IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Novastar Ventures Limited

Firm Overview

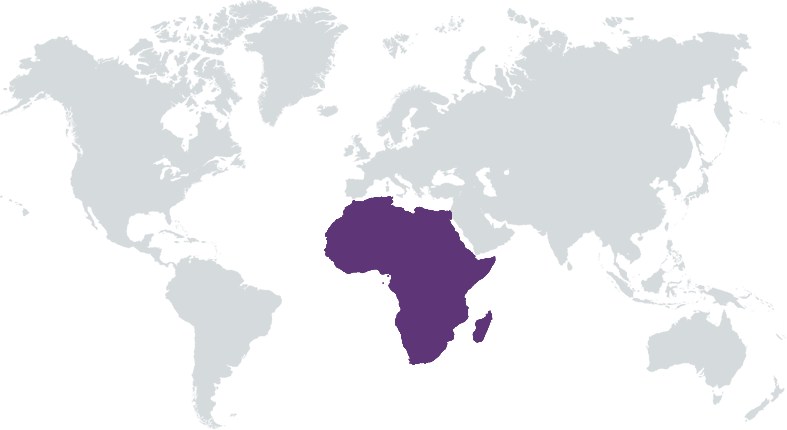

Novastar is a global VC with offices in the vibrant entrepreneurial centres of Lagos, London and Nairobi. Since 2014, Novastar has been partnering with the bold entrepreneurs to build businesses that create value for the many, not just the few, for people and planet - for good. With $200m AUM, Novastar’s 20-strong team is currently investing from its second fund with a portfolio of 20 companies. Novastar investors include the leading European DFIs, as well as institutional investors, and family offices. Novastar’s sector-agnostic investment thesis follows threads of everyday consumer behaviour in the fast-growing, often informal, African markets where they live, work and shop. We back companies that provide essential goods, services and economic opportunity: Healthcare, (mPharma, Elephant, Penda), Financial Services (TeamApt, Turaco), Education (NewGlobe), Agriculture (GreenPath), Energy (Paygo, SolarNow), Forestry (Komaza), Information (poa! internet, Ignitia, iProcure), Sanitation (Sanergy), Retail (MoKo, Soko, SureChill, TradeDepot) and Mobility (BasiGo,MAX).

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

Novastar backs ‘breakthrough businesses’ that employ innovative business models to widen market access, reduce cost and improve quality of basic goods and services to the many, not just the few.

Novastar’s commercial venture strategy drives investment in businesses that can scale by addressing the biggest problems in the largest markets. Novastar was established on the premise that sustainable, scalable benefits to the overwhelming majority of households in Africa will derive from the commercial growth and success of businesses that either, (a) serve their latent demand for basic goods and services, or (b) incorporate them in the value chain of their business. The largest market opportunities in our principal regions are those that address the basic needs of mass market consumers or incorporate them in the value chain of the business. Profitably serving these markets at scale requires innovative, often tech-enabled business models to widen market access, reduce cost and improve quality of basic goods and services. Novastar portfolio companies that do this successfully have the potential get to scale and generate strong financial returns for the funds and their investors.

Novastar’s founders have been partnering with entrepreneurs in African since 2009, launching Novastar’s first venture fund in early 2014 when there was no VC asset class in Africa. Since then, venture-backed entrepreneurship on the continent has increased 20-fold, with VC funding eclipsing $5 billion in 2021. Apart from being the first and most experienced VC on the continent, Novastar’s key differentiators include: • Deep knowledge of the behavioural economics of the mass market consumer and producer… • … and the informal markets where they typically live, work and shop – and where 90% of the economic activity in Africa is found • Locally present in Africa’s entrepreneurial hubs of Nairobi and Lagos, while internationally connected in London and the Silicon Valley • A business partner with mission-driven entrepreneurs, from seed to scale • An experienced commercial VC consistently applying an impact screen to every investment and reporting the inclusive value created by our investments

