IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Social Investment Managers

and Advisors, LLC

Climate Change

Climate Change Community Development

Community Development Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

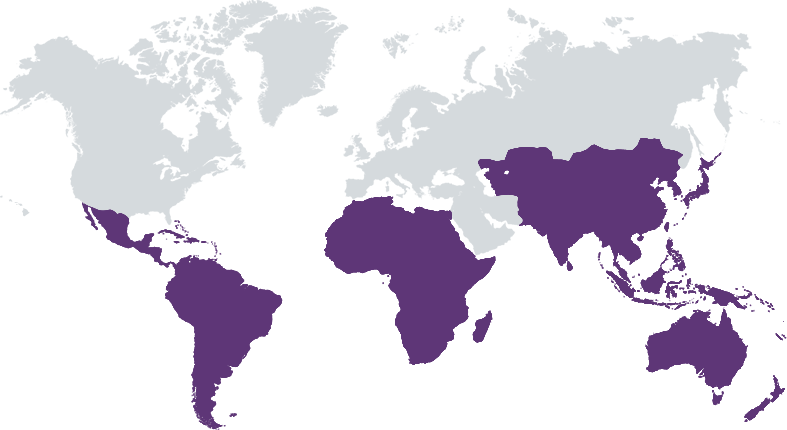

SIMA was founded in 2016 as a new generation impact investment manager with long-standing impact investment expertise in companies serving customers at the bottom of the pyramid. SIMA manages 3 Funds with AUM of USD 180 Million in 50 companies and 20 countries. These impact investments are in financial inclusion, affordable housing, education and off-grid solar. Our investors include development finance institutions, faith-based pensions, banks, insurance companies, commercial investors, family offices, foundations and HNW individuals. SIMA’s international and local presence includes 29 employees in the US, Kenya, Uganda, Pakistan, India and Mexico. SIMA leads by example and demonstrates internal and external transparency; we are employee-owned and our Managing Partners contribute 10% of profits to social enterprises. As field-builders, SIMA first developed codes of conduct – which later became industrywide – for microfinance and off-grid solar.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

We invest funds from commercial, development institutions and social impact investors to improve the lives of customers at the Bottom of the pyramid by providing flexible, demand-driven financing to scale social businesses with good track-records, customer service and products to improve livelihoods and produce exemplary financial, social, and environmental impact.

Our Funds illustrate our thesis. Lack of access to clean energy and financial exclusion at the Bottom of Pyramid forces low-income households to burn unhealthy and environmentally damaging fossil-fuels. SIMA Fund I provides early-stage growth debt financing to innovative off-grid solar and financial inclusion companies which make high-quality off-grid solar products affordable for Bottom of Pyramid customers by enabling them to pay in installments over time. Financing trends skew toward internationally owned companies. Instead, the SIMA DFF fund targets financing to local companies to enable them to make off-grid solar products affordable for Bottom of Pyramid customers and improve livelihoods and reduce emissions. Energy Access Relief Fund seeks to sustain off-grid energy companies in Africa and Asia against economic impacts of COVID-19. Subsidized loans from the EARF will prevent worker lay-offs and shutting off customers who are temporarily unable to pay, thus improving livelihoods and reducing emissions.

SIMA maintains deep relationships with social businesses globally. We attract private sector commercial investors to impact investing and also structure public/private ‘blended finance’ funds and offer local currency loans. We innovatively developed a code of conduct for off-grid solar and microfinance. SIMA pragmatically aligns and makes legal covenants with borrowers on social and business and monitors, evaluates and reports on progress toward social goals. SIMA is more than an investor and works collaboratively to build industry best practices and standards especially in early-stage industries. We gathered CEOs of leading off-grid solar companies to produce the first draft of the code of conduct which has now evolved into GOGLA Code of Conduct. Ability to structure innovatively to grow the sector such as using tripartite financing for small distributors, FX risk mitigation and results based and milestone-based financing.

Investment Example

Redavia GmbH provides reliable, cost-effective and clean solar power for businesses, universities, hospitals, and communities in Sub-Saharan Africa. Its solar farms serve customers in agrofoods processing, manufacturing, healthcare, education, pharmaceuticals, housing, mining, hospitality, and other sectors. Redavia’s business model uses high-performance solar PV modules and components which are easy to ship, set up and scale for both on- and off-grid customers. Once the solar farm is installed, Redavia’s trained, local specialists manage the installation, operations and maintenance.Despite constraints due to COVID, SIMA’s team completed diligence and made a working capital facility to Redavia for funding 6 solar farms for SME clients. Since SIMA’s funding, Redavia’s topline has increased by over 200% and as of June 2021 Redavia serves 34 customers with 86 solar units with total 6.7 MWp capacity. Over time, Redavia’s solar farms will reduce tons of CO2 emissions and support thousands of jobs in the SME sector.

Leadership and Team

|

Asad Mahmood – CEO & Managing Partner More Info

Asad holds a Bachelor’s Degree in Civil Engineering from Rutger’s University, New Brunswick and an MBA in International Finance from Temple University. One of the longest serving investors and fund managers in the impact investing industry. Formerly the Managing Director for Global Social Investment Funds for 17 years at Deutsche Bank. |

|

Michael Rauenhorst – Managing Partner More Info

Michael graduated from Columbia Business School with Master in Business Administration. Michael has developed social investment enterprises for large corporations and specialized private investment firms. He is a co-founder of Micro Credit Limited, Jamaica and served as Analyst for Moody’s Social Performance Assessment. |

|

Amitesh Sinha – Partner More Info

Amitesh is recognized among the top 20 CFOs (2018) in India for continued commitment to excellence in developing best practices and innovative strategies. Amitesh is ACA, ACS and CPA (Maine, USA) with with over 15+ years of global cross-functional experience. Amitesh has proven track record in leading finance areas such as financial planning and analysis, investor relations, fund-raising, controllership, corporate finance, budgeting, business valuations, supply chain and risk advisory. Globally accepted education qualification with ACA, ACS and CPA (Maine, USA). He was most recently Head of Finance for LinkedIn India and Global CFO and operations head for one of the largest off-grid solar company prior to that. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

SIMA’s funds are mandated to invest only in sectors that engender significant social impact such as financial inclusion, off-grid solar, clean cooking, affordable housing and commercial and industrial solar sector. Companies in these sectors are focused on increasing access to energy or financial services in some of the poorest countries of the world. As such, social and/or environmental impact is integral to the product or service of our portfolio companies. However, SIMA Funds has added additional checks to ensure there is no material environment, social or governance (ESG) risks in the operations of its investee companies. These checks include analyzing and presenting these risks at screening stage as well as to SIMA’s investment committee, creating a bespoke social scorecard for each sector to track and monitor corporate practices, filling an on-site ESG validation checklist, instating social covenants in the legal agreement and monitoring these through term of the loan.

SIMA’s investment process is guided by a comprehensive Environmental and Social Management System (ESMS) Policy. According to this policy, SIMA’s investment team is required to ensure that there are no material environmentally unsustainable practices during on-site due diligence and annual trips. All loan agreements with SIMA’s investee companies require an adherence ESG compliance and to IFC’s exclusion list (https://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/sustainability-at- ifc/company-resources/ifcexclusionlist). Furthermore, on its most recent fund SIMA has partnered with Power Africa to integrate gender lens in investment process and reporting practices. This will also ensure that SIMA lends to companies that are gender diverse.

Impact Tracking and Monitoring

Learn More

157 Columbus Ave, Suite 512, New York City, NY 10023, USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.