IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Circulate Capital

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and InclusionFirm Overview

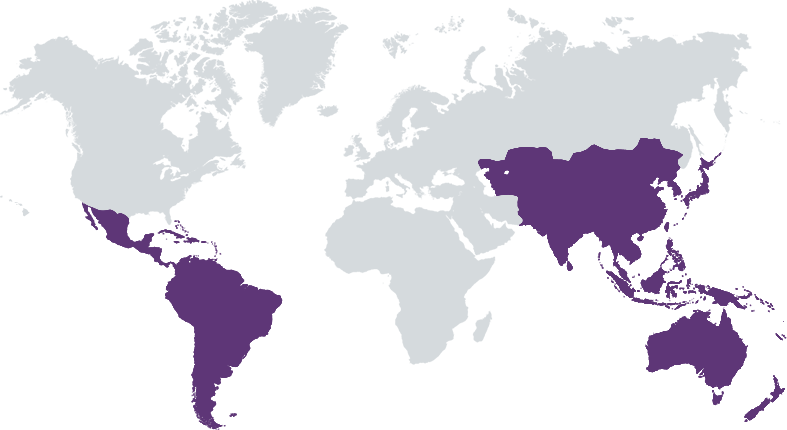

Circulate Capital is the leading circular economy investment platform in high-growth markets – with investments and teams in 10+ countries. Partnering with global brands and institutions, we invest to transform recycled plastic supply chains at scale, by delivering financial, environmental and social returns. Launched in 2018 by supply chain experts and leading corporations - including PepsiCo, Procter & Gamble, Dow, Danone, Chanel, Unilever, The Coca-Cola Company, Chevron Phillips Chemical Company LLC and Mondelēz International - aspiring toward a waste-free future, the firm’s US $245 million assets under management are invested across the waste management, recycling, and innovative materials value chains. We are also supported by a blended finance partnership with the U.S. International Development. Founded in and originally focused on South and Southeast Asia, the firm now targets scalable solutions and untapped opportunities in high growth markets to generate value and spark further investment in the emerging circular economy.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

By investing in waste management, recycling systems, and the circular economy in high-growth markets like South and Southeast Asia , we can prevent plastic pollution and catalyze capital while delivering impactful financial, environmental, and social returns.

Circulate Capital addresses the global waste crisis by targeting the investment gap in sustainable waste management and recycling in high-growth markets. Our approach channels investments into scalable and sustainable circular economy solutions, aiming to demonstrate their economic viability as well as their environmental and social benefits. Through strategic investments and value addition in such companies, Circulate Capital intends to drive a just transition to climate benefit, and to inspire further investment into the circular economy sector, with the goal of unlocking US$1 billion into the sector and preventing 150 million tonnes of plastic leakage.

What makes Circulate Capital unique: Distinct and diverse strategy: - Exclusive focus on recycling supply chain and adjacent innovations - 18 portfolio companies across seven countries Largest portfolio in Asia dedicated to the circular supply chain: - Unparalleled corporate LPs - Unique approach to relationships delivers strategic value in sourcing, due diligence, value creation and exit Experienced local teams - 15+ investment professionals with 135 years collective PE experience, majority from South or Southeast Asia - 1,310+ deals reviewed across all strategies, 90% proprietary deal flow Authentic impact - Measuring and delivering impact: environmental, climate, social and gender - Aligned with best industry standards: PRI, OPIM, IFC Performance Standards. - One of only 12 firms selected worldwide on the 2024 BlueMark Impact Leaderboard.

Investment Example

Lucro Plastecycle Private Limited (Lucro) is a homegrown Indian manufacturer that specializes in recycling difficult-to-manage flexible plastic packaging, and while this waste stream tends to be overlooked, the company’s success has demonstrated a scalable business model. Since Circulate Capital’s investment in 2020, Lucro has grown from a recycling startup to become a successful innovative materials science company: - Forged a groundbreaking partnership with Circulate Capital's investor Dow to develop and commercialize post-consumer recycled flexible plastic packaging - Became India’s largest supplier of recycled flexible plastic materials, having expanded processing capacity from 1,000 to 30,000 tonnes per year. - Established a fully integrated and traceable supply chain, including own collection centers and traceability software collection - Forged long-term agreements with global brands for post-consumer recycled packaging supply Lucro’s continued growth led us to do a larger follow-on investment in the company 2022.

Leadership and Team

|

Rob Kaplan – CEO and Founder More Info

Rob is Founder and CEO of Circulate Capital. He established Circulate Capital to deploy catalytic capital in partnership with leading corporations and investors to scale solutions that advance the circular economy and prevent the flow of plastic waste into the ocean in South and Southeast Asia. Rob leads Circulate Capital’s strategy, team, and operations as the firm identifies, incubates, and invests in opportunities diverting waste from the environment into the recycling chain in South and Southeast Asian countries. Circulate Capital’s model relies on supporting the local innovators implementing solutions on the ground, on partnerships with global corporations to leverage their supply chains to drive scale, and on incentivizing a new generation of entrepreneurs to build a fresh pipeline of investable projects. |

|

Regula Schegg – Founding Partner and CF&OO More Info

Regula is Founding Partner and Chief Financial & Operating Officer (CF&OO). A key member of the Leadership Team, Regula is responsible for all corporate functions, including corporate finance, HR, IT, investor relations, legal & compliance, and fund management. Throughout her career, Regula has held leadership roles in various sectors and regions, including corporate strategy, mergers and acquisitions, private equity, strategic finance/controlling, and business development. Prior to joining Circulate Capital, she worked with global companies such as Hilti Group, SAM Private Equity (now Emerald Ventures), and Sulzer Group. |

|

Ellen Martin – Chief Impact Officer More Info

Ellen Martin is Circulate Capital’s Chief Impact Officer. In her role, Ellen is responsible for driving impact and insights for Circulate Capital and its affiliated nonprofit, The Circulate Initiative, and providing shared evaluation, research, analysis and strategy services across the organizations. As a member of each organization’s leadership team, Ellen is focused on ensuring our collective strategies, assets, and relationships deliver impact as we grow.Prior to joining Circulate Capital, Ellen was Vice President for Impact and Strategic Initiatives at Closed Loop Partners. At Closed Loop, Ellen led impact, research and portfolio management for Closed Loop’s Infrastructure Fund. During her tenure, the Fund deployed $50M with $200M co-invested in projects in North America, resulting in avoidance of 2 million tons of GHG emissions in the first three years. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our investment thesis centers on impact. Our financial success is linked to the impact we create in the plastics waste value chain and systemically. We invest in circular solutions to achieve positive environmental and social outcomes while driving business growth. This approach influences every stage of our investment process, from sourcing to portfolio management and exit. In alignment with the Sustainable Development Goals, our impact management system centers on measuring progress across three key objectives, adopting standardized metrics and methodologies wherever feasible: 1- Generating circular and climate benefit 2- Scaling investable business models 3- Improving livelihoods and communities

As part of our Gender Smart Investing strategy and 2x Challenge commitment, we made sure that all our tools in the investment process integrate a gender perspective to ensure women-owned and led enterprises are not excluded: - We expanded tools such as the screening and due diligence questionnaires to include questions related to gender. - At the pre-investment process, we embedded gender in the investment thesis and set specific terms (precedent and subsequent) for new investments based on gender targets. Gender metrics have been included as part of the fund’s quarterly reporting templates.

Impact Tracking and Monitoring

Learn More

6 Temasek Boulevard, #09-05 Suntec Tower Four, Singapore 038986

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.