IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Vital Capital

Food Systems and Agriculture

Food Systems and Agriculture Health and Wellbeing

Health and Wellbeing Water and Sanitation

Water and SanitationFirm Overview

Vital Capital is a high-performing investor in growth markets. We leverage our deep operational expertise to identify overlooked opportunities, building successful, scalable businesses that transform lives. We turn critical challenges associated with the provision of water, food, healthcare, and sustainable infrastructure into high-return opportunities that deliver impact at scale.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 100%

To use the power of successful, scalable businesses, to solve critical social and environmental challenges faced in growth markets.

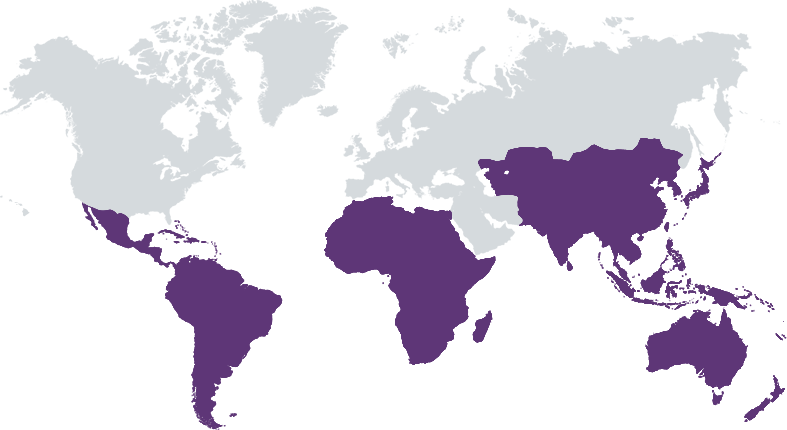

Since inception in 2011, Vital Capital’s investment strategy has been guided by the conviction that creating positive, sustainable impact can go hand-in-hand with delivering market-rate, risk-adjusted returns for our investors. Central to Vital Capital’s approach is how we leverage our deep operational expertise to build innovative businesses from the ground up and rebuild strong, scalable businesses that solve fundamental societal challenges. Vital Capital has taken a thematic approach addressing four critical challenges: Food, Water, Healthcare, and Sustainable infrastructure. With a focus in sub-Saharan Africa, our impact approach is rooted in the belief that increasing the availability and affordability of essentials is expected to drive transformative impact in critical social and environmental challenges.

In selecting and managing its investments, Vital draws on the extensive experience, operational strength, SSA insight and deep local relationships of its management team. Vital considers investing in ventures and business in all life-stages and has a unique risk appetite, thereby creating a relatively unique financing source. Start-up/greenfield risks are frequently viewed as acceptable as we strongly believe our team’s extensive prior experience in similar situations allows us to mitigate such risks adequately. This makes Vital less likely to compete on over-subscribed investment opportunities. Those elements allow Vital to have a unique contribution as an investor by: • Differentiated, impact-focused origination and due diligence processes • Flexible capital structuring that can meet the situational needs of companies • Strategic building, enhancement and turnaround of companies’ operations and impact through veteran experience, deep operational expertise and networks • Identifying key market gaps and developing overlooked greenfield opportunities • Signal that impact matters and transforms lives

Investment Example

Kora Housing, Vital’s largest investment, develops integrated affordable housing communites which provide a wide-range of facilities to enable a high quality of life. Kora was contracted to build 45,000 affordable housing units in 16 sites throughout 9 provinces in Angola. Each site is an integrated, affordable community for the Angolan middle-class. Kora’s communities provide a full range of amenities including 100sqm, 3 bedroom, 2 bath housing units, alongside a sustainable urban layout with social, cultural, educational, retail and recreational facilities. By situating the communities in different regions around the country, Kora is contributing to much-needed development of far-flung rural areas. Kora earned a Platinum GIIRS rating in 2018, based also on the impact delivered, including affordable housing solutions for over 240,000 Angolans, spending over US$500 million locally, building 51 educational facilities and employing more than 5,000 people. In 2019, Vital exited from this investment, yielding over 20% IRR.

