IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Pymwymic Investment

Management B.V.

Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

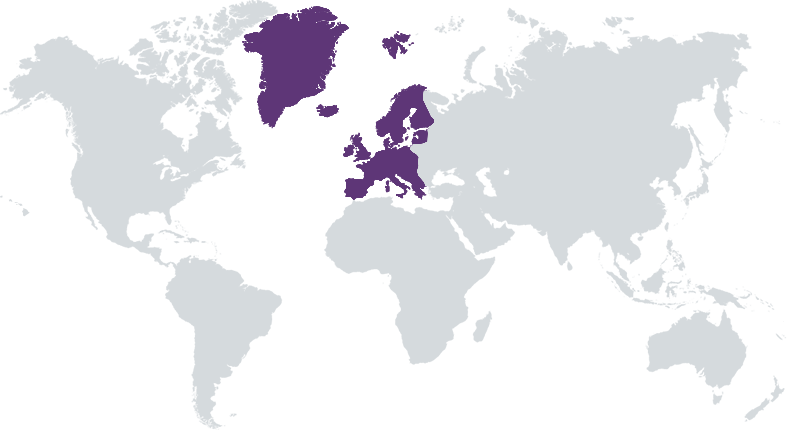

Pymwymic is a co-owned impact fund leveraging a peer-to-peer network and exchange of knowledge and expertise. With over 25 years of experience in impact investing, we are a frontrunner investment cooperative of private investors who seek to make smart investments that serve people and planet. As an investor you become a co-owner of the Pymwymic Impact Investing Cooperative, joining an active peer network of over 180 impact investors. The Coop invests in impact-driven enterprises through SDG themed sub-funds.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: Less than 25%

We invest through the Healthy Food Systems Impact Fund II. Investing in the food system is a high-growth market opportunity, driven by an increasing number of consumers demanding healthy and environmentally friendly products, and also by growing political push. A wave of transformation is taking place to improve the sector.

We invest in innovative and scalable impact companies that support the transition of the food system while providing an attractive financial return. The aim of this fund is to ensure sufficient healthy food for everyone with care for the environment and people’s wellbeing. We take minority stakes in companies acting across the food supply chain: production, storage, processing, retail and consumption. Together with Wageningen University and Research, a formal partner of the Healthy Food Systems Impact Fund II, Pymwymic has developed its investment thesis and impact strategy. The transformative technologies we invest in, will result in concrete improvements of the food system across one or more of the following areas: (i) food security for a growing population, (ii) a nature-positive food system, (iii) safe and healthy diets and (iv) fair socio-economics for farmers.

Founded in 1994, Pymwymic has played a pioneering role in the global impact investing industry for more than two decades. Four key elements that set us apart: (i) experience with building early to growth-stage companies in the food and ag-tech sectors, (ii) strong network of knowledge, deal partners and a formal partnership with world-renowned Wageningen University & Research, (iii) a robust pipeline of investment opportunities, building on over 25 years of brand, network and track record (>1,500 investments screened since the launch of the first fund in 2017) and (iv) a recognized impact guardian. Pymwymic has been invited to deals by both founders and co-investors to specifically play a role in supporting the realization of concrete impact results. To safeguard impact, the Manager plays an active role in embedding impact into the governance of a company, developing an impact strategy, measuring and managing impact key performance indicators.

Investment Example

The advancement of existing connectivity technologies (e.g. LPWAN, Wi-Fi6, High-band 5G, etc.) is expected to radically transform many aspects of our food systems in the decade to come. A variety of innovations that can be observed includes both low-cost and higher-cost solutions: from better crop inputs, new regenerative methods, low-cost IoT, to distributed ledger platforms like blockchain. According to the World Economic Forum, technology innovations, combined with other interventions can play an important role in enabling and accelerating food system transformation. Potential investments include new ways to improve sustainable and local farming, digital platforms supporting a more efficient and shorter supply chain or data-driven production methods ensuring a better soil quality. All investments focus on disruptive, innovative and technology-based business models.

Leadership and Team

|

Rogier Pieterse – Managing Director More Info

As a former entrepreneur and being passionate about bringing change, Rogier is leading PYMWYMIC since 2016. He is excited about those who aim to do good and the catalytic role of impact investing – aiming to keep pushing for improved standards in the way we all invest. Rogier has an investment background with extensive experience in evaluating, negotiating, structuring deals and creating value by scaling and initiating successful businesses. |

|

Pieter Vis – Investment Manager More Info

Pieter loves working in a high pace environment with care for people and planet. He has been working in finance and private equity for many years. Through his experience in building businesses in the renewable energy sector, combined with his technical and strong social skills, he understands the daily challenges of entrepreneurs. Pieter holds a Master of Science degree in Civil Engineering & Geoscience from Delft University of Technology and Master in European Business from ESCP Europe. |

|

Monique Meulemans – Investment Manager More Info

Born and raised in New Zealand, Monique has an inherent passion for nature and outdoors. She is a firm believer that business is a force for good and should act in service of people and planet. Monique has over ten years of experience in strategy consulting and corporate finance. Within Pymwymic she is responsible for investments as well as designing, developing and implementing new standards for impact investing. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact must be at the core of the target company. The product or service provided must be impactful in itself. The Theory of Change, impact KPIs, and impact targets must be directly aligned with the commercial activities of the company. We make a comprehensive analysis of impact, focusing not only on the positive impact but also on the negative impact + unintended consequences. We work together with the entrepreneurs to identify first targets and mitigation strategies to address the negative impact / unintended consequences. There is a progressive plan to increase not only the impact targets but also to decrease the negative impact.

Impact (at the core) comprehends the commercial activities of a company and also how the company performs these activities considering its stakeholders. Therefore it must consider employees, customers, environment, and any other stakeholder influenced. As we invest in companies that are about to scale up, we can bring the business experience of the team to put in place healthy and human policies that also influence the outcome of our companies. In the end, people are the most important asset that any company has. The team is the one delivering whatever business plan is on paper, therefore must be respected and considered with priority.

Impact Tracking and Monitoring

Learn More

Mauritskade 64, 1092 AD Amsterdam, the Netherlands

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.