IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

LeapFrog Investments

Energy

Energy Health and Wellbeing

Health and Wellbeing Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

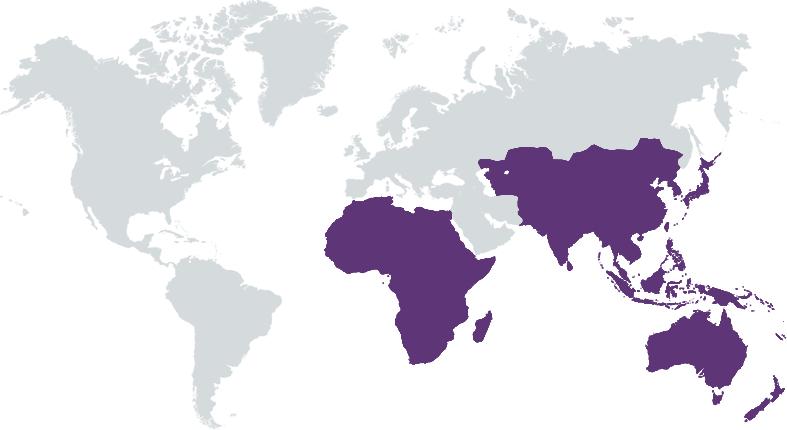

LeapFrog is a pioneer of impact investing and a global expert in ethically scaling technology across emerging markets. LeapFrog's mission is Profit with Purpose: it aims to open the gates of capital markets to high-growth, purpose-driven businesses. With a decade-long track record of building global leaders in industries such as telemedicine, genomics, micro-insurance, and mobile banking businesses, LeapFrog companies reach 537 million people. Across South Asia, Southeast Asia and Africa, LeapFrog companies provide access to essential healthcare, climate, and financial tools and grow revenue, on average, at 23% annually.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

LeapFrog invests in high-growth, purpose-driven financial services and healthcare businesses in emerging markets in Asia and Africa, partnering with their leaders to achieve leaps of scale, profitability and social impact.

LeapFrog Investments aims to unlock capital for purpose-driven businesses that empower emerging consumers to lift themselves out of poverty. Focused on high-growth financial services, healthcare and climate solution companies across Asia and Africa, LeapFrog invests in businesses that provide essential products and services which are safety nets and springboards for low-income consumers. LeapFrog drives the growth of its portfolio companies through innovative value-add programs, including CX Launchpad, which enhances customer experience, and Talent Accelerator, which fosters leadership development. Backed by over US$2.6bn in commitments from global banks, insurers, pension funds, and development finance institutions (DFIs), LeapFrog’s portfolio companies are supported to scale rapidly, delivering clear impact, strong governance, and customer-centric solutions.

LeapFrog differentiates itself through an exclusive focus on emerging consumers, deep sector specialisation, intimate local knowledge, and a rigorous profit with purpose methodology. LeapFrog adds unique value to its portfolio companies, helping them to tailor services to low-income consumers, develop talent, and harness digital, including: • CX Launchpad: an initiative that helps build capabilities in companies to enhance end-to-end customer experience. • Talent Accelerator: a training and mentorship program that bridges talent gaps across emerging markets, including ensuring teams are enabled to improve products, design relevant features and reach more people. LeapFrog was the first impact investor in the world to release the results of its independent audit against the Operating Principles for Impact Management, the industry standards co-developed by the IFC. LeapFrog was awarded the highest rating for each of the nine principles again in its 2023 audit by independent auditor BlueMark, one of just nine managers to do so.

Investment Example

LeapFrog invested in pioneering MSME lender Electronica Finance in 2024, recognising the value of its finance products to the MSME sector and India’s transition to clean energy. Electronica offers livelihood generating loans to 43,000+ customers – enabling businesses to expand operations, increase revenue and create jobs. The company specialises in machinery loans and, with a deep track record of serving customers over the past 30 years, is uniquely equipped to provide credit to the growing MSME sector which employs more than 110 million people. Electronica employs 1,878 staff directly, and through its loans to MSMEs supports a wider 64,400 jobs across 16 states. 88% of jobs are for emerging consumers, earning less than $11.20 a day. Building on a track record of investing in innovative finance products for emerging consumers, LeapFrog is working with the company to broaden its product offering and expand its reach to more underserved regions.

Leadership and Team

|

Dr. Andrew Kuper – Founder and CEO More Info

Dr. Andy Kuper is an investor and entrepreneur whose Profit with Purpose philosophy has shaped diverse industries and countries. He founded LeapFrog Investments in 2007. Within a decade, Fortune ranked LeapFrog as one of the top 5 Companies to Change the World, alongside Apple and Novartis. In 2022 in the Queen’s Birthday Honours, Andy was appointed an Officer of the Order of Australia for “distinguished service to the impact investing industry, to global business leadership, and to financial inclusion”. |

|

Dominic Barton – Chairman More Info

Dominic Barton joined LeapFrog as non-executive chairman on April 1, 2022. He was formerly Global Managing Partner at McKinsey & Company where he served from 2009 to 2018, and most recently served as Canada’s Ambassador to China. Dominic has also served as Chairman of Teck Resources and as Non-Executive Director at the Singtel Group in Singapore and Investor AB in Sweden. He was also a board member of the Olayan Group, a private family-owned company. Dominic’s leadership in developing responsible investing strategies and impact metrics stretches back decades. He was one of several co-founders of the non-profit organisation Focusing Capital on the Long Term (FCLT Global), which has a mission to focus capital on the long term to support a sustainable economy. |

|

Nakul Zaveri – Partner and Co-Lead for Climate Investment Strategy More Info

Nakul has over 20 years of experience spanning entrepreneurial, operational and investing activities. He brings relevant investing experience across Climate and Responsible Investment strategies including investing in renewables, climate tech, industrial/ enterprise efficiency, evolving consumer priorities, and related value chains. Nakul guides LeapFrog’s climate strategy, focussed on supporting pathways out of poverty for emerging consumers that also deliver rapid decarbonisation of all sectors of industry. He is a member of the firm’s Executive Committee. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

LeapFrog actively seeks out portfolio companies that deliver accessible and affordable healthcare and financial services for emerging consumers both profitably and at scale. Each opportunity is examined against social and financial criteria through LeapFrog’s proprietary impact measurement framework, FIIRM. FIIRM is LeapFrog’s in-house measurement framework that provides an integrated view of a company’s performance in the four key areas of Financial, Impact, Innovation and Risk Management (FIIRM). It is used to set goals and track portfolio company and fund performance. LeapFrog was the first impact investor in the world to release the results of an independent audit of its impact against the Operating Principles for Impact Management (OPIM), the industry standards co-developed by the International Finance Corporation. The independent audit was conducted by BlueMark, which awarded LeapFrog the highest rating for each of the nine principles comprising the OPIM standard, declaring that LeapFrog is an “exemplification of industry best practice".

LeapFrog has developed a rigorous sourcing and investment process incorporating best-practice ESG principles that it implements with respect to investment activities. First, LeapFrog has a Responsible Investment Code (RIC) which is formally adopted by each portfolio company. The RIC outlines material ESG risks, and serves as a basis to discuss these risks openly with each portfolio company since the beginning of the process. Second, as part of its FIIRM Framework, LeapFrog has developed an ESG questionnaire which deal teams and companies complete during due diligence which provides a clear report on current status in ESG and opportunities for improvement. Third, in higher-ESG risk investments, LeapFrog has worked with specialised independent consultants to fully analyse potential risks and opportunities.

Impact Tracking and Monitoring

Learn More

3 Orchard Street, London, SW1H 0BF, United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.