IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Clean Growth Investment

Management LLP

Climate Change

Climate Change Natural Resources and Conservation

Natural Resources and Conservation Water and Sanitation

Water and SanitationFirm Overview

Clean Growth Fund (CGF) is an early-stage venture capital fund focused on clean technology companies developing innovative solutions within the following sectors: Power, Buildings, Transport, Industry and Waste/Water. Prospective investments need to demonstrate their potential to significantly reduce greenhouse gas emissions or improve resource efficiency. CGF’s core focus is Seed and Series A investments into companies with limited technical risk but likely some engineering risk, particularly around scale-up, as well as product, operational and market risk. The fund invests in both pre-revenue and revenue generating businesses.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 50% – 99%

The growth of the Net Zero Economy is creating vast new markets and companies that understand these shifting dynamics are creating and capturing tremendous amounts of value.

There are major drivers to change that are creating demand for new solutions, including:

- Demand pull – Customers demanding that the products and services they buy have reduced environmental impact;

- Regulatory push – Governments and regulators encouraging or forcing change to reduce CO2 emissions or other environmental impacts; and

- Economic fundamentals – Drivers encouraging business and consumers to reduce cost and risks by consuming less and re-using and recycling more.

These factors are all contributing to the growth of the Low Carbon / Net Zero Economy and CGF is well-placed to supports innovators within this new economy to ensure they achieve their maximum positive impact potential.

Our investment team has significant industry experience (BP, Shell, Centrica) and knowledge of the energy sector. We work with one of the UK's longest established clean technology consultancies (Carbon Limiting Technologies - CLT, established in 2006) to provide support to our portfolio. CLT has provided strategic and commercialisation support to over 350 clean tech SMEs. We are one of the only Seed-Series A investors in the UK which is solely focused on climate and clean technology.

Investment Example

Tepeo Limited Investment thesis: Gas and oil-fired boilers are not compatible with climate targets and alternative low carbon residential heating options are often prohibitively expensive or hugely disruptive to home owners. Tepeo has developed the drop-in replacement Zero Emission Boiler (ZEB) which offers flexible electric heating at a reasonable cost. The first generation ZEB can store 40 kWh of heat energy (vs c. 10 kWh for a residential chemical battery) which enables it to charge during periods of low electricity prices and discharge as required during the day. In a power system with high renewable penetration this saved between 1-3 tonnes of CO2 per year per home.

Leadership and Team

|

Beverley Gower-Jones – Managing Partner More Info

Beverley is the Fund’s Managing Partner. She chairs the investment committee, guides the investment strategy of CGF and leads fundraising. Beverley co-founded Carbon Limiting Technologies, a low-carbon business incubation consultancy, and was a founder and Vice President at Shell Technology Ventures where she was instrumental in defining Shell’s technology venturing strategic approach. She chairs BEIS Energy Entrepreneurs Fund commercial panel which has supported early stage, clean tech ventures with more than £72m of funding. |

|

Jonathan Tudor – Investment Partner More Info

Jonathan is an Investment Partner at the Fund and sits on its investment committee. Jonathan has more than 20 years of venture investment experience across multiple sectors, geographies and markets. He has led investment teams at BP Ventures and more recently was Technology Strategy director at Centrica. He returns to work with Beverley having previously worked with her as part of the in-house venture team at QinetiQ, where they helped to create, fund and build several companies. |

|

Stephen Price – Investment Director More Info

Stephen Price is the Fund’s Investment Director. He has 10 years of experience in early stage technology investing, including as Investment Director at Northstar Ventures. He joined Northstar in 2010 to take primary responsibility for the North East Proof of Concept Fund, an early stage technology seed fund. He has completed investments in dozens of companies across multiple technology domains and industry verticals, providing hands-on support to these throughout the early stages of their development. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We can only invest in companies which can demonstrate the potential for significant environmental impact. This is in the region of >100,000 tonnes of CO2-eq abated per year and/or thousands of tonnes of resource saved.

Impact Tracking and Monitoring

Learn More

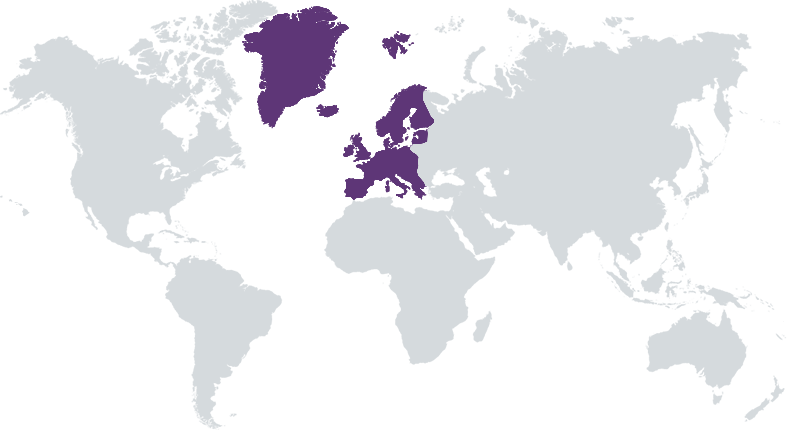

2A Charing Cross Road

London, UK

WC2H 0HH

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.