IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Goodwell Investments BV

Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial Services Transportation

TransportationFirm Overview

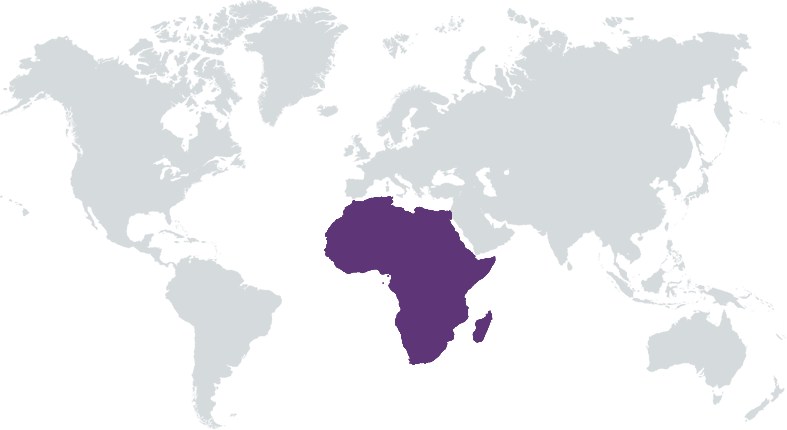

Goodwell Investments is an impact investing firm focused on inclusive growth in emerging markets. Our vision is a world where basic goods and services are accessible to everyone, what we call an inclusive world that leaves no one behind. We invest in early-stage businesses which provide basic goods & services in sectors where low-income households spend most of their income, with a dual mission of financial returns and social impact. This includes sectors like Financial Inclusion, Agribusiness, Logistics, transport, mobility, education, healthcare and other high impact sectors. Since 2006, Goodwell has raised five funds, with investments across India and Africa. In over seventeen years investment experience, we have demonstrated the ability to simultaneously deliver strong financial returns and significant social impact. We achieve this through collaboration with our local teams in East Africa, Southern Africa & West Africa.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Our investments support entrepreneurs and businesses that increase access to basic goods and services, and income generation opportunities for the un(der)served. In doing so, we contribute to the UN Sustainable Development Goals, more specifically, to the inclusive economy in emerging markets, while earning market-rate financial returns for our investors.

Goodwell Investments' current fund (uMunthu II) is investing in inclusive growth through smart equity to scalable companies in their early growth stages, as well as hands-on support with regional teams. We have an ecosystem approach, investing across multiple sectors namely: 35% financial inclusion (including fintech), 25% food and agriculture,15% in mobility/logistics and the remaining 25% in other impact sectors such as health, education and energy. Geography: (currently) Africa, diversified across regions. Stage: invest in relatively early stages, capable of doing relatively small (initial) investments, providing hands-on support through regional teams; typically the first institutional investor, providing a long runway and attracting new (co-)investors in follow-on rounds. Role of technology: Innovation-driven but not a tech fund; support brick-and-mortar businesses to become more efficient and grow faster, invest in tech businesses that apply proven technology solutions to bridge market gaps for underserved segments.

Experience and track record as an early-stage private equity investor in inclusive economies in developing markets. Our track record has been strong and consistent across all funds under management. Diversification and traction: Our fourth fund (uMunthu I fund) invested in a diversified portfolio of 20 companies across different impact sectors and regions in Sub-Saharan Africa. Local presence, local teams: with a presence at four locations, Goodwell Investments has a strong, proprietary pipeline and closely monitors its investees while offering them hands-on support. Providing investees with a long runway, typically entering as the first institutional investor, guiding investees through growing pains, while attracting co-investors (that typically focus on later stage/larger investment sizes) thus growing the investee's investor base. Independent owner-managed investment firm.

Investment Example

Omiretail Technologies is a retail tech company that provides small and medium-sized enterprises (SMEs) in Sub-Saharan Africa with affordable digital tools to enhance their inventory management, customer engagement, and payment processing. By offering a cloud-based platform, Omiretail enables local businesses to transition from manual operations to efficient digital systems, helping them grow and scale. The company partners with community-based vendors and retail outlets, many of which are owned by women, to modernize their retail operations. This improves their operational efficiency and helps them compete with larger retail chains, ultimately increasing profitability. The retail sector in emerging markets has vast potential for boosting economic growth and creating sustainable jobs, particularly for underserved populations.

Leadership and Team

|

Wim van der Beek – Founder and Managing Partner More Info

Wim van der Beek is the founder and managing partner of Goodwell Investments. Within Goodwell he manages Aavishkaar Goodwell India Microfinance Development Company I and II. Wim also serves on the Board of AGIMDC II and the Board and Investment Committee of GWAMDC. In 2004 he decided to “walk his talk” and founded GIBV as an investment firm focused on high impact investment solutions. He has conducted in-depth research into the field of microfinance and social investments to lay the foundations for this impact investment firm. |

|

Els Boerhof – Managing Partner More Info

ls Boerhof is an investment professional with over 21 years of experience in development finance and cross border investments. Her time at Goodwell began in March 2008, when she joined as a partner and co-owner. She has since led the consolidation of the rm’s investment infrastructure and the launch of Goodwell’s Africa-focused funds. Within the firm, she is the lead for the Financial Inclusion sector. Under Els' guidance Goodwell’s Social Performance Management System is continuously being developed. Additionally, she sits on the boards of portfolio companies Women’s World Banking Ghana and Musoni Systems and also represents the Asian Development Bank on the board of Credit Access Asia Holding. |

|

Nico Blaauw – Partner More Info

Nico Blaauw is the Director of Investor Relations, Marketing, Communications and Communities at Goodwell Investments. Nico joined the Goodwell team in 2014 as Director of Marketing. His role is to intensify marketing and communications activities in line with Goodwell’s ambition to grow its investment portfolio in inclusive economy significantly over the next years. Prior to joining the Goodwell team, Nico worked as Director of Communications for various international companies in financial services and retail FMCG. Nico founded and led a management consultancy focused on increasing impact by moving towards more credible sustainable strategy rooted in relevant purpose and solid economics. In addition, he acts as a chairman for the Global Breath Foundation. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

At the core of our investment strategy is a commitment to expanding access to affordable, high-quality goods and services for underserved communities. The companies we invest in not only drive impact through their business models but also address critical social challenges. We follow a robust ESG and impact framework, integrating social impact at every stage—from screening and due diligence to post-investment growth. Instead of a "bolt-on" approach, we embed impact into the core of each investment, ensuring active engagement with stakeholders throughout the process. Post-investment, we closely track impact KPIs, focusing on ESG metrics that align with our mission. Additionally, we maintain a clear exit policy to ensure that the positive impact and sustainability achieved during our investment continue long after we exit, preserving business continuity and long-term value.

As a firm, we don’t adopt an "impact-first" mindset; instead, impact is embedded in everything we do. Our impact-focused mandate filters out potential investments that do not serve or support underserved communities. This process begins with screening opportunities against the fund's Exclusion List and evaluating the ESG risk rating. If an opportunity meets these criteria, it moves to the next stage of our investment process: Deal Screening. Upon approval, we conduct a more in-depth due diligence, where the investment manager completes a sector-specific checklist aligned with IFC best practices. This due diligence process informs the development of both the value creation strategy and the ESG action plan. While each deal team is responsible for crafting the ESG sections and action plan, our ESG lead provides oversight and guidance throughout the process.

Impact Tracking and Monitoring

Learn More

Herengracht 201, 1016 Amsterdam, The Netherlands

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.