IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

BTG Pactual Timberland

Investment Group, LLC

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Entrepreneurship and Job Creation

Entrepreneurship and Job CreationFirm Overview

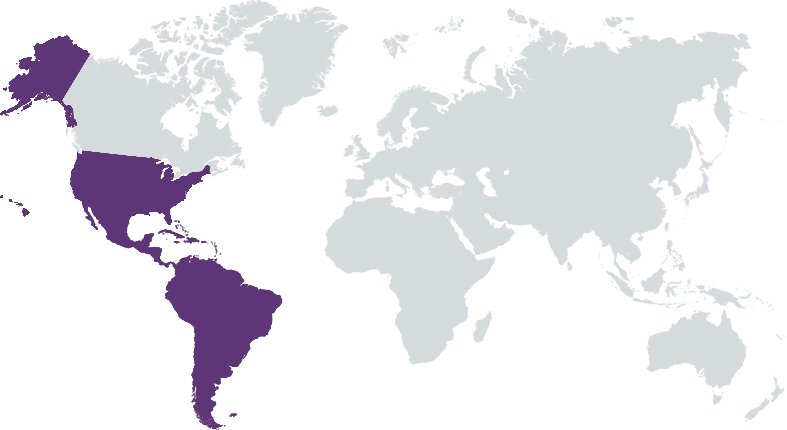

TIG manages assets and commitments of US$ 7.2B and 2.8M acres. TIG and its directly owned and affiliated companies have over 160 professional staff members located across 21 offices, bringing exceptional local, regional, and global experience to bear on the careful management of client investments. TIG is dedicated to the integration of sustainability throughout its entire investment process (100% of its eligible global footprint is certified to FSC and SFI sustainability standards) and has launched innovative collaborations with two of the world’s largest environmental NGOs, The Nature Conservancy and Conservation International. TIG’s assets are primarily based in North America (U.S.) and Latin America (Brazil, Uruguay, and Chile).

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

TIG seeks to sustainably manage the world’s timberland while generating compelling investment returns, delivering net positive environmental and social impact through the management of its clients’ assets in alignment with its investment and stewardship principles, third-party sustainability standards, best management practices, and collaborations with global environmental NGOs.

TIG manages timberland investments in North and South America, with a significant on-the-ground presence, utilizing forestry as an opportunity to sequester carbon, produce sustainable wood products, and improve social-ecological systems while generating financial returns. Currently, TIG has three primary investment strategies: a Latin America Reforestation Strategy, a Core Latin America Strategy, and a Core U.S. Strategy. The Latin American strategies are both closed end strategies. The Latin America Reforestation Strategy is an impact-focused strategy targeting forest protection, restoration, reforestation, and carbon removals at scale. Conservation International serves as the strategy’s Impact Adviser, helping to achieve positive environmental, climate, and social impacts. The Core Latin America Strategy is focused on acquiring and sustainably managing brownfield, core commercial timberland assets. The Core U.S. Strategy is an open ended strategy focused on commercial timberland. The Nature Conservancy is this strategy’s Conservation Advisor, helping deliver conservation outcomes at scale while maintaining or enhancing returns.

TIG believes that it is differentiated from its competitors by its: - Track Record: TIG has been operating and investing in timberland assets in the U.S. and Latin America since the group’s inception in 2013, deploying over US$ 4.4B across both regions, operating through multiple economic cycles, and returning over US$ 2.9B to investors since inception. -Operational Capabilities: Dedicated and experienced team of 160+ investment, operational, and sustainability professionals across 21 offices facilitating an active on-the-ground management approach across TIG’s 2.8M acres of sustainably-managed forests -Alignment of Interests: Substantial GP co-investment alongside LPs -ESG Capabilities: Robust ESG framework closely integrated into all investment processes, significant ESG expertise among its professionals, and innovative collaborations with two of the largest environmental NGOs

Investment Example

TIG launched the Latin America Reforestation Strategy to pursue large-scale reforestation of degraded land in Latin America, restoring and permanently protecting natural forest across 50% of the portfolio, establishing FSC-certified commercial tree farms on the remaining land, and investing in the development of processing facilities to manufacture climate positive forest products. This strategy acquired its anchor asset in 3Q2022, a ~24k ha contiguous property (primarily cattle pasture) in Mato Grosso do Sul. The restoration design seeks to maximize positive impact on water quality, watershed function, and habitat connectivity. The restoration of ~2.6k ha of natural forest and establishment of 400m riparian buffers is expected to enhance ecologically important riparian habitats, creating a ~5km corridor to a large neighboring natural forest and connectivity across more than 10k ha of natural forest. TIG believes that this could be one of the largest restoration projects in the Brazilian Cerrado biome.

