IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Conscious Investment

Management Pty Ltd

Climate Change

Climate Change Community Development

Community Development Diversity, Equity and Inclusion

Diversity, Equity and InclusionFirm Overview

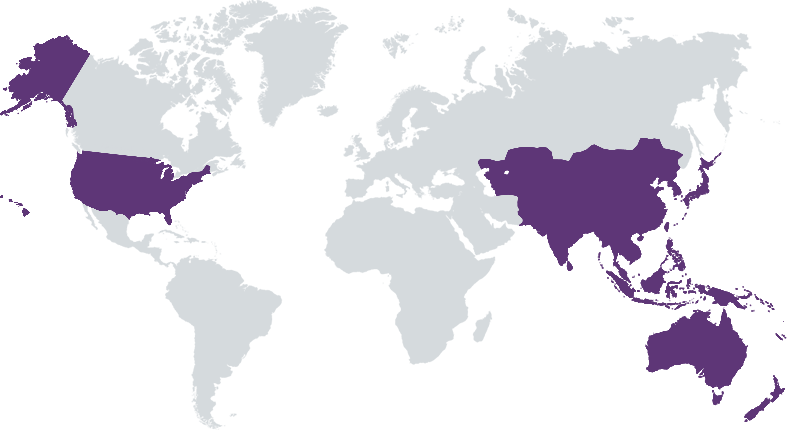

Conscious Investment Management is a Melbourne, Australia based impact investment fund manager. We use an innovative 'Impact Partner' model, partnering with charities and social enterprises (who have lived experience of a challenge) to acquire assets or fund programs, which our Impact Partner charity can then operate for the benefit of the people they support. In this way, we have a positive, additional impact on the world while making investment decisions to earn market returns. We currently manage a diversified, real assets focused impact fund and a number of co-investment vehicles for major investors. Conscious Investment Management is currently the largest dedicated impact investment fund manager in Australia.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 25% – 49%

Assets that have fundamental social and environmental value will deliver more defensive and outsized returns as a result.

By working hard to build relationships with our Impact Partners (charities and socially minded enterprises), we understand the assets and programs that we can acquire or fund for them, to support their provision of services to their clients. We recognise that investors don't always have lived experience of a particular challenge, and our Impact Partner model assists us to combine impact and investment. We identify and source investment opportunities together with our Impact Partners, before conducting our own independent investment assessment of the opportunity. If we choose to proceed with an investment, we hand back asset management rights to our Impact Partner. In this way, we have built a portfolio of market-rate returning investments, which deliver fundamental social and environmental value - housing or cheaper power, for example.

The key differentiator of our firm from peers is the our Impact Partner model. Our networks and relationships with leading charities and socially minded enterprises has been developed over years, and enables us to invest at market rates of return, with real and authentic positive social and environmental impact. These partners also act as an investment referral network, enabling us to scale our portfolio and impact. As with many other investment firms, we believe we are further differentiated by the quality of our team and our experiences, our position as a leading impact investor in Australia (giving us access to capital and investment opportunities), and our track record.

Investment Example

We recently partnered with a Community Housing Charity, and State Government of Victoria, to finance $150m of social and affordable housing under a unique partnership model - the first time that social housing has been financed in this way in Australia (which we hope to repeat in other States). Under the program, we will finance the acquisition of up to 307 new apartments, which are provided under a 10 year lease to our Impact Partner charity. The charity will lease these to tenants in need (people currently experiencing homelessness, escaping family violence, or living with disability) who pay deeply discounted rent. The Government will provide a payment to bridge investors to market rate financial returns. As a result of this investment, around 500 people will have new housing.

Leadership and Team

|

Matthew Tominc – Chief Investment Officer More Info

Previously managed the impact investment mandate of Light Warrior Group – a Melbourne-based family office, investing a significant pool of capital across a range of global strategies. Prior to Light Warrior Matthew worked at Goldman Sachs. |

|

Alex Debney – Partner More Info

Alex is focused on investment strategy, execution and management of our investments. Previously worked in real assets and sustainable agricultural investment and structuring with Macquarie Infrastructure and Real Assets (MIRA). Alex co-founded a social technology business – Yoinki – focused on delivering innovation and better outcomes to the not-for-profit sector. Alex also worked in corporate advisory at Goldman Sachs. |

|

Casey Taylor – Director More Info

Casey is focused on the origination, execution and management of our investments. Prior to joining CIM, Casey worked at Social Ventures Australia developing social impact bonds and managing impact investing funds. Prior to SVA, Casey worked in Deal Advisory at KPMG. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We begin all investments by working with our expert Impact Partners to understand people and society’s needs. These Partners are mostly leading Australian charities. Secondarily, using our finance experience and capital, we structure, design and invest into assets that will create a better and more sustainable future. We build long-term relationships with our Impact Partners. Once we have made an investment into, say, social housing, we provide asset management rights to our Impact Partner to ensure that the asset is operated with the level of social impact we intended when making the investment decision.

We have an Impact Investment Policy, which sits alongside our Investment Policy as the guiding document for our Investment Committee and executive team when making investments. A core part of this Impact Investment Policy includes 'impact due diligence' on our partners, including their social/environmental sustainability practices. These considerations are presented to Investment Committee with the same level of focus as investment considerations.

Impact Tracking and Monitoring

Learn More

Level 2, 6 Palmer Parade,

Cremorne VIC 3121

Australia

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.