IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Blume Equity SCSp

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

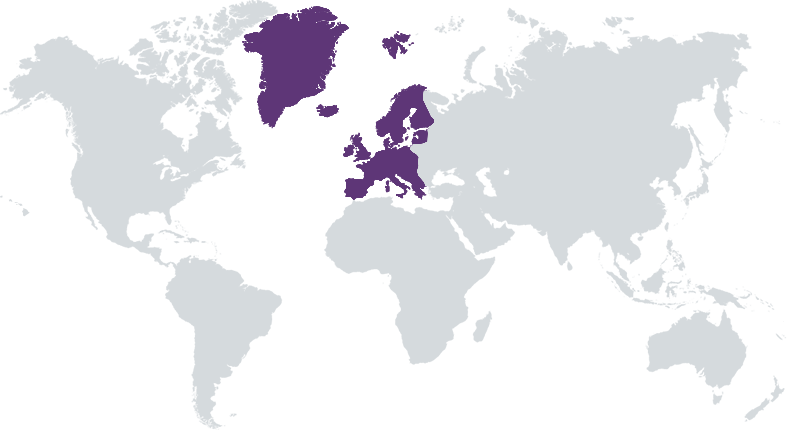

Blume Equity is a climate-tech growth equity firm investing in companies driving sustainable outcomes for the planet and people. We invest across three sustainability themes - Sustainable Food System, Responsible Consumption and Healthy Environment – where we see structural trends drive a paradigm shift, creating exciting investment opportunities in Europe. We are a female led fund, founded by three women who bring 40+ years of investment and sustainability track records from blue-chip investment firms. We are highly experienced growth investors and are supported by an accomplished and diverse advisor network spanning industry operating expertise, growth equity, sustainability, innovation and policy. Our strategic advisors include Sir Dave Lewis – former CEO of Tesco, Sam Gyimah – Goldman Sachs International board member focused on ESG, and Diane Holdorf from the World Business Council for Sustainable Development.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

Blume Equity is a female led firm, investing in high-growth European companies driving sustainable outcomes for planet and people across three sustainability themes: Sustainable Food System, Responsible Consumption and Healthy Environment.

How we use the earth's finite resources needs to dramatically change to avert a climate crisis and consequential health crisis, creating a wealth of commercially attractive and impactful growth stage opportunities. We are hurtling towards an unliveable planet if emissions are not reduced by 45% by 2030 and Net Zero not achieved by 2050. Across Europe, achievement of net zero requires ~$1.7 trillion of investment each year. Technology-led innovation across the full value chain is essential to achieving net zero. We are focusing on the following under tapped areas: Sustainable Food System, a farm to fork strategy focused on food productivity, sustainability and nutrition, Responsible Consumption and Production, targeting resource efficiency, and Healthy Environment, which is focused on nature-preservation solutions such as clean air, soil and water. As a female-led firm, we have unique access to the high-share of female-founded climate tech businesses.

Blume Equity makes €10 - 40m investments in climate tech businesses at the Series B stage and onwards. In Europe, there is a vibrant early venture ecosystem and there are large late-stage growth and buyout funds - but there remains a growth equity gap in the middle. For example, European companies raised 38% of global venture capital at Seed, but only 21% at Series B and 14% at Series C in 2020. Climate tech founders usually prefer thematically aligned investors due to stronger mission alignment and value add. While there is a thriving early-stage climate focused funding ecosystem, there are very few climate focused growth funds and most of these only invest in rounds greater €100m, leaving a significant gap in Blume's focus areas. Blume is also very unique as a female-led growth firm, creating unique access to the high-share of female-founded climate tech businesses.

Investment Example

We are hurtling towards an unlivable planet if emissions are not reduced by 45% by 2030 and Net Zero not achieved by 2050. There is a lot of enthusiasm to address the challenge - 90% of global GDP is committed to Net Zero – but limited and inconsistent carbon reporting. Thankfully, disclosure obligations are rapidly growing globally, and companies will be required to produce regular and accurate carbon reporting. To achieve this, they will need to enlist the support of software providers. Through a detailed mapping of the market, we identified Normative as a standout player in the fast-growth carbon accounting market. We built a strong relationship with the team and led their Series B investment and are on the board, supporting the team in their continued scale-up. Normative enables businesses to more accurately measure and reduce carbon emissions – a key enabler for the Net Zero transition.

Leadership and Team

|

Clare Murray – Co-founding Partner More Info

Clare has a background in sustainable investing and fundraising. Prior to co-founding Blume Equity, Clare worked at LeapFrog Investments, a leading impact investment firm, and BlackRock, where she brought together the firm’s various sustainability-related functions to establish the BlackRock Sustainable Investment Platform. Clare worked across public and private markets on ESG integration, investment solutions targeting environmental and social outcomes alongside financial returns, and impact management systems. |

|

Eleanor Blagbrough – Co-Founding Partner More Info

Eleanor has a background in investing and consulting. Prior to co-founding Blume Equity, she was an investor at ECI Partners, a leading European growth-orientated private equity firm. There she focused on tech and health investing. Before joining ECI in 2009 she worked at McKinsey & Co where she led strategy and operational projects across sectors including health and food. She also spent a year on secondment working for Prime Minister Tony Blair as a health advisor. |

|

Michelle Capiod – Co-Founding Partner More Info

Michelle has a background in private equity and venture capital. Prior to co-founding Blume Equity, Michelle was a private investor focused on early-stage investments in sustainable food and digital health. She is an active board member of portfolio companies and has been working closely with founders and management teams to scale up their operations and accelerate value creation. Michelle was previously a Partner at Mid Europa Partners, where she spent 13 years sourcing, executing, monitoring and exiting investments across a range of sectors, including TMT, consumer and healthcare. She started her career in investment banking at Merrill Lynch. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We specifically seek to invest in Inherently Impactful businesses that have the potential to generate superior financial returns, alongside positive environmental and health outcomes. Sustainability is core to the operations of the businesses we invest in and is fully integrated into the investment process from sourcing to exit. Our overall goal is to reduce greenhouse gas emissions and have the following associated environmental impacts: 1. Reduce waste and pollution 2. Reduce the environmental footprint of our food system 3. Improve health outcomes by investing in a healthy environment and healthy food

As a fund, Blume Equity aligns with the IFC Operating Principles for Impact Management and ensures we adhere to the Principles for Responsible Investment (“PRI”). To focus on the most material ESG issues for a company and its sector, we use the Sustainability Accounting Standards Board (SASB) sector guides. We also leverage Global Reporting Initiative (GRI) sector-specific guidance on disclosure topics. Given we incorporate the Impact Management Project’s 5 Dimensions into our diligence process, we are joining The Global Impact Investing Network (GIIN). We work with management teams to develop best-in-class ESG policies and to identify and track 3 KPIs that are most relevant over the life of our investment. These KPIs are primarily drawn from IRIS+ metrics, EU Green Deal action areas, and Sustainable Development Goals targets and indicators. For all our investees, we also track the GHG reduction they have enabled and their diversity metrics.

Impact Tracking and Monitoring

Learn More

Route d’Esch 412F, Luxembourg, N4 L-1471

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.