IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Calvert Impact

Affordable Housing

Affordable Housing Climate Change

Climate Change Gender Equality

Gender EqualityFirm Overview

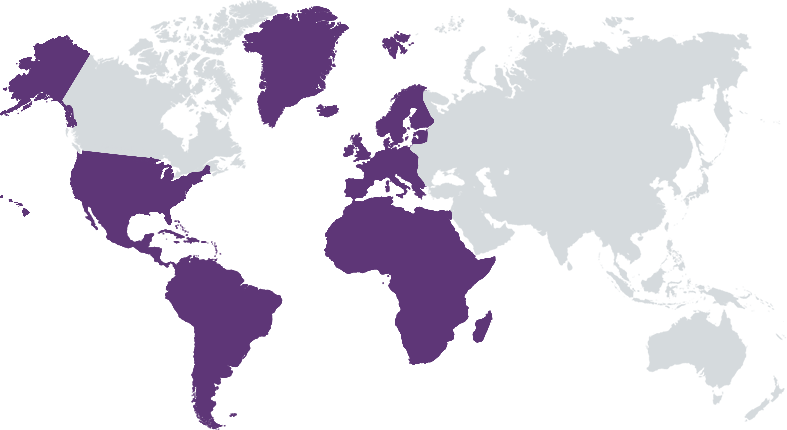

Calvert Impact makes impact investable through products and services that change the world. For nearly 30 years, Calvert Impact has shown how private capital can be invested in communities overlooked by traditional finance. As a proven market leader in the global impact investing industry, Calvert Impact has raised over $5 billion and achieved 100% repayment of principal and interest to more than 20,000 lifetime investors. Calvert Impact offers impact investment opportunities to institutional, accredited, and retail investors for as little as $20. Calvert Impact invests in organizations, funds, and social enterprises, both domestically and internationally, that work in under-resourced communities to address climate change and improve access to quality affordable housing, healthcare, income and wealth building opportunities, and other critical community services. The portfolio directly contributes to the Global Sustainable Development Goals and Calvert Impact is an industry leader in measuring the impact outcomes of each investment.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

Calvert Impact finances sectors and organizations that have the potential for transformative impact and seeks to create more inclusive and accessible markets throughout the United States and around the world.

Calvert Impact makes investments to finance broad economic opportunity and protect our planet, prioritizing both financial resiliency and lasting impact. We believe community-facing intermediaries are a critical part of the infrastructure necessary to build scalable impact markets. Each investment creates a positive, measurable impact and the portfolio spans nine core sectors including small business, renewable energy, health, microfinance, sustainable agriculture, education, environmental sustainability, and community development. Each sector has a unique impact thesis and strategy that outlines the impact Calvert Impact targets, how impact is measured, and what role Calvert Impact’s capital plays in strengthening local markets. Calvert Impact conducts thorough due diligence on each of our portfolio partner organizations and follows rigorous credit quality and social performance standards. Beyond investing, Calvert Impact also provides unofficial technical assistance, advising many portfolio partners on how to strengthen their organization and scale their impact on the ground in communities.

Calvert Impact is known for its track record of innovation, impact, and financial performance of 100% repayment of principal and interest to all investors throughout its 29-year history. As an industry leader in impact measurement and management, Calvert Impact was a founding signatory to the Operating Principles for Impact Management. Calvert Impact’s Community Investment Note has a diversified portfolio across impact sectors and geographies, creates measurable social and environmental impact, and is managed by a team with deep credit analysis, risk management, and impact measurement and management expertise. Complementing our strong portfolio performance is a capitalization cushion of over $100 million to protect investors against any potential portfolio losses. More than 7,000 individual and institutional investors, as well as hundreds of financial advisors, have conveniently made investments ranging from $20 to $20 million through Calvert Impact’s online investment platform or through over 135 brokerage firms.

Investment Example

One investment illustrative of our thesis is Partner Community Capital (PCAP). PCAP advances equity and helps communities flourish by lending to enterprises that promote a healthy environment and healthy families in Central Appalachia and the Southeast US. PCAP meets its mission as a certified community development financial institution (CDFI) by supporting a range of enterprises that promote equity, protect the environment, and grow the economy. They also support businesses with green lending and technical assistance services. Over 50% of the businesses they support are owned by women or people of color, and over 85% are in rural or economically distressed communities.

Leadership and Team

|

Jennifer Pryce – President and CEO More Info

Jennifer Pryce is President and CEO of Calvert Impact, a global nonprofit investment firm. Over the past decade, Jenn has shaped the strategic direction of Calvert Impact to focus on innovation, sustainability, and scale. Under her leadership the organization has tripled the size of its flagship product, broadened the organization’s mission to focus on equitable climate solutions, expanded the corporate structure to support the development of new products and services and has industry-wide efforts on how to scale impact with integrity. |

|

Derek Strocher – CFO More Info

Derek is an accomplished and innovative strategic thinker with over 20 years of international expertise gained at large for-profit corporations in North America and Europe. Prior to joining Calvert Impact Capital, Derek led the Innovative Finance portfolio at the World Bank, working with governments around the world to explore and design innovative financial solutions to address problems in development. As Chief Financial Officer at Calvert Impact Capital, Derek oversees all financial activity of the organization and provides strategic leadership as a partner to the CEO and Board. |

|

Justin Conway – Chief Product & Partnerships Officer More Info

Justin Conway is Chief Product & Partnerships Officer at Calvert Impact, an impact investment firm helping people and institutions invest for social and climate justice. Justin is excited about the firm’s growing impact investment platform of the Community Investment Note, Cut Carbon Note, Mission Driven Bank Fund, and beyond. He manages the Investor Relations team that has supported over 20,000 investors and financial professionals on their impact investing journeys, sits on the Staff Investment Committee, and is Chief Impact Officer of the Cut Carbon Note. He previously led Calvert Impact’s investment advisor in providing customized portfolio services to institutional investors. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Calvert Impact exclusively lends to organizations that have social/environmental impact at the core of their work and applies a gender and racial equity lens across all investments. We also employ a proprietary Impact Scorecard, an impact rating tool we used to assess every transaction at origination and project the expected impact that the loan or investment is anticipated to create. All investments have an articulated impact theory of change and methodology for tracking and measuring output metrics as a result of their work. The progress toward each impact goal is analyzed in Calvert Impact’s due diligence process and is monitored on a regular basis. Performance along these goals is an important consideration when analyzing whether to renew an investment. All impact metrics are aggregated and reported out in our annual impact report: https://calvertimpact.org/impact/impact-report.

Calvert Impact pays careful attention to each portfolio partner’s social and environmental sustainability practices as part of its underwriting. Both upstream and downstream business cycles must be determined to be acceptable and fit into Calvert Impact’s theory of change with social and environmental benefits. References are checked as part of underwriting and one of the screening questions deals directly with these impacts. Calvert Impact actively looks to lend to organizations with strong internal social/environmental policies and practices, including board and staff diversity, and preference for those using green/sustainable practices.

Impact Tracking and Monitoring

Learn More

7550 Wisconsin Avenue, 8th Floor, Bethesda, MD 20814 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.