IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Global Partnerships

Food Systems and Agriculture

Food Systems and Agriculture Health and Wellbeing

Health and Wellbeing Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

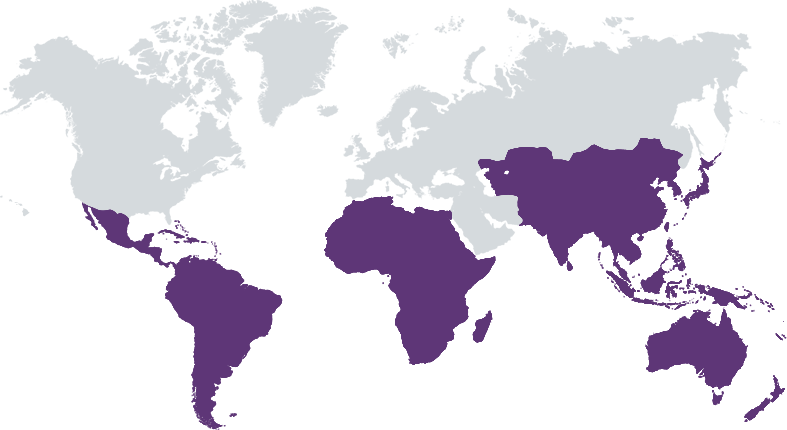

Global Partnerships (GP) is an impact-first investment fund manager dedicated to expanding opportunity for people living in poverty. For 30 years, GP and its affiliated funds have invested in sustainable solutions that help people living in poverty increase their incomes and improve their lives, with investments in economic livelihoods, education, energy, food, health, housing, sanitation, and water. As a 501(c)(3) nonprofit and fund manager, GP’s model helps donors and accredited investors access and navigate the global development and impact investment space. Since inception, GP and its affiliated funds have deployed approximately $786 million in impact investments to 201 social enterprise partners, bringing meaningful impact to nearly 34.9 million lives in 34 countries in Latin America, the Caribbean, and sub-Saharan Africa (as of 6/30/24).

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

Global Partnerships uses impact-first investment funds to provide capital to social enterprises whose products and services expand opportunity for people living in poverty.

Global Partnerships is guided by the belief that with access to the right tools, resources and information, people have the power to earn an income and improve their lives. We believe that capital and markets have essential roles to play in unlocking and sustaining opportunities for millions of people living in poverty. Our funds invest debt and equity into social enterprises bringing goods and services to people living in poverty, helping them build economic resilience, stabilize and expand incomes, and improve the health and well-being of their families.

Global Partnerships' affiliated funds use an “impact-first” approach to investing; delivering social impact for people living in poverty, by seeking to invest to: - Broaden opportunity across different facets of poverty including, but not limited to, economic opportunity, education, energy, food, health, housing, sanitation, and water. - Deepen inclusion of poorer and underserved people, including women and the rural poor. - Serve millions through sustainable and scalable solutions that can positively impact the lives of millions of people. - Improve lives by empowering people to earn a living and meet their basic needs. We do this while seeking to preserve capital with a modest financial return for all fund investors.

Investment Example

CREDICAMPO S.C de R.L de C.V (Credicampo) is a microfinance institution in El Salvador in Global Partnerships’ Rural-Centered Finance with Education initiative. As of June 30, 2024, Credicampo was serving more than 35,000 borrowers, with a focus on vulnerable communities. Approximately 80 percent of their borrowers live in rural areas. A 2024 study of Credicampo borrowers found that 92 percent reported that their quality of life had improved, with many citing increased business profits, business growth, and a greater ability to afford business expenses. 80 percent reported that their ability to manage their finances had improved, and 66 percent reported that their confidence in themselves and their abilities had increased. Female borrowers were especially likely to report benefits that carried over to the household, such as increased spending on children’s education (57 percent), home improvements (48 percent), and the number and quality of meals (49 percent).

Leadership and Team

|

Mike Galgon – CEO More Info

Mike Galgon joined Global Partnerships (GP) as CEO in 2024 after serving on GP’s Board for over twenty years, including as President and Chair. Mike brings extensive executive and investment experience to the CEO role. For more than twenty-five years, Mike has been an entrepreneur, investor, and impact investor in Seattle. In 1997, he co-founded aQuantive, a publicly-traded family of leading digital marketing companies, including Avenue A, Atlas, and DRIVEpm. |

|

Mark Coffey – President More Info

In his role as President, Mark provides executive level oversight of Global Partnerships' social investment funds, including debt fund and portfolio management, social enterprise partner relationship development, and credit management. He cultivates strategic relationships with investors, peers, social enterprise partners, and other actors in support of GP’s commitment to exemplify and amplify impact-first investing and provides internal leadership to strengthen the organization’s culture. |

|

Megan Muir – General Counsel and Chief Operating Officer More Info

Megan is the General Counsel & Chief Operating Officer of Global Partnerships, overseeing legal, finance and operations for the organization. Prior to joining Global Partnerships, she was a partner with the international law firm DLA Piper LLP (US) for nearly 10 years where she represented investors and technology companies of all sizes. Prior to DLA Piper, Megan was General Counsel of a wireless company, an attorney with Venture Law Group and a clerk to a federal judge. She holds a B.A. with highest honors from Pitzer College and received her law degree with honors from Harvard Law School. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

GP employs an iterative approach to impact management that informs investment strategy and decision making. Our impact management begins with research that synthesizes information gathered from practitioner experience and the existing body of evidence. If we identify capacity to reach and positively impact those living in poverty in a market-sustained way, the research culminates in the definition of an investment initiative. That definition then functions as an investment thesis within a given sector (e.g., Women-Centered Finance with Health), defining who is served, what is delivered, and why it is impactful. The next step is identifying and investing in social enterprise partners that show strong capacity to execute on that thesis. We conduct upfront, initiative-specific impact screening that goes beyond responsible lending considerations (such as strong client protection practices) to evaluate outreach to people in poverty, as well as the design and delivery of aligned products and services.

Global Partnerships’ screening and due diligence process includes a “responsible lending” review; successfully passing this screening is necessary but not sufficient to enter the portfolio. The responsible lending screen includes assessment of practices related to IFC Performance Standards 1 and 2, and a review of key social and environmental questions/risks by sector. For example, in microfinance we underwrite for client protection practices and in agriculture we emphasize responsible environmental practices. Review of partner enterprises’ relevant industry certifications (when available) such as Fair Trade/Organic for agriculture and Lighting Global Quality Standards for solar energy products, provide additional visibility into their social and environmental sustainability practices.

Impact Tracking and Monitoring

Learn More

1201 Western Avenue, Suite 410, Seattle, WA 98101 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.