IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

UNICEF USA Impact Fund

for Children

Demographic-based Impact

Demographic-based Impact Education

Education Health and Wellbeing

Health and WellbeingFirm Overview

The Impact Fund, in partnership with UNICEF, exists to develop and implement financial solutions to ensure every child is healthy, educated, protected, and respected. It provides working and flexible capital to UNICEF to support its work for vulnerable children, driving toward long-term, sustainable outcomes. Since inception, it has managed 2 pooled debt funds (1 active today – the Bridge Fund), deployed over $670M to UNICEF with zero write-offs or defaults, and reached over 1 billion children in 50+ countries. Our current offering, the Bridge Fund, fast-tracks lifesaving assistance around the world when time matters most. In addition to the Bridge Fund, the Impact Fund, in partnership with UNICEF, launched a Child-lens Investment Framework in service of building a larger Child-lens investment market. Child-lens Investing (CLI) is an approach to sustainable investing in which investors intentionally consider child-related factors to advance positive child outcomes while minimizing child harm.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

The Impact Fund drives greater intentionality for children’s wellbeing in investment strategy and process to reduce harm and drive improved child outcomes. Its Bridge Fund closes funding timing gaps of critical programs, driving systems-level solutions, fast-tracking life-saving support, and ensuring continuity of programs so that children survive and thrive.

We believe truly scalable, long-term impact will only be accomplished when we move beyond philanthropy alone by tapping into the multi-trillion-dollar capital markets on behalf of the world’s most vulnerable children to maximize the impact of philanthropy, transform markets, and scale purpose-driven businesses. The Bridge Fund (BF) leverages private market investors and philanthropy dollars to fast-track critical funding to eliminate cash gaps and provide uninterrupted and expedited access to critical programs for children. It does this by advancing cash against philanthropic, sovereign, or multilateral loan or funding sources for UNICEF development programs, supply procurement, immunization campaigns, and humanitarian emergency response. In addition to our fund, we’re striving to expand impact via field-building. We developed Child-lens Investing, an investment approach that provides guidance to investors to incorporate child-related factors in their investment processes and decisions to increase intentionality around risks and opportunities for positively impacting children.

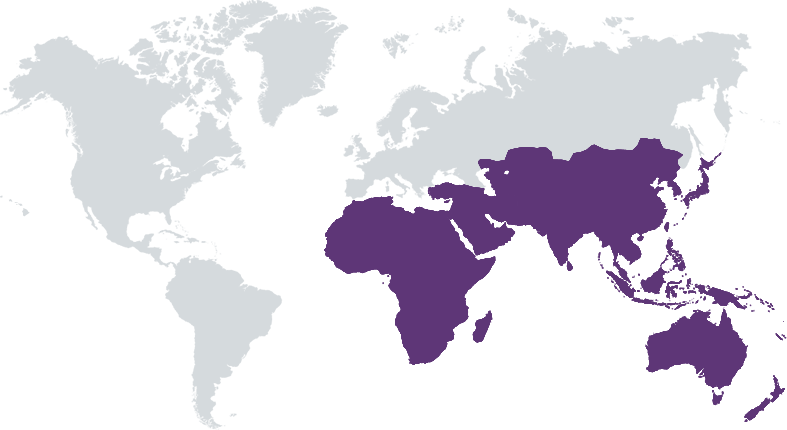

Our key differentiation is our connection to UNICEF’s ability to drive impact through its programmatic scale, scope, and expertise globally. The Bridge Fund reaches children where UNICEF has programming (190 countries), in locales untapped by most traditional investors. UNICEF benefits from government partnerships and has a unique ability to engage at multiple levels - global, regional, country, and local - supporting collaborative and innovative finance solutions. Our brand and reputation allow us to leverage private market investors who want to make an impact but wouldn’t have the channels without UNICEF. Through this network, in FY24, the Bridge Fund accelerated $75.4M of capital to 3 SDGs and emergency response efforts. The Impact Fund has a unique opportunity to capitalize on UNICEF’s influence and global networks, its in-country community engagement and advocacy, and its role as a market shaper as the UN’s leading procurement agent for supplies for children.

