IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Seedstars Capital

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Financial and Economic Inclusion

Financial and Economic Inclusion Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

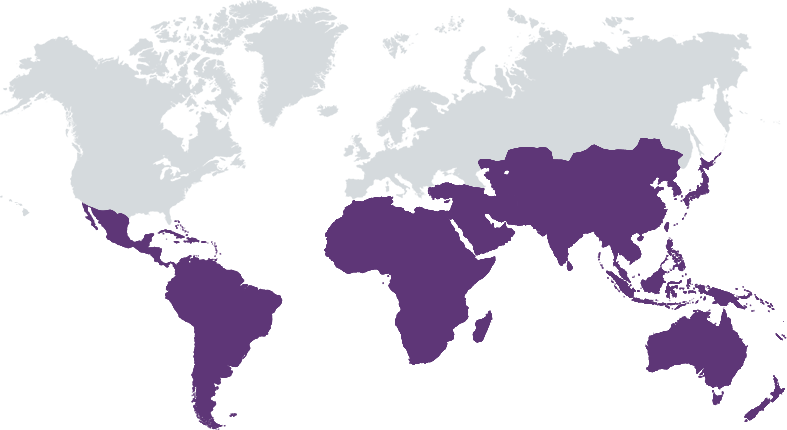

Seedstars group was founded in late 2012 with a mission to have an impact in emerging markets through technology and entrepreneurship. The group has supported early stage entrepreneurs from over 90 countries and worked with leading organizations (eg. Gates Foundation, IFC, Grameen, Orange, Microsoft etc) to implement their impact and development strategies. In 2017, Seedstars formalized its investment activity with the creation of Seedstars International Ventures I, an industry agnostic VC investing in seed stage tech companies across emerging and frontier markets that can deliver top-tier venture capital returns combined with measurable social and economic impact. Fund I portfolio consists of 80 startups from 32 countries. By the end of 2021, Seedstars international Ventures II will have its first close, led by an international DFI and a leading impact investment group.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 50% – 99%

We are an impact VC firm investing in seed stage tech companies across emerging and frontier markets and providing hands-on growth mentoring.

Seedstars Capital invests at a seed stage in a broad range of sectors including Fintech, Edtech, Healthtech, Agritech and Transport/logistics across emerging and frontier markets. We believe high growth companies are best placed to solve some of the world’s key social and environmental challenges and also provide significant economic and employment growth prospects. In addition to capital, we provide all portfolio companies with hands-on support to implement a growth team and methodology so they can scale sustainably and attract further capital.

Capacity building: Our first investment ticket is linked to a 3-month virtual growth program. The program is mainly driven by 1:1 mentoring supporting the portfolio companies to set up and professionalise their growth team and find a repeatable growth formula. Moreover, we support them in their raise of their next funding round through our network of 800+ VCs and investors. The program has been proven to be successful, with the follow-on funding success rate after the program at 61% and a NET promoter score of 83%. Brand: Seedstars group’s international presence in +90 markets and its extensive network of over 200,000 entrepreneurship ecosystem stakeholders including over 1,200 active mentors and over 800 investors, has also given the Fund and its companies the advantage in sourcing and screening high-quality deal flow as well as obtaining the needed support and scale practices across multiple markets simultaneously.

Investment Example

Seedstars invested in the Pakistani based women led startup Oraan at its pre-seed round in July 2021. Oraan is digitizing saving circles as a way to onboard women into the financial system in Pakistan creating the first female-focused neobank in the region. At the time of the due diligence, Oraan had solid traction and unit economics as well as large market opportunity, targeting 50M unbanked women in Pakistan creating a market opportunity that could grow significantly as Oraan scales its product. Since investing, Oraan closed a $3M seed round. News article here: https://techcrunch.com/2021/09/26/oraan

Leadership and Team

|

Charles Graham-Brown – General Partner & Chief Investment Officer More Info

Charlie started out as a mechanical engineer working on projects such as A380 at Airbus. Seeking a faster paced career, he switched tracks through an MBA at the Collège des Ingénieurs in Paris, and subsequently moved to Geneva and into investment management. Charlie spent four year with BlueOrchard Finance, investing in high impact financial institutions in 20+ countries across Africa, Asia and MENA and became a CFA charterholder. The entrepreneurial bug struck in 2013 when Charlie started his own venture before joining the founding team of Seedstars in early 2014. |

|

Pierre-Alain Masson – General Partner (non-exec) & Group CEO More Info

Pierre-Alain graduated from the University of St. Gallen in Switzerland where he founded his first company at age 20. He is a serial entrepreneur and has advised on multiple $100m+ M&A deals/exits. He was also the CFO of an international insurance company and travelled to over 20 countries to launch the first worldwide startup competition. Pierre-Alain is now running Seedstars, an international organisation he co-founded that is focused on impacting people’s lives in 85+ developing economies by investing and supporting entrepreneurs. |

|

Alisée de Tonnac – Founding Partner More Info

Alisee de Tonnac, is the co-founder and co-CEO of Seedstars, a Swiss investment holding on a mission to impact people’s lives in emerging and frontier markets through technology and entrepreneurship. Seedstars works in partnership with governments, development agencies, corporate partners, and private donors to develop emerging market entrepreneurship ecosystems, create jobs and fuel income growth. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

The Fund aims to have investments tied to an SDG and is focused on sectors with the potential to leverage technology in order to impact a high number of people. By focussing on core challenges like financial inclusion, agriculture, healthcare and education, we ensure that impact is directly embedded in our investment thesis.

As part of Fund 2, we are implementing an environmental and social due diligence process as per the standards of our lead DFI investor

Impact Tracking and Monitoring

Learn More

36 Avenue Cardinal Mermillod, 1227 Geneva, Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.