Leadership and Team

|

Eytan Stibbe – Founding Partner More Info

Mr. Stibbe is a successful entrepreneur who has been actively investing and building businesses in Africa for the past 30 years, and a driving force behind the Impact model for investment in developing markets. His vision and leadership have led to the initiation, implementation and successful completion of large-scale projects throughout Africa, each of which has aimed to achieve tangible humanitarian objectives and financial and business returns. His professional endeavors have spanned a wide range of sectors, including the construction of rural and urban communities, agriculture and agro-industrial projects, the creation of aviation and air-traffic control systems, large-scale educational ventures, healthcare, technology, clean-energy and water-related businesses. As a result, Mr. Stibbe’s successes have resulted in real and marked improvements in the quality of life for large populations. |

|

Nimrod Gerber – Managing Partner More Info

Mr. Gerber is the Managing Partner of Vital Capital Fund and a member of its investment committee. He has 15 years of experience in implementing large-scale partnerships and projects in sub-Saharan Africa. Mr. Gerber is engaged in impact and development finance, business management and advisory for investors and funds with developmental impact goals. His focus is on projects that create economic growth and have a direct positive impact on urban and rural communities such as infrastructure, housing, agro-industry, agriculture, and manufacturing SME’s. Mr. Gerber is experienced in government and in private sector engagements, covering a variety of business models, investment strategies, and financial structures. |

|

Prof. Jimmy Weinblatt – Investment Committee Member More Info

Professor Weinblatt is one of Israel’s most respected economists. After receiving his B.A., M.A. and Ph.D. degrees in Economics from the Hebrew University of Jerusalem, he began a four-decade career at the Ben Gurion University of the Negev which culminated in his appointment as Rector of the University from 2002-2010. After retiring from Ben Gurion University, Professor Weinblatt served as President of Sapir Academic College until 2014. Professor Weinblatt’s research has covered a broad range of topics, including theoretical and empirical studies in the areas International Economics, Macroeconomics, Economics of Crime, Development Economics, Economics of Social Issues, and the Economies of Israel and Palestine. He has published several books and more than fifty articles on these topics. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact is integral to what we do, from deciding where to invest to helping us refine our approach to future investments. By using our unique dual gatekeeper model, we weigh financial and impact considerations when underwriting and managing investments. Only those transactions that have the highest potential for both are pursued. Translating our approach into practice, we have established a 4-gate investment process that integrates impact considerations at every stage. Industry-standard benchmarks as well as proprietary tools help us to evaluate each investment in terms of its potential and actual, short- and long-term impact. Amongst its tools, Vital developed a unique, four-dimensional assessment tool, the Vital Impact Diamond, which helps us evaluate investments’ adherence to our impact objectives and assess their potential impact.

Vital’s ESG policies are comprehensive, guided by international standards and implemented throughout the investment cycle. Vital's adopted the IFC's sustainability framework and EHS guidelines and implemented an extensive investment process to categorize, assess, screen and improve investees’ ESG performance. Vital follows a due diligence procedure to assess potential investees' adherence to applicable standards including a review of the investee’s social and environmental management systems, practices across Labor and Working Conditions, Pollution Prevention, Community Health, Safety and Security, Land Acquisition and Involuntary Resettlement, Biodiversity Conservation and Sustainable Natural Resource Management, Indigenous Peoples and Cultural Heritage. The process is covered by formal ESG appraisal and supervision procedure and a designated tool to track status and progress. We are a signatory to the International Finance Corporation-led Operating Principles for Impact Management and published our first annual public disclosure statement this year.

Impact Tracking and Monitoring

Learn More

Nicolaou Laniti 7A, Larnaca 6022, Cyprus

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.