Investment Example

Around 25M children miss out on life-saving vaccines each year, a statistic that has been worsened by violent conflict, displacement, and COVID-19 related disruptions. UNICEF’s Vaccine Independence Initiative (VII) is a funding mechanism to help countries secure a sustainable supply of life-saving vaccines and health supplies, while providing assistance to country supply systems so that they may progress toward efficiency and self-sufficiency. VII helps countries minimize vaccine stock-outs, ensuring children receive vaccinations on time. Recently, VII enabled vaccine procurement for the multiregional mpox outbreak, which was declared a public health emergency by the Africa CDC and WHO. The Bridge Fund invested $30M in VII to date. Support from the Bridge Fund and other partners enabled VII to reach 150M children faster with 200M doses of routine vaccines by the end of 2023.

Leadership and Team

|

Cristina Shapiro – President of the Impact Fund and Chief Strategy Officer of UUSA More Info

Cristina has 25 years of leadership experience in innovative finance, impact investing, strategy implementation, and economic development. Cristina came to UNICEF USA in 2020 from Goldman Sachs, where she led multiple strategic impact investing and philanthropic initiatives over 9 years. She was global head of the 10,000 Women initiative, a program that fosters economic growth for female entrepreneurs in developing economies. From 2011 through mid-2018 Cristina worked in the Urban Investment Group, as the lead for the Access to Capital program of the 10,000 Small Businesses initiative. |

|

Erin Egan – Managing Director of the Impact Fund for Children More Info

Mission-oriented leader with 10+ years of experience spanning both public and private sectors with a passion for driving social change. Deep knowledge and experience in Finance, including Sustainable and Impact Investing, Operations and Development. Specialized skills include: risk management, systems building, due diligence, portfolio management, grant writing and non-profit fundraising. |

|

Glen Baptist – UNICEF USA Impact Fund for Children Board of Directors, Chairman More Info

Highly accomplished C-suite Executive with 35 years of success in the investment management industry, and Board Member on several not-for-profit Boards. Corporate, mutual fund and not-for-profit Boards can leverage my wealth of international and multi-cultural business experience, including business leadership, culture change, strategic and financial planning, talent management, investment management, and corporate governance. Currently serving as a member of the National Board of UNICEF USA as well as UNICEF USA Impact Fund for Children, organizations focused on traditional and innovative funding strategies to support UNICEF program needs. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The Bridge Fund provides accelerated funding for UNICEF's programs, many of which utilize a results-based approach. Under this framework, UNICEF's country programs are structured around results and outcomes and funds are directed to have the largest long-term social impact on the lives of children. The Bridge Fund's investment evaluation is also in line with UNICEF's focus on equity and inclusion, which means that all children have an opportunity to survive, develop, and reach their full potential, without discrimination, bias or favoritism.

The Bridge Fund provides funding to UNICEF and other UNICEF-approved NGOs. In this practice, we strongly consider the business and programs of these entities before providing funding. UNICEF’s mission is to advocate for the protection of children's rights, help meet their basic needs, and expand their opportunities. UNICEF’s five core business values: care, respect, integrity, trust, and accountability, build its internal culture. UNICEF is dedicated to environmental sustainability in its own operations. It is working to transform how and where it works to reduce greenhouse gas emissions and environmental impact and established a dedicated internal fund to support this. UNICEF is implementing solutions to reduce its environmental footprint in 70+ offices worldwide, with energy efficient lighting, heating, ventilation and cooling systems, water efficient fixtures, solar water heating and energy systems, and more. An increasing number of offices are running on solar power, including in Jordan, Zimbabwe, India and Haiti.

Impact Tracking and Monitoring

Learn More

125 Maiden Lane, New York, NY 10038 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.