IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Pomona Impact Management

Fair Trade

Fair Trade Microfinance and Low-income Financial Services

Microfinance and Low-income Financial Services Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

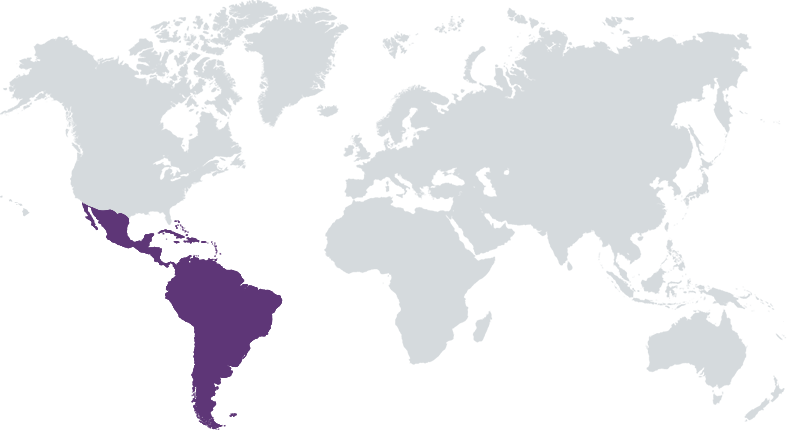

Pomona Impact Management is a fund manager incorporated in Panama with a local office and team based in Antigua, Guatemala. It has launched two funds so far: Pomona Impact Fund I was a $2 million fund launched in 2011 where 20 investments were made across Central America, Mexico, Colombia, and Ecuador. More recently in April 2021, Pomona Impact Fund II was launched to address the missing middle and finance scalable SGBs in the same geographic region.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 50% – 99%

Pomona Impact Fund II, LP (“Fund II”) primarily invests in businesses in the Agro-processing, Basic Goods & Services,and Digital Economy industries to profitably scale their social and environmental impact.

Fund II focuses on Central America (minimum of 75% of the portfolio) but it will also consider opportunistic co-investments in Mexico, Colombia, and Ecuador. Through Fund II, Pomona utilizes self-liquidating instruments (i.e., mezzanine debt), which offers flexibility of terms, structured exits, strong governance through investment covenants, downside protection, and upside potential through royalties, profit sharing, and/or warrants. In terms of the sectors, the Fund invests in Agro-processing, Basic Goods & Services (such as Access to Energy, Water, Education, Health, and Housing) and Digital Economy industries (eCommerce, Fintech, Edtech, Agtech).

First, the investment team is locally-based in Guatemala, and has 50+ years of combined regional and sectoral experience. In addition, its has an extensive network of advisors and fund allies providing global and local perspectives. Through the investment strategy, it has a strong opportunity to address the “missing middle” in Central America. In addition, Pomona offers a high degree of flexibility to structure the investment using mezzanine/venture debt instruments while targeting high-impact and highly scalable sectors. Lastly,it has strong momentum after reaching its first close of $10M in April 2021 with strong institutional support such as Capria and IDB. It has already approved $2.5M of investments across 4 deals, and has a robust pipeline to continue deploying capital at an accelerated rate.

Investment Example

The first investment through Fund II was a $500 thousand investment in Vexi, a Mexican neobank serving the Mexican underbanked population allowing them to build credit history and become integrated into the formal banking system. It offers a user-friendly mobile application system that allows clients to access their financial data at all times and manage spending. Another investment was a $500K investment in Tunart, a fishing and fish-processing company operating in Guatemala that sources high-quality seafood (mainly tuna) from the country’s coastline and supplies local and international clientele. The loan is a Revenue Based Financing instrument that is expected to generate an estimated 23% IRR for the Fund. In terms of its impact, it will be focusing on impoverished coastal communities in Guatemala; they have worked with over 200 artisal fishers, and on average, the revenue for fishers have increased by 3x more per pound of fish.

Leadership and Team

|

Richard Ambrose – Managing Partner More Info

Richard is an accomplished emerging market private equity and venture capital investor with 15+ years of experience. He has played an active role in raising new investment funds, as well as originating, structuring, monitoring and exiting direct investments. |

|

Daniel Granada – Partner More Info

Daniel has over fourteen years of private enterprise experience in Latin America, combining entrepreneurial skills, business acumen and an ample regional network. Since 2009 Daniel is focused on identifying investment opportunities in agriculture and basic services in Central America, working with institutional and local private investors to raise funds for early stage growth and impact. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Pomona uses a positive screening process to ensure all companies that proceed through the investment process provide a clear social and/or environmental positive impact. During the initial stages of analysis, the company at hand is asked to explain its business model and impact, in which the investment team verifies and completes additional research to understand and validate the business model and its impact. In addition, Pomona's gender lens includes understanding the company's relationship with women by requesting data regarding the number of women directly and indirectly impacted. Sample KPIs with a gender lens include: number of jobs created for women, number of client women individuals, and number of women in senior leadership

During the investment process, Pomona Impact requests for information from the company such as if it has an ESG policy, and what type of governance is utilized to implement the ESG policy. In addition, the company is asked if it complies with local (labor) laws - for example, by implementing the minimum wage, yearly bonuses, formal contracts, benefits, etc. Compliance with legal laws are verified by Pomona's legal partner to ensure the intrafirm practices are established and strictly followed.

Impact Tracking and Monitoring

Learn More

El Cubo Center, Office 102D, San Lorenzo El Cubo, Sacatepequez, Guatemala

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.