Investment Example

Novastar has backed NewGlobe Education from seed (one school serving 200 pupils) to scale (now 2.3 million pupils in 8,000 schools). NewGlobe works with national and state governments to create tech-enabled public education systems that transform learning outcomes. Through technology and training, the company equips teachers with digital lesson guides adapted to the national curriculum with specifics for every grade level, subject and day. Learning and development coaches build on intensive induction training to ensure consistent support. NewGlobe’s full-stack, cloud-powered education management platform is proven to deliver the most significant transformation of emerging market public education systems ever recorded. Nobel Laureate economist Michael Kremer conducted randomized control trial research on the learning outcomes of 10,000 pupils revealing unprecedented learning gains in in NewGlobe-run schools. NewGlobe investors have benefited alongside the pupils, parents and teachers. Revenues, profitability and shareholder value have grown in line with the educational transformation delivered.

Leadership and Team

|

Steve Beck – Managing Partner More Info

Steve has been investing in African start-ups since 2009 when he founded a private investor circle making seed-stage investments in East Africa. The investments that he and his partners made – NewGlobe and Sanergy among them – formed the proof-of-concept portfolio for Novastar’s first fund. He had an 18-year career in consulting and led the European, African and Asian businesses of two global consulting businesses. Steve took leave of consulting in 2002 to help set up and lead Geneva Global - a philanthropic investment bank managing grants to more than a thousand projects in global health, human liberty, microfinance, education, and conflict recovery. |

|

Andrew Carruthers – Managing Partner More Info

Andrew began investing in start-ups during the dot-com era in 1996. He launched his first fund on the London Stock Exchange in 1999 and was involved in managing 12 more over the next 15 years, investing in Europe, India and China along the way. Born in Lesotho with periods growing up in Ethiopia and Kenya, he is a graduate of the London School of Economics. Andrew began fulfilling his professional ambition to apply Venture Capital investment techniques to stimulate transformation on the continent first in South Africa in 2009, and then in East Africa with Steve Beck, raising Novastar’s first fund in 2014. |

|

Sapna Shah – Partner More Info

Sapna started her career in international banking, initially at Lloyds TSB and later at HSBC, working with entrepreneurs and SMEs at various stages of their business lifecycle in the UK, US, Europe and the Middle East. She returned to Kenya in 2012 to continue her passion for working with entrepreneurs, this time as an investor at Acumen and co-founder of a food start-up. She joined Novastar in 2015. Sapna graduated from the London School of Economics with a Bsc (Hons) in Government and Economics. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Novastar applies an intentional, rigorous Social Value Screen to every new investment – a screen that is explicitly codified in the funds’ governing documents. Novastar positively screens for investments where profitable commercial growth and the scale of benefits are clearly and strongly correlated and avoid investments that entail a trade-off between social and financial value. At the time of Novastar’s initial investment, the company must satisfy at least one of the following three criteria: Core business is to provide basic goods and services to the many, not just the few. That is, the commercial success depends on profitably serving mass market consumers; and/or Business model generates large-scale benefits to mass market suppliers who are integral to the value chain of the business; and/or Novastar’s investment is designated and structured to enable the business to serve and/or benefit the mass market.

The governing documents of each of Novastar’s funds require adherence to an Investment Code adopted by European development finance institutions and strong ESG policies and practices. Novastar has developed an ESG policy and management system based on the IFC Performance Standards to complement its strategy for creating social and environmental value for people and planet, to maximise value for investee customers, shareholders, workers, and future generations, and minimise negative environmental and social impacts generated by the activities of its portfolio companies. Novastar partners actively with its portfolio companies to ensure objective, consistent, and fair treatment of all stakeholders, and the adoption of good corporate governance. The goal is to develop companies that act with integrity, fairness and diligence in all dealings, promote international best practice with regard to the environment, communities and employees, while also delivering the social and financial benefits that derive from the company’s commercial growth and development

Impact Tracking and Monitoring

Learn More

Fox Court, 14 Grays Inn Road, WC1X8HN, London, United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.