IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

True North

Impact Investments, Inc.

Climate Change

Climate Change Health and Wellbeing

Health and WellbeingFirm Overview

Founded in 2018, True North Impact Investments (“True North”) is a Toronto-based, globally minded impact investing firm that focuses on early and growth-stage companies seeking to have a positive impact on society and the planet. With over 50 years of experience as both investors and entrepreneurs, the leadership team at True North is well-positioned to identify the best impact investments and partner with management teams to achieve strong financial results and lasting impact.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 50% – 99%

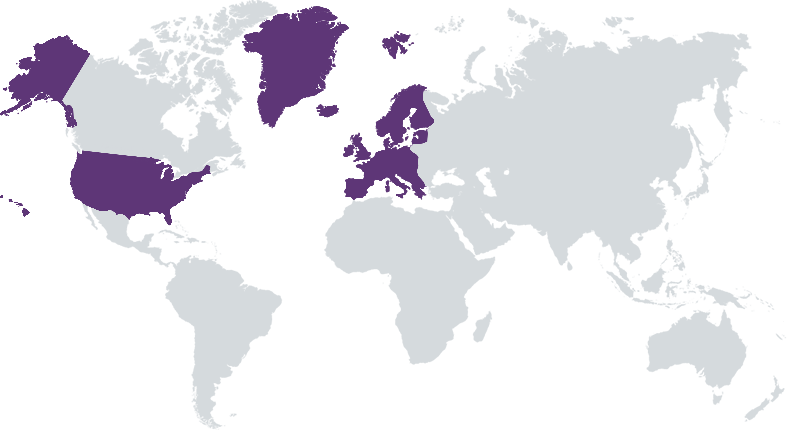

True North is launching a $30M Digital Health and Wellness Fund to invest in early-stage health and wellness ventures across North America and Europe that have impact integrated into their core businesses.

True North is launching a $30M Digital Health and Wellness Fund to invest in early-stage health and wellness ventures across North America and Europe that have impact integrated into their core businesses. Our Digital Health & Wellness fund invests in three key verticals: 1) Aging Populations, 2) Women’s Health, and 3) Behavioral Health In line with our impact investment principles, these verticals also address United Nations Sustainable Development Goals #3 (good health and well-being), #5 (gender equality), and #10 (reduced inequalities).

With extensive Healthcare sector experience and previous health investments, True North is well positioned to identify the best opportunities to achieve strong financial results and generate lasting impact Our strategic advisory team has a value-added approach to impact investing that centers on working with founders to build great companies, maximizing financial potential and scaling social and environmental impact through utilizing our proprietary impact assessment model to enable strong growth and venture performance across our three key investment verticals.

Investment Example

In 2020, True North made an investment in Callaly, a period-care innovator and B-corp based in the UK, as part of our women's health vertical. Callaly set out to improve the $34bn period care industry with the launch of the Tampliner, a completely new period care product and first design upgrade to the tampon in 90 years. It is a 2-in-1 period product that combines an organic cotton tampon with a soft mini-liner for extra protection against leaks, connected by a ‘virtual applicator’. The Tampliner, which is designed and manufactured in the UK and was launched in February 2020, was invented by Dr Alex Hooi, a senior British gynaecologist and Fellow of the Royal College of Obstetricians and Gynaecologists and developed by garment technologist Ewa Radziwon, who trained at London College of Fashion.

Leadership and Team

|

Diana Adachi – Partner and Senior VP More Info

As a Blockchain expert and experienced executive, Diana has worked with both innovative emerging companies and the largest corporations in the world applying her passion while also supporting under-served markets. |

|

Frank O’Dea, O.C. – Partner and Chairman More Info

Frank O’Dea, OC, is the Chair of the Advisory Board, a career entrepreneur, philanthropist, and author of the best selling biography, When All You Have is Hope. |

|

Kai Chen – Partner and Fund Manager More Info

Consultant and Venture Capital professional passionate about building and empowering teams. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact has to be an intrinsic component of the company's business model. E.g., we invested in Callaly, a UK-based femcare provider holding patents on the Tampliner, a safer and more sustainable alternative to traditional period products, known to be wasteful on the environment and potentially harmful to women's health.

We have a multi-tiered approach to assessing impact in the onboarding and due diligence stage. It is composed of three separate assessments, where we evaluate: 1) Completeness of Vision, 2) Ability to Execute, 3) Impact created per dollar invested (impact ROI)

Impact Tracking and Monitoring

Learn More

42 Rosenfeld Crescent, Ottawa, Ontario K2K2L2, Canada

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.