IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Energy Impact Partners

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Energy

EnergyFirm Overview

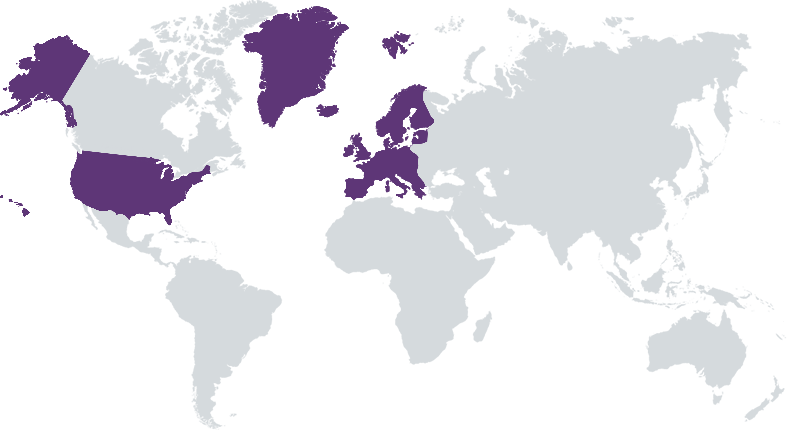

Energy Impact Partners LP (EIP) is a global investment firm leading the transition to a sustainable future. EIP brings together entrepreneurs and some of the world’s most forward-looking energy and industrial companies to advance innovation. With over $4.5 billion in assets under management, EIP invests globally across venture, growth and credit – and has a team of over 90 professionals based in its offices in New York, San Francisco, Washington D.C., Atlanta, Palm Beach, London, Cologne, Oslo and Singapore. For more information on EIP, please visit www.energyimpactpartners.com.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

The energy systems of the world are critical infrastructure that is scale-intensive and highly networked. Decarbonizing these systems requires technology changes within the companies that own and operate all segments of this system, from generation to use. These technology changes will occur most quickly by collaborating directly with these companies.

The transition to net-zero energy represents an enormous opportunity for innovation and profitable investment. The key to rapid and successful decarbonization is to work collaboratively with the companies that are leading the transition in their own operations, and investing in the clean energy transition should be done in a manner that promotes DE&I and increases the resilience of our energy systems. These principles guide all our work across our investment strategies. The Flagship strategy focuses on inflection and growth-stage companies across the clean energy value chain, both in Europe and US. The Frontier strategy invests in pathbreaking early-stage deep decarbonization technologies. Our Elevate Future strategy is directed entirely at founders and managers from underrepresented groups. Our credit strategies are licensed Small Business Investment Companies that provide capital to a wide range of small, established companies supporting the clean energy transition and other goals.

EIP operates as an investment manager with a platform for strategic collaboration. Our coalition of over 65 strategic investors own and/or operate huge portions of the world’s energy production and use systems, including electric and gas networks, industrial facilities, transportation companies, and large-scale buildings. Our strategic partners have over 400,000 employees and annual capital spending in excess of $100 billion, much of which can be directed towards lower-carbon technologies. Our utility partners have more than 150 million customers and operate transmission and distribution networks about half as large as the entire U.S. grid. In total, 37 of our 67 strategic partners are working with at least one of our portfolio companies. The number of portfolio companies - LP contracts continues to grow, adding 178 new contracts in 2023 to reach a cumulative total of 601 contracts, with just over $3 billion in aggregate value.

Investment Example

Infravision was our first major investment in T&D with environmental and social impacts. Infravision has created the world’s leading drone stringing system, offering an alternative to the incumbent method of power line stringing: helicopters. Not only is this incumbent method emissions-intensive due to the fuel use, but it also requires significant amounts of vegetation clearing, disrupting natural environments that serve as carbon sinks and with adverse impacts on biodiverse ecosystems. Additionally, stringing via helicopter is unsafe. The company’s flagship TX system is a drone stringing system that replaces emissions-intensive helicopters, mitigates the need for vegetation clearing, and severely reduces safety risks associated with line stringing. In today’s energy landscape, T&D capacity is a major hurdle in expanding the availability of affordable and reliable renewable energy, and Infravision’s TX system makes expanding transmission and distribution infrastructure cleaner, safer, and with severely reduced adverse impacts to natural ecosystems.

Leadership and Team

|

Hans Kobler – Founder & Managing Partner More Info

Hans Kobler is the Founder and Managing Partner of Energy Impact Partners (EIP), a $4.5 billion global investment firm specialized to invest in the technologies powering the energy transition. EIP brings together forward-thinking utilities and industrials to advance innovation. He is responsible for directing EIP’s overarching investment strategy and leading a global team that invests in venture, growth and credit in the U.S. and Europe. Hans is a 25-year veteran of energy and climate technology investing, and a pioneer of corporate venture capital. |

|

Sameer Reddy – Managing Partner, Flagship More Info

Sameer Reddy is a Managing Partner at Energy Impact Partners (EIP), a $4 billion global investment firm custom-built to invest in the energy transition. EIP brings together forward-thinking industrials and climate innovators to help decarbonize the global economy. Sameer has over 15 years of experience in energy transition and climate technology. He joined Energy Impact Partners (EIP) in 2015 and oversees the firm’s Flagship Fund. |

|

Adam James – Partner, Head of Impact and Customer Experience More Info

Adam James is a Partner at Energy Impact Partners, where he leads the firm’s Customer Experience team and the Impact & Sustainability team. Adam joined EIP from Tesla where he worked on global business operations. Prior to Tesla, he was the Deputy Director at SolarCity, supporting global market expansion including business development, M&A, and utility partnerships. Adam previously held roles with GTM Research and at the Center for American Progress. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

Decarbonizing the world’s energy systems will require a vast number of new technologies and business processes in addition to many policy improvements, behavior changes, and public sector actions. At EIP, we assess the impacts of our portfolio companies' technologies through carbon impact savings and other KPIs that allow us to assess the foundational roles that do not lend themselves to being quantified in ton-by-ton, unit-by-unit carbon savings. In addition, we score every company's role to the energy transition and discuss its contribution as part of the investment decision process.

For every investment, we conduct an ESG assessment that covers metrics in the following categories: 1) environmental metrics (Climate Risk Assessment, Environmental Management Systems, Environmental Policies, water, waste, etc), 2) diversity metrics (% FTE women, % FTE URM, % board women, % board URM, % management women, % management URM, % companies founded or led by women and URM), 3) good governance policy metrics (health and safety, parental leave, anti-corruption, anti-bribery, anti-slavery, human rights, cybersecurity), 4) good governance and social strategies (health and safety management system, employee resource groups, responsible supplier code of conduct), and 5) carbon metrics (annual enabled savings (absolute and ownership adjusted), lifetime enabled savings (absolute and ownership adjusted), planned 5-year savings, and carbon footprint).

Impact Tracking and Monitoring

Learn More

600 Third Avenue, 38th Floor, New York, NY 10016 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.