IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Aavishkaar Venture

Management Services

Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial Services Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

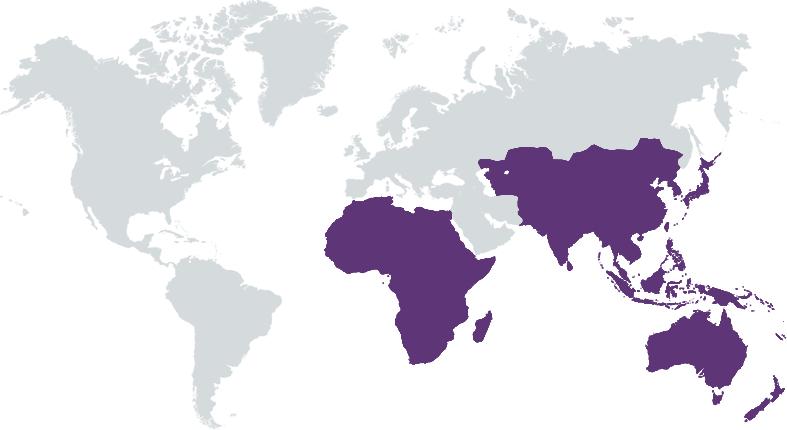

Aavishkaar Capital, part of the Aavishkaar Group, is a global pioneer Impact Fund Manager, that invests in growth stage enterprises in Asia and Africa since 2001, with a focus on geographies and sectors that were often overlooked and challenging. With impact at its core, Aavishkaar Capital has raised 8 impact funds, invested in over 60 enterprises, while generating commercial returns with over c.555 million in Assets Under Management. Aavishkaar Capital creates livelihoods, reduces vulnerabilities, and provides access to essential products and services to the target population through its investments in ambitious and innovative entrepreneurs. In addition, Aavishkaar is the first Fund Manager in Asia to qualify for the 2x Challenge Flagship Initiative. Aligned to 13 out of the 17 Sustainable Development Goals, Aavishkaar Capital’s unique approach has resulted in its invested enterprises impacting over 136 Million lives (52% of whom are women).

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Aavishkaar Capital seeks to deliver Impact at Scale & Commercial Returns by investing in businesses across 3 core sectors - Financial Inclusion, Sustainable Agriculture, and Essential Services, providing early and growth capital to pioneering entrepreneurs motivated to create scalable businesses with a focus on unit economics.

Our investment thesis is to leverage the confluence of consumption, financial inclusion and technology across emerging low and middle income populations to build sustainable, impactful and highly scalable businesses, which can create significant value for both the investors and the society. The Firm seeks to invest in businesses which meet the following criteria: • Operations focused on the targeted demographics of the emerging 3 billion population. • Business model with the potential to scale significantly within 4 to 5 years. • Strong management team with the ability to capitalise on the market potential. To achieve our goals we follow a multi-stage 'sow-tend-reap' investment strategy which supports businesses across the growth spectrum, from seed to growth stages, while building a portfolio with a balanced risk return profile. With an active investment style, we support the investee companies in building their capacity for growth by advising on strategy, governance, operational processes, human resources, and fundraising.

Aavishkaar Capital sees Impact as a value accretive framework for entrepreneurs and we seek and support those entrepreneurs who are creating value by solving problems worth solving. While Impact Measurement and Management and ESG assessments are strongly integrated within our investment processes, we make a clear distinction between the Impact created by our Fund and the impact created through our investments. Our policy framework seeks each of our Funds’ teams to define its own impact thesis that defines the impact of the Funds as independent from the impact of their portfolio companies. Growth and scale are important, but we ensure our entrepreneurs demonstrate laser sharp focus on unit economics and the bottom line. This discipline has kept our portfolio companies in good stead during the pandemic. We understand the challenges faced by entrepreneurs having been through that journey ourselves building the Aavishkaar Group into the leading platform investing for impact

