IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Positive Ventures

Diversified

DiversifiedFirm Overview

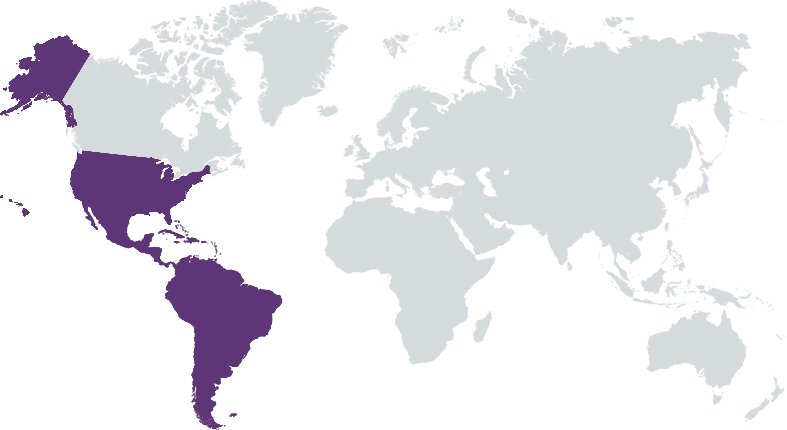

Positive Ventures (PV) is an entrepreneurs-run, impact-oriented, early-stage venture capital investment company based out of São Paulo and San Francisco. We started on stealth-mode in late 2016 with highly impactful and tech-enabled startups. PV was Brazil’s first GP incorporated as B-Corp with a top-tier impact score since inception. In early 2020, PV launched its first cross-border investing vehicle. Our fund was backed and seeded by the same coalition of investors that has been backing us since 2016, in addition to several other strategic investors that built top-notch investment companies, technology unicorns, and are in charge of public-listed or other key companies.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

We are on a mission to invest in entrepreneurs that are fixing the world at scale while delivering outstanding financial returns to their investors.

We are facing a historic generational opportunity. Millennials are now “the most important range for economic activity”. These consumers are willing to switch to values-based brands, and they believe that financial performance shouldn’t be the only goal of businesses. Our core is to look at social and environmental problems that can be solved by solid businesses, and we invest in companies that are developing disruptive technologies and embracing a massive transformative mission that will result in a long-lasting competitive edge. We designed our strategy to discover early-stage opportunities with tangible impact propositions and a validated business model. We have an extensive network generating leads and a lean investment approach, resulting in a solid reputation within the Brazilian entrepreneurial and impact arena. Brazil is well-positioned for impact investing, as it has, on one hand, a hugely dynamic market, and on the other hand, it presents countless social and environmental challenges.

We are one of the most active impact investors regionally, constantly striving to innovate. Our impact approach and clear focus are on scalable businesses, leveraged by our network and footprint in LatAm and the Silicon Valley have been key in differentiating Positive Ventures from any other impact investor in LatAm. We are backed by a stellar group of investors and operators from mainstream financial markets and venture capital markets, while also bringing diversity with knowledgeable people on impact and sustainability. Positive Ventures uses the best practices of mainstream venture investing with diligent impact analysis. We leverage the collective knowledge utilizing several tools, such as the IMP, to bring rigor to our research process. Based on extensive research of more than 500 deals evaluated, we also developed a scoring system to understand business viability.

Investment Example

Eureciclo is Latin America’s pioneer and leading clearinghouse for recycling credits exchange, coding a blockchain-based marketplace to boost recycling rates and make a dent in fighting climate change. As the first Packaging Recovery Organization (PRO) in LatAm, Eureciclo is backed by over 100 industry associations in Brazil and Chile. Through its asset-light business model and tech-based solutions, Eureciclo has supported brand owners to offset their environmental footprint, fostering the Circular Economy by financing more than 12.000 suppliers, including 05 MRFs. Positive Ventures was their first institutional investor (early 2017) and was joined later by world-class investors such as Lanx Capital and Redpoint ventures (led Series A). Eureciclo has tracked more than 7.5M Tons of waste, provided extra income for +120.000 waste pickers, and supports 5k+ small, medium, and large businesses to comply with the National Solid Waste Policy.

Leadership and Team

|

Andrea Kestenbaum – Partner & CEO More Info

Andrea Kestenbaum is Positive Ventures' co-founder and CEO. Andrea has extensive experience in entrepreneurship and management, having participated in companies in the services, retail and international trade sectors as investor and executive, including her role in making investments for her family. With a Master's Degree in Economics from the Polytechnic University of Catalonia and a Specialization in Leadership from MIT and Schumacher College, Andrea has dedicated management and governance issues, is an observer on Letrus Board of Directors and a permanent member of the Corporate Citizenship Institute. |

|

Murilo Johas Menezes – Partner & CIO More Info

Murilo Menezes is Positive Ventures’ CIO and focused on investing in purpose-driven businesses that are solving societal challenges. Prior to joining Positive Ventures, Murilo was the Chief of Staff and Impact Investing Officer at Brazil's largest impact-focused single-family office, Maraé, a multi-billion holding led by Mr. Guilherme Leal, co-founder of Natura&Co. From 2010 to 2015 he worked at institutions such as Goldman Sachs and Itaú BBA. Murilo is a board member at Slang, is part of WEF`s Expert Network, he holds a master’s degree from the Center for Public Leadership in Brazil, with extension at the Harvard Kennedy School and a bachelor’s degree in Economics from the University of São Paulo. |

|

Fábio Kestenbaum – Partner and Chairman of the Investment Committee More Info

Fábio Kestenbaum is Positive Ventures’ Co-founder and Chairman of the Investment Committee. Prior to his transition towards venture capital and impact investing, he was part of the BMA Advogados M&A team, acting as buy-side legal counsel in towering deals, e.g., the mergers of Itaú with Unibanco, Sadia with Perdigão, and Bovespa with BM&F. Fabio is a board member at Eureciclo and Labi Exames, and serves as an ad hoc advisor for Google for Startups, Accelerator 100+ Ambev, Insper Business School, and United for a Living Amazon Philanthropic Fund. Besides his J.D. in Law, Fabio holds a PgD in Economic Development from Blavatnik School of Government. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We will not consider companies related to negative-screened markets (such as weapons, tobacco, alcohol, etc.). We will not invest in companies without an impact-oriented mission statement or that are not clearly expressing intentionality to address at least one SDG. The impact needs to be in the companies' core business, and it must be decisive, being relevant in the transition for a more equal and sustainable world.

Our impact framework process permeates all phases of the investment. At a qualified stage, we use an in-house framework that includes a Q&A for an impact due diligence process in the areas of Governance, Workers, Environment, and Impact, aligned with the B Impact Analytics (BIA - used to certify a company as a B Corp), and the Impact Management Project (IMP), that is a collaboration of organizations to provide comprehensive standards for impact measurement, management, and reporting. This will help our team deep dive into evidence-based research on the outcomes of similar interventions, envision the business impact opportunities, and unravel the company impact on the IMPS’s five dimensions. During the negotiation, we co-define the possible impact metrics to be measured; define the Impact Champion of the company, which will be our primary point of contact inside of the company for impact issues; and write and sign the Positive Term sheet.

Impact Tracking and Monitoring

Learn More

Rua Gumercindo Saraiva, 54, São Paulo, 01449-070, Brazil

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.