded as Everly Health, and was valued at $2.9B. Currently, Everly Health is valued at $3.6B, creating not only half a billion in revenue, but also the future of consumer-facing health testing solutions.

Leadership and Team

|

Elizabeth Galbut – Co-founder and Managing Partner More Info

Elizabeth Galbut is Co-Founder and Managing Partner of SoGal Ventures, the first female-led millennial venture capital firm, which invests in diverse founding teams in the US and Asia. With over 100 investments to date, she is actively seeking to back exceptional startups revolutionizing how the next generations live, work, and stay healthy. Elizabeth’s favorite investment area is the intersection of smart design and machine learning/AI fueling major health and wellness innovation. Her portfolio of health & wellness startups include lab platform Everlywell, clean customized personal care brand Function of Beauty, autism care innovator Elemy, child development leader Lovevery, digital pathology analytics pioneer Proscia, holistic wellness platform Parsley Health, smart socks Siren Care, and veterinary immunotherapy cancer technology Vetivax. |

|

Pocket Sun – Co-founder and Managing Partner More Info

Pocket Sun is a visionary investor, entrepreneur, and activist. Since 2015, she has pioneered a global movement to invest in women's potential as founders and funders. At age 24, Pocket co-founded SoGal Ventures, the first women-led, next-gen venture capital firm investing in world class women and diverse entrepreneurs. In the past few years, SoGal has built a track record of being the earliest and/or the only women investors in multiple billion-dollar companies. Under Pocket's leadership, SoGal has built a top-performing, high-impact financial institution, a global brand as a strong ally for women entrepreneurs, and a strong network in core sectors including consumer tech, digital health & wellness, and future of work. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

SoGal community of 127,000+ subscribers around the world, across 50 cities and 6 continents. SoGal's large global audience creates big pipelines of women entrepreneurs, investors and operators, and serves as a distribution channel for all key tasks of the fund and our portfolio. It's also a proprietary, massive deal source: 120K+ Black women & non-binary founders applied for our SoGal Black Founder Grant program in the past 18 months. On a day-to-day basis, SoGal’s global community is operated by the SoGal Foundation. SoGal Foundation hosts educational programming, offers funding opportunities, trains investors, and promotes founder wellness: two marquee programs are Fempire x SoGal (angel investing training) and Black Founder Startup Grant (in collaboration with Walmart and multiple corporate partners).

We invest in broad-based diverse teams, including women, people of color, immigrants, LGBTQ+, veterans, etc. 95% of SoGal portfolio companies have 1+ female co-founders, 84% SoGal portfolio companies have female CEOs, 36% of SoGal portfolio companies have 1+ BIPOC co-founders, and 5 of SoGal portfolio companies are Certified B-Corps. SoGal Ventures has seeded 3 billion-dollar category creators, co-founded by women, from outside of Silicon Valley. We assist and support our companies to hire diverse talent, design sustainable products and services that benefit overlooked or underprivileged groups.

Impact Tracking and Monitoring

Learn More

5660 Strand Court Unit #A105, Naples, FL 34110 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.