IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Deetken Asset Management Inc.

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Gender Equality

Gender EqualityFirm Overview

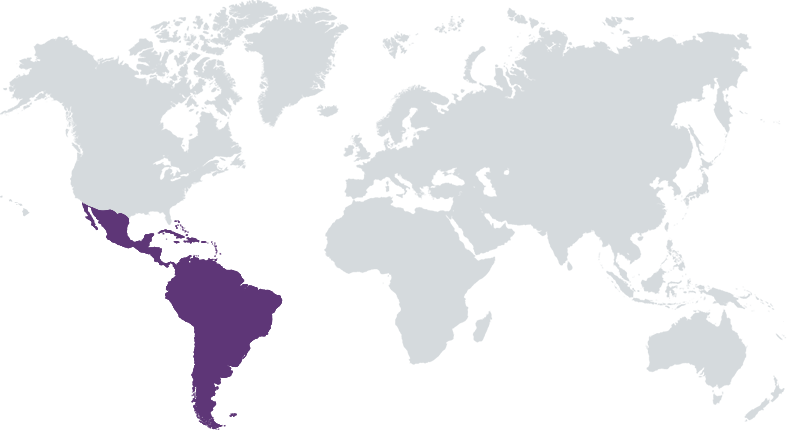

Deetken Impact is a registered investment fund manager based in Vancouver, Canada, with decades of experience delivering strong, stable returns to investors by supporting businesses that make a meaningful contribution to the Sustainable Development Goals. Managing US$145 MM in assets across Latin America and the Caribbean, including the Ilu Women's Empowerment Fund—a joint venture with Pro Mujer—Deetken Impact is committed to generating positive social and environmental outcomes. With a multicultural, gender-balanced team that lives and works in many of the countries in which we invest, Deetken Impact provides not only capital but also technical assistance to help companies enhance their business models and gender practices.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Deetken Impact is committed to generating positive social and environmental impacts through its investments. We invest in businesses that promote entrepreneurship, improve access to basic services, advance gender equality and climate change mitigation and adaption. We seek out untapped opportunities that positively impact communities in Latin America and the Caribbean.

Deetken Impact uncovers opportunities to earn attractive financial returns while helping to build a more sustainable and just world. To achieve this, we build strong, lasting relationships with investors and the companies and communities in which we invest. Deetken Impact invests in Latin America to generate long-term returns while helping communities to grow and prosper. We focus on three investment strategies: Alternative Finance, Women’s Empowerment and Sustainable Energy. Through our deployment of capital, we seek to influence the growth of businesses that generate positive social and/or environmental impact and gender equity across various sectors including renewable energy infrastructure, clean tech, financial inclusion, education, sustainable production and consumption, and healthcare, among others. We provide customized and flexible financing instruments tailored to each company's needs and growth profile. Additionally, we augment our financial support with tailored technical assistance to improve the impact outcomes of our investees.

We offer a comprehensive array of financing solutions for Latin American and Caribbean impact businesses. We strive to be pioneers in the region, leading the charge for gender equality by implementing strong gender-lens investing practices across our portfolio. Our on-the-ground presence and strategic partnerships in the region have allowed us to expand our regional presence while maintaining strong local networks. We believe in the importance of tailored and flexible financial instruments to support impact businesses and scale impact investing in the region. Our diverse team of dedicated impact investment professionals shares a deep commitment to delivering exceptional long-term financial returns while contributing to a more sustainable and just world. Additionally, we customize our instruments to meet our clients' needs and payment capabilities, and provide hands-on support to enhance business and gender-smart practices through our in-house-managed technical assistance programs.

