IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Nonprofit Enterprise and

Self-sustainability Team, Inc.

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

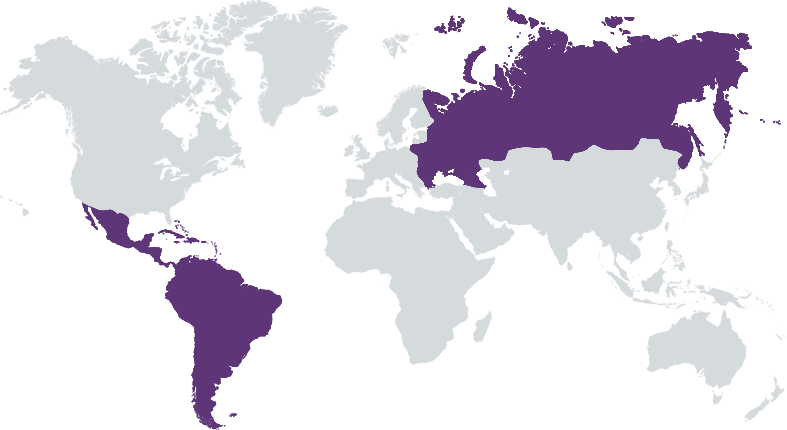

NESsT catalyzes high-impact companies that create quality jobs for people who continue to face barriers to dignified livelihoods, including Indigenous peoples, the LGBTQIA+ community, migrants and refugees, people with disabilities, smallholder farmers, women, and youth. NESsT operates two businesses: 1- Impact funds that provide debt financing to small and growing businesses; and 2- Accelerators that catalyze early-stage enterprises towards investment readiness. NESsT targets employment creation in the following areas: climate change through regenerative agriculture, circular economy, and green jobs; gender equity through the economic empowerment of women, and workforce development through the diversity and inclusion of underserved talent. Since 1997, NESsT has accelerated and financed 236 enterprises to sustain more than 89,000 formal jobs. NESsT has impacted more than 30,000 entrepreneurs and improved 1.1 million lives across 50 countries.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

NESsT brings appropriate investment capital and business assistance to small and growing businesses that promote the employment of marginalized communities while sustaining the planet.

Millions of small to medium-sized businesses in emerging economies with persistent inequality are in the “missing middle” – they are at the cusp of achieving sustainable growth but are unable to reach that stage because of a lack of financing. We lend to enterprises in sectors with a large population of marginalized individuals and target enterprises with less than $5 million of revenues that improve livelihoods for Black people, Indigenous peoples, the LGBTQIA+ community, migrants and refugees, people with disabilities, smallholder farmers, women, and youth. We provide patient, flexible investment instruments along with business assistance that meet the needs of each enterprise, ensuring their success in repaying our loans, reaching impact milestones, and graduating to commercial investors.

We differentiate our organization in six ways: 1- Track record: we support small and growing businesses in emerging economies since 1997. 2- Impact first: our capital reaches the most marginalized communities. Our loan portfolio employs Black people, Indigenous peoples, the LGBTQIA+ community, migrants and refugees, people with disabilities, smallholder farmers, and women. 3- Local: while U.S. headquartered, 85% of our staff is based in emerging market countries where they understand the context, build networks, and foster local ecosystems. 4- Pipeline: because of our local presence, we generate a unique pipeline of companies that typically fall outside of the impact investing ecosystem. 5- Business assistance: we put an emphasis on providing business assistance along our capital to develop deeper relationships with our portfolio of companies. 6- Accelerator: we have a thriving accelerator program with 66 companies receiving investment readiness capital and services that provide a proprietary pipeline for our fund.

Investment Example

Pomario sells organic produce sourced from smallholder farmers and grown in its greenhouses to Colombian families, retailers, and high-end restaurants. With NESsT’s support, Pomario attained remarkable growth and impact. In addition to obtaining organic certification, the social enterprise achieved 53% increase in staff from marginalized communities and almost 200% growth in revenue. In 2022, Pomario reached a milestone with sales surpassing USD$ 1.1 million for the first time, consolidating a clear growth trend and reaching breakeven. In the same year, Pomario secured an additional $330,000 in investments from the NESsT Lirio Fund. After receiving the NESsT loan, Pomario was able to expand its operations and build a new facility to grow their sales and impact. Today, almost 70% of Pomario's employees are women, and the social enterprise has developed an inclusive environment that fosters women's career advancement, offering career training and growth opportunities in addition to fair compensation.

Leadership and Team

|

Nicole Etchart – CEO and Co-Founder More Info

Experienced Co-Founder with a demonstrated history of working in the non-profit organization management industry. Strong business development professional skilled in Social Enterprise, Venture Philanthropy, Social Investment, Corporate Social Responsibility, Economic Development, and Fundraising. |

|

Chad Sachs – Lirio Fund Director, Peru Country Director More Info

Chad Sachs is Fund Director of the NESsT Latin America Fund. He is a seasoned executive that has been investing or raising capital for the last 20 years, primarily in the renewable energy industry. He founded two companies focused on successfully developing, investing and operating solar power plants. He led the structured finance teams at companies that developed and operated solar power plants, raising over $1.1 billion of capital. He grew his last company to become a top five independent asset managers in the solar sector in North America. He held Senior Vice President positions at Fotowatio Renewable (acquired by SunEdison) and MMA Renewable Ventures. |

|

Renata Truzzi – Global Acceleration Director More Info

As the Global Acceleration Director I am responsible for building a strong portfolio of social enterprises, impact management, knowledge management, methodology and gender lens inclusion of the NESsT Global Portfolio (over 50 companies in six countries). Before that as the Country Director of NESsT in Brazil, I was responsible for leading the portfolio of social impact enterprises and thought leadership activities in Brazil. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

All of our investments must meet strict social and environmental criteria, including: 1- Social: all investments must target companies creating jobs for low-income and/or marginalized individuals. A minimum of 80% of the jobs created must target these individuals, whether they are low income, refugees, farmers, LGBTQIA+ or others. We evaluate the level of poverty and marginalization of individuals targeted by our companies through interviews and site visits. 2- Environmental: all investments must target companies that manage their environmental footprint and engage in sustainable operations. We assess each company's resources use relating to energy, water, waste management, pollution, engagement with Indigenous and traditional peoples, use of recycled materials, and natural ecosystem conversion. For our portfolio of rural business loans, our borrowers must use sustainable land management ensuring environmental sustainability and biodiversity protection.

All of our investments meet strict intra-firm social and environmental criteria, including: 1- Diversity and inclusion: target companies must adhere to equity principles in gender, race, sexual orientation and gender identity across their hiring, management and governance policies. 2- Employment practices: target companies must comply with best practices regarding employee wellbeing, including policies that address harassment and discrimination, workplace safety, equitable hiring, sexual harassment/bullying, inclusive and equitable procurement process. We also due diligence staff turnover to understand root causes and how those can be addressed. 3- Sustainability: target companies must adhere to sustainable business practices in relation to their use of natural resources including water, waste, energy, habitat and biodiversity conservation, and engagement with Indigenous and traditional peoples.

Impact Tracking and Monitoring

Learn More

3276 12th Street North, Saint Petersburg, FL 33704 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.