Leadership and Team

|

Mark Wishnie – Chief Sustainability Officer and Portfolio Manager More Info

Mark provides overall leadership on sustainability policy and performance for TIG. Mark previously led the Global Forestry program at The Nature Conservancy (TNC), and before joining TNC, led Portfolio Management and Portfolio Analytics at TIG. Mark was a Founder and Managing Director of Equator, LLC and its Brazilian subsidiary, TTG Brasil. Prior to Equator, Mark led reforestation research for the Smithsonian Institution and was Program Director for the Yale Tropical Resources Institute. Mark serves on the Executive Committee of The Forests Dialogue at Yale, and Mark’s research has been published in Sustainability, Forest Ecology and Management, Conservation Biology and The Annual Review of Anthropology. Mark received his B.S. in Forestry from the University of Washington and his Master of Forest Science from Yale. |

|

Gerrity Lansing – Head of BTG Pactual Timberland Investment Group More Info

Gerrity provides overall strategic and business leadership for TIG, and is a Managing Director and Partner of BTG Pactual. Prior to his current role, Gerrity was a Founder and CEO of Equator, LLC and its Brazilian subsidiary, TTG Brasil Investimentos Florestais Ltda (“TTG Brasil”), which was acquired by BTG Pactual in 2012. Prior to this, Gerrity spent nearly a decade building and as CEO of Madison Trading, LLC and Chatham Energy Partners, LLC (acquired by The Intercontinental Exchange). He is on the Board of the Nasher Museum of Art at Duke University, the Buckley School in New York City, the National Alliance of Forest Owners (NAFO) and La Fundación de la Universidad del Valle de Guatemala. Gerrity received his B.A. from Duke University. |

|

Mitchell Kosches – Chief Operating Officer and Head of Investment Management More Info

Mitch has spent his career in accounting, finance, and investment banking, including more than 12 years of timberland investment experience. Mitch oversees all phases of transaction execution and investment management within TIG. Prior to this role, he was a Founder and COO of Equator, LLC and its Brazilian subsidiary, TTG Brasil, where he was responsible for day-to-day operations. Prior to joining TTG Brasil, Mitch was the CFO of Chatham Energy Partners, LLC and Madison Trading, LLC. Mitch also worked as an investment banker, first at Gruntal & Co., and later at Brean Murray and Co., Inc. and as an accounting manager in Donaldson, Lufkin and Jenrette’s Merchant Banking Group. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

TIG targets investments in sustainably managed timberland assets with a focus on maximizing their net positive environmental, climate, and social impacts. TIG’s underwriting includes an evaluation of ESG risks, mitigants, and opportunities for all transactions. TIG assesses environmental risks pre-acquisition to audit and certify compliance with third-party sustainability certifications (such as FSC and SFI) and to address other site- and project-specific issues that may arise, including, but not limited to, potential environmental or social impacts. The findings of TIG’s ESG due diligence process are included in every acquisition’s Investment Memorandum and are debated alongside other key underwriting assumptions prior to approval. Once acquired, TIG seeks to certify all eligible properties to third-party verification programs and, where applicable, collaborate with The Nature Conservancy and Conservation International to enhance positive impacts. Currently 100% of TIG’s eligible properties globally are certified to internationally recognized third-party standards.

TIG’s underwriting process includes a an evaluation of ESG risks, mitigants, and opportunities for potential acquisitions. This process includes, but not limited to, an analysis of environmental licenses, forestry permits and licensing procedures, applicable environmental laws, rights of third parties (indigenous and/or traditional communities), forest certification, and field assessment surveys (protected areas; waterways; prevention of environmental damage; soil protection; chemical waste deposits and soil contamination; waste management plan). Where applicable, TIG collaborates with its environmental NGO partners to enhance its ESG diligence process. For instance, acquisition targets for TIG’s Latin American Reforestation strategy are screened by the strategy’s Impact Adviser, Conservation International, for compliance with a set of rigorous Impact Criteria. CI completes an assessment of each acquisition against the Impact Criteria before the acquisition is finalized, aiming to ensure positive environmental and social impacts of activities, and to safeguard against unintended negative consequences.

Impact Tracking and Monitoring

Learn More

601 Lexington Ave, 57th floor, New York, NY 10022 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.