Investment Example

Deetken Impact first invested in Puntored, a Colombian fintech, in 2020 to expand financial inclusion in remote and underserved areas across Colombia. Puntored connects over 70,000 merchants, including small businesses and microentrepreneurs, to digital financial services through a mobile phone app, enabling access to banking, payment solutions, internet services, and government financial aid across 938 municipalities. Many of these regions face significant barriers due to geographic isolation and infrastructure challenges and wouldn’t have access to traditional banking otherwise. Puntored delivered robust financial returns, achieving a 27.3% IRR in local currency and a 1.5x multiple on invested capital for the first tranche, which has already been exited. Recognizing Puntored’s strong financial performance and its support for farmers, rural communities, and small business owners, Deetken reinvested in the company in 2022 and 2024. In recognition of this transformative investment, Deetken was awarded the Deal of the Year at the 2024 LAVCA Awards.

Leadership and Team

|

Alexa Blain – Managing Partner More Info

Alexa is responsible for finance, operations and investor relations at Deetken Impact. She brings over 10 years of experience in financial consulting and asset management, with specific expertise in company and investment analysis, business valuation and securities/corporate finance. Prior to joining Deetken, she spent three years with African Alliance, a pan-African financial services group, where she focused on expanding the firm’s retail financial services operations as well as on the origination and negotiation of new capital. In addition, Alexa has six years of asset management experience with the Canada Pension Plan Investment Board, the Macquarie Group and the Ontario Teachers’ Pension Plan. |

|

Erik Wallsten – Managing Partner More Info

Erik was the Founder and Managing Partner of Adobe Capital, one of Latin America’s leading impact investment fund managers and now part of Vancouver-based Deetken Impact. Over the last decade, he has played a catalytic role in the growth of the impact investing sector in Latin America. Before launching Adobe Capital, he worked at various private equity and venture capital funds in Mexico. Erik received an MBA from The University of Chicago Booth School of Business and holds a Bachelor of Science degree in Industrial Engineering with Honors from Universidad Iberoamericana. |

|

Magali Lamyin – Managing Partner More Info

Magali is Managing Partner of Deetken Impact and oversees the impact management and communications strategy at Deetken Impact. She also leads business development efforts for current funds under management and co-leads the strategic development of new funds. She has actively participated in the company’s investment decisions for the past ten years and currently leads the pipeline development for various segments and countries. She is a member of the investment committees of three of Deetken Impact’s five investment funds where among business and financial considerations, she ensures the integration of social, environmental and gender considerations in the investment decision process. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We invest in companies that achieve measurable social, environmental, and gender impact in alignment with the SDGs. As gender lens investors, we support gender equity across business activities and implement investment management practices that empower women. To achieve these goals, we implement an impact management process that integrates climate finance, gender, social, and environmental considerations at every step of the investment process. On one hand, the integration of social and environmental impact to the company's core product/service and/or operations is assessed through a scoring methodology driving on Impact Frontier's five dimensions of impact. On the other hand, we implement a Gender Scorecard aligned with 2X to assess, monitor, and advance companies’ gender business practices across five gender lenses: inclusive leadership and governance; workplace equity; gender-smart products, services and marketing; value chain equity and advocacy; and community engagement. These practices ensure that target companies generate measurable impact and promote gender equity.

Deetken Impact benefits from a best-in-class Environmental and Social Management System (ESMS) aligned with the IFC Performance Standards and the British International Investment guidelines. As such, environmental and social risks and negative impacts are thoroughly assessed, mitigated, and managed through Deetken Impact's investment decision-making process, including both the external impact generated and the internal adoption of social and environmental sustainability practices. During the due diligence process, we conduct comprehensive, sector-specific assessments to evaluate risks and impacts, encompassing areas such as labour practices, occupational health and safety, gender-based violence and harassment, human rights, biodiversity, resource use, pollution, climate change risks, grievance & whistleblowing mechanisms, ethics, and more. Moreover, when areas of opportunity are detected, we create corresponding action plans to be monitored throughout the investment holding period to support the companies in the process of improving their internal practices..

Impact Tracking and Monitoring

Learn More

500 - 210 Broadway St. W, Vancouver, BC, V5Y 3W2, Canada

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.