Investment Example

Aavishkaar Capital was the first institutional investor in Ulink Agritech Private Limited (AgroStar) in 2013. Today, the Company has become the largest agritech-solutions platform for smallholder farmers in India that offers Agronomy, Technology and Data to solve systemic issues in farming practices and agri-inputs supply chain. The Company provides real-time agronomy advisory and access to quality farm inputs to its network of 7 million farmers across 5 states in India, resulting in increased crop yields and farm incomes. With a view to further improve their service to farmers, AgroStar has established a footprint of over 4000 stores across its target geographies. Since Aavishkaar’s investment in 2013, Agrostar has raised capital over multiple rounds from investors like British International Investment (BII), Accel, Hero Enterprise, Chiratae Ventures, etc. https://www.corporate.agrostar.in/

Leadership and Team

|

Vineet Rai – Founder and Managing Partner More Info

Vineet Rai is the Founder and Chairman of Aavishkaar Group, an Impact Investment Platform, which includes Aavishkaar Capital, Arohan, Ashv Finance Intellecap & Sankalp Forum, impacting millions using an entrepreneurship-based development based approach. The Group employs over 7000 people and manages assets of over $1.2 billion. Vineet has received numerous awards including the Impact Investor of the Year by News Corp 2016, Porter Prize for Strategic Leadership in Social Space, 2016, G20 – SME Innovation in Finance Award 2010, UNDP-IBLF–ICC World Business Award in 2005, amongst others. In 2022, Vineet was invited by the Hon’ble PM Shri Narendra Modi for his “Roundtable interaction with Venture Capital and Private Equity Funds”. He serves as Commissioner at the BCSD, as Senior Advisor to Blended Finance Working Group at OECD and as an Advisor to United Nations Economic and Social Commission for Asia and the Pacific Science Technology and Innovation Advisory Board. |

|

Anurag Agarwal – Partner More Info

Specialties: Impact Investing, Investment Banking, Consulting, Research, Financial Inclusion, Angel Investing, Social Enterprise Eco-System |

|

Tarun Mehta – Partner, Funds & Strategy More Info

Seasoned investment and fundraising professional with extensive experience in all aspects of early and growth stage private market investing across India, South East Asia and Middle East. Specific interests in Impact, Climate, ESG and Sustainability sectors. Investment Committee member and Board Director. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

At Aavishkaar Capital, impact analysis is a key prerequisite at each stage of the investment cycle and Impact Screening (Positive and Negative) is taken up at the very start of the investment process during deal sourcing, even before the commercial assessment. The Four Key steps in the investment process would start with Impact screening, then Impact Benchmarking, Impact Forecasting (Impact KPIs) and Impact Reporting. Each of these steps are linked to the investment process, due diligence, IC evaluation and reporting. All target companies are screened against Aavishkaar Capital’s impact themes, which includes Job and livelihood creation, Enhancement for the society and/or Risk and Vulnerability reduction. Contextual significance of the business would be additional aspects to strengthen the case for Impact. This would include business’s inherent ability to address the gap of geographic accessibility (rural or remote areas), demographic inclusion (gender, disability or other vulnerabilities) or affordability of an essential service.

Aavishkaar Capital strongly believes that good Environmental Social and Governance (ESG) practices are vital to creating stronger, more sustainable, and value accretive businesses. Aavishkaar’s core mandate is to identify potential investee companies that offer products/services which are resource-efficient or are offering improved ways of mitigating climate risk or produce carbon offset. Being “Responsible”, is, therefore, a fundamental value driver that is included alongside financial, commercial, and strategic impact considerations. As a part of the due diligence process, an in-depth and comprehensive ESG assessment is undertaken including identification of current and potential risks. These are discussed with the investee companies and suitable procedures/processes are identified which would help mitigate these risks as well as monitor and tract them. The output of the assessment forms a company-specific Corrective Action Plan (“CAP”) to address shortfalls in the business, which are monitored throughout our investment period.

Impact Tracking and Monitoring

Learn More

13B, 6th Floor, Techniplex II, IT Park, Off Veer Sarvarkar Fly Over, Goregaon West, Mumbai - 400 